Taiwan Semiconductor (#TAIWANSM) Weekly Special Report based on 1.00 Lot Calculation:

CHIP INDUSTRY

- MARKET POTENTIAL: The global semiconductor market was valued at $466.32 billion in 2022 and is expected to reach a value of $908.92 billion by 2030. This is an increase of around 95% in total, or up to around 13.5% each year on average.

- TAIWAN MARKET SHARE (2023): According to Statista.com, Taiwan Semiconductor's market share was 61.2% in 2023. It was followed by Samsung (11.3%), GlobalFoundries (5.8%) etc.

TAIWAN SEMICONDUCTOR: THE COMPANY

- Taiwan Semiconductor is a global leader in semiconductor fabrication and makes the vast majority of the world’s leading-edge logic chips, used in emerging technologies such as artificial intelligence. Its focus on areas such as artificial intelligence and automotive technology positions the company as a strategic partner for innovative companies seeking cutting-edge solutions.

- DEPENDENCE OF LARGE TECHNOLOGY COMPANIES: Nvidia is one of Taiwan Semiconductor´s main customers. Of Taiwan Semiconductor's total revenue in 2023, about 10% was contributed by Nvidia, 25% by Apple, 10% by AMD and 9% by Qualcomm. In other words, 50% of Taiwan Semiconductor´s sales come from large and well-known customers (Apple, Nvidia, AMD and Qualcomm).

TAIWAN SEMICONDUCTOR: NEWS AND EVENTS

- EVENT (THURSDAY, APRIL 18, PREMARKET): Q1 EARNINGS REPORT. Taiwan Semiconductor is expected to print $18.18 billion in revenue for Q1 of 2024. This is an increase of 8.7% from the same period last year ($16.73 billion). In addition, the company is expected to post a net income of $6.66 billion.

- COMPANY EARNINGS PERFORMANCE: According to Bloomberg, Taiwan Semiconductor has beat earnings expectations 6 times over the past 6 quarters, and beat revenue expectations 3 times over the past 6 quarters.

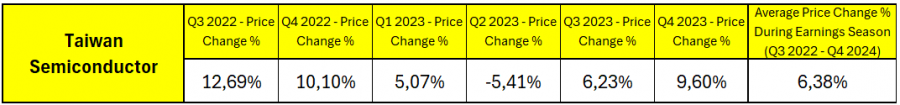

- TAIWAN SEMICONDUCTOR STOCK PRICE RISES 6.38% AFTER EARNINGS ON AVERAGE. According to the table below, Taiwan Semiconductor stock on average rose 6.38% after earnings. The average is calculated for the period of the last six quarters, during which period the Artificial Intelligence remained in the spotlight.

Data Source: Bloomberg

Please note that past performance does not guarantee future performance.

- U.S OFFERS AID PACKAGE OF $6.6 BILLION (April 8): Biden administration announces $6.6 billion aid package for Taiwan Semiconductor as pushes for chip security. Taiwan Semiconductor’s new factory in Arizona is estimated to cost $40B. This funding will support Taiwan Semiconductor’s investment of more than $65 billion in three manufacturing plants in Phoenix.

STOCK PRICE ACTION:

- STOCK PRICE ACTION: Taiwan Semiconductor stock hit an all-time high of $158.40 on March 8, 2024. The current price stands at $146. If the Goldman Sachs forecast is realized this would provide an upside potential of around 29%. However, the price could decline.

- ANALYST OPINION: Goldman Sachs forecasts $188. HSBC forecasts $164.

Taiwan Semiconductor, April 11, 2024

Current Price: 146.00

|

TSM |

Weekly |

|

Trend direction |

|

|

200.00 |

|

|

180.00 |

|

|

160.00 |

|

|

135.00 |

|

|

132.00 |

|

|

130.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

|

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

54,000.00 |

34,000.00 |

14,000.00 |

-11,000.00 |

-14,000.00 |

-16,000.00 |

|

Profit or loss in €² |

50,209.44 |

31,613.35 |

13,017.26 |

-10,227.85 |

-13,017.26 |

-14,876.87 |

|

Profit or loss in £² |

42,959.26 |

27,048.42 |

11,137.58 |

-8,750.96 |

-11,137.58 |

-12,728.67 |

|

Profit or loss in C$² |

73,678.41 |

46,390.11 |

19,101.81 |

-15,008.57 |

-19,101.81 |

-21,830.64 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 10:00 (GMT+1) 11/04/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail