SILVER weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

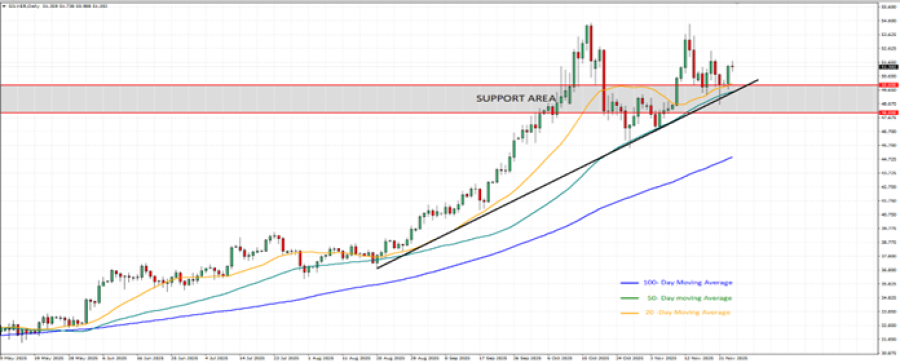

- SUPPORT: $50 - $48. After bouncing off the $48 level, the silver price has managed to restore its previous psychological support area between $50 and $48.

- UPTREND SINCE JANUARY 2025: After the March-April price pullback, silver prices have reinstated their uptrend, as depicted by the daily chart below and the solid uptrend line on the same chart. Since the beginning of 2025, the silver price has been rising solidly, hitting a fresh all-time high in October ($54.454), marking an increase of around 88%. However, it could also decline.

- ANALYSTS’ OPINION: UBS forecasts $55; BANK OF AMERICA forecasts $65. ANZ forecasts $57.5.

GRAPH (Daily): May 2025 – November 2025

Please note that past performance does not guarantee future results

EVENTS:

- WEDNESDAY, NOVEMBER 26 AT 13:30 GMT: U.S. WEEKLY INITIAL JOBLESS CLAIMS. A higher-than-expected jobless claims reading would indicate cooling labor-market conditions, thereby increasing expectations for further Federal Reserve rate cuts. This would put pressure on the U.S. dollar and help support palladium prices, as lower rates typically boost demand for commodities.

US FEDERAL RESERVE:

- NEXT MEETING: DECEMBER 10 AT 19:00 GMT. The US Federal Reserve is expected to finish the year 2025 by cutting the rates to 3.75% on December 10.

- BREAKING (OCTOBER 29): US FEDERAL RESERVE CUT INTEREST RATE TO 4.00% FROM 4.25%. The Fed cut rates again in October after the one earlier in September. In total, this year, rates have fallen from 4.50% to the current 4.00%.

GEOPOLITICS: RUSSIA – UKRAINE

- EVENT (THURSDAY, NOVEMBER 27): DEADLINE IMPOSED BY US PRESIDENT DONALD TRUMP FOR UKRAINE TO ACCEPT THE LATEST PEACE DEAL PROPOSAL. The latest peace proposal crafted by the Trump-led administration includes that Ukraine must give up Donetsk and Luhansk (Donbass Region), Crimea, and some territory in Zaporizhzhia and Kherson. There have already been similar proposals throughout 2025, and all of them ended with no agreement.

LAST TIME (OCTOBER): TRUMP–PUTIN CALL ON OCTOBER 16, 2025. The call led to a potential new summit between US President Trump and Russia’s Putin, but due to further disagreements, the summit never happened, and Trump announced sanctions on Russia’s Lukoil and Rosneft on October 22.

SILVER, November 25, 2025.

Current Price: 50.70

|

SILVER |

Weekly |

|

Trend direction |

|

|

57.00 |

|

|

55.00 |

|

|

53.00 |

|

|

48.50 |

|

|

48.25 |

|

|

48.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

63,000 |

43,000 |

23,000 |

-22,000 |

-24,500 |

-27,000 |

|

Profit or loss in €2 |

54,655 |

37,304 |

19,953 |

-19,086 |

-21,255 |

-23,423 |

|

Profit or loss in £2 |

48,059 |

32,802 |

17,545 |

-16,782 |

-18,689 |

-20,597 |

|

Profit or loss in C$2 |

88,952 |

60,713 |

32,474 |

-31,062 |

-34,592 |

-38,122 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 8:20 (GMT) 25/11/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.