USA500 Weekly Special Report based on 1.00 Lot Calculation:

USA500 INDEX:

- WHAT IS A STOCK INDEX: According to Investopedia.com, a stock index measures the price performance of a basket (group) of stocks using a standardized methodology. The S&P 500 Index is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market.

- COMPONENTS: USA500 includes 500 companies including Tesla, Apple, Google, Nvidia, Meta, and Goldman Sachs.

STARGATE: THE LARGEST A.I. INVESTMENT IN U.S. HISTORY

- US PRESIDENT DONALD TRUMP PRESENTED “STARGATE,” A $500 BILLION A.I. INVESTMENT. The project aims to establish a nationwide network of next-generation data centers and computing power for artificial intelligence.

- COMPANIES THAT COULD POTENTIALLY BENEFIT: Oracle, Microsoft, ARM, Nvidia, Broadcom, AMD, Palantir, Taiwan Semiconductor, and others, most of which are already included in USA500.

BIG TECH’S MASSIVE A.I. SPENDING IN 2025 AND BEYOND

- Meta (Facebook), Alphabet (Google), Microsoft, and Amazon plan to invest over $250 billion in capital expenditures this year, with a strong focus on A.I. and cloud infrastructure.

- Meta (Facebook): ~$65 billion

- Alphabet (Google): ~$80 billion

- Microsoft: ~$85 billion

- Amazon: ~$120 billion

- BREAKING (FEBRUARY 24): APPLE ANNOUNCED $500 BILLION INVESTMENT IN USA. Apple announced that it plans to invest more than $500 billion in the United States over the next four years, including plans to hire 20,000 people and build a new server factory in Texas (Source: APNEWS)

US PRESIDENT DONALD TRUMP AND HIS IMPACT ON THE US STOCK MARKET:

- (JANUARY 20, 2025) PRESIDENT DONALD TRUMP WAS INAUGURATED AS THE 47TH PRESIDENT OF THE USA. Donald Trump took office on January 20, 2025, after which he started implementing all his promises regarding the economic policy under his rule, including lowering corporate taxes to 15% from the current 21%.

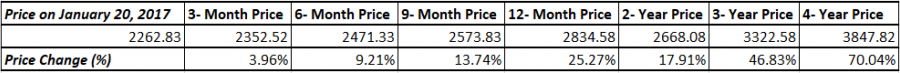

- STATISTICS (US STOCKS DURING TRUMP’S FIRST TERM (2017 – 2021)): USA500 INDEX ROSE 25.27% WITHIN THE FIRST 12 MONTHS FOLLOWING DONALD TRUMP'S INAUGURATION AS 45TH U.S. PRESIDENT (January 20, 2017 – January 20, 2018). In addition, the USA500 index rose 70.04% during the entire first term of Donald Trump’s service as 45th President of the USA.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- BREAKING (JANUARY 29): FEDERAL RESERVE KEPT RATES UNCHANGED AT 4.5%. The US Federal Reserve decided to cut its benchmark interest rate by 0.50% points in September, 0.25% points in November and 0.25% in December. The bank expects to cut rates two more times in 2025 to slash its benchmark rate to 4% by the end of 2025. The bank expects rates to fall to 3.40% in 2026 and further down to 3.10% in 2027.

- NEXT FED INTEREST RATE DECISION: March 19, 2025.

US EARNINGS CALENDAR:

- NVIDIA: WEDNESDAY, FEBRUARY 26, AFTERMARKET. Nvidia is expected to print $38.294 billion in revenue (a new record high), up 9.1% from Q3’s $35.08 billion, and up around 73% from the same period last year ($22.103 billion). Nvidia is expected to print $20.98 billion in net income (a new record high), up around 8% from Q3’s $19.3 billion and up around 72% from the same period last year ($12.21 billion).

- Nvidia is the second largest company in the USA500 (behind Apple and ahead of Microsoft), and it plays a crucial role in the GPU and semiconductor market. Its technology is essential for AI models developed by OpenAI, Google, Microsoft, and Meta. Over the past year, its performance has been a key driver of the index’s growth. If Nvidia delivers strong financial results, it could boost confidence in the tech sector and act as a catalyst to push the USA500 higher.

USA500, February 26, 2025

Current Price: 5,990

|

USA500 |

Weekly |

|

Trend direction |

|

|

6,670 |

|

|

6,450 |

|

|

6,200 |

|

|

5,800 |

|

|

5,750 |

|

|

5,700 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USA500 |

||||||

|

Profit or loss in $ |

6,800 |

4,600 |

2,100 |

-1,900 |

-2,400 |

-2,900 |

|

Profit or loss in €² |

6,475 |

4,380 |

2,000 |

-1,809 |

-2,285 |

-2,761 |

|

Profit or loss in £² |

5,372 |

3,634 |

1,659 |

-1,501 |

-1,896 |

-2,291 |

|

Profit or loss in C² |

9,740 |

6,589 |

3,008 |

-2,721 |

-3,438 |

-4,154 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 08:15 (GMT) 26/02/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.