WALT DISNEY (#DISNEY) Weekly Special Report based on 1.00 Lot Calculation:

WALT DISNEY: THE COMPANY

- The Walt Disney Company is one of the world's leading providers of entertainment and information services. The leading entertainment company is a diversified international media leader, operating across the following business sectors:

- Studio Entertainment: is the original foundation of the Walt Disney Company. Today it produces films, plays and music for a worldwide audience. It owns Pixar Animation Studios, Marvel Entertainment and the rights to the Star Wars franchise.

- Media Networks: are now Disney's main unit. They include a number of television networks, cable channels and broadcasters through two divisions: Walt Disney Television and ESPN.

- Disney Parks: bring Disney's most famous characters to life through attractions, experiences, resorts and cruises. They also produce toys, clothing, books and video games.

- Direct-to-consumer and international: a distinct segment of the organization with responsibility for global content and advertising sales. Includes the Disney+ streaming service.

- DISNEY´S KEY POINTS:

- Highly diversified business model: merchandising, theme parks, films for children and adults, TV channels.

- Pioneer in new technologies and always keeping pace with new consumer trends.

- Acquisition of large franchises that have brought it large revenues at the ticket office.

- Introduction into the Chinese market, with the opening of Shanghai Disney, a market with great potential.

- Entry into a market in full growth, the streaming platform market.

WALT DISNEY: NEWS AND EVENTS

- EVENT (THURSDAY, MAY 7, PREMARKET): Q1 EARNINGS REPORT. Walt Disney is expected to print $22.11 billion in revenue and $1.1 in earnings per share for Q1 of 2024.

- LAST EARNINGS REPORT (FEBRUARY 7, 2024): Walt Disney reported a net income of $1.279 billion, marking an 11% increase compared to the previous year. Earnings per Share (EPS) stood at $1.22 per share, surpassing the estimated $1. Additionally, total revenues amounted to $23.518 billion, reflecting an 11% rise from the previous year's figure.

- JOINT VENTURE BY WALT DINSEY, FOX AND WARNER BROS: The three major sports media companies, which own 80% of the content market, are planning to establish a joint venture to offer an online sports streaming service. Led by Walt Disney, Fox, and Warner Bros Discovery, this initiative aims to attract a younger audience that prefers streaming over traditional television. The joint venture is set to launch this autumn and will feature an extensive array of sports rights, including professional leagues like the NFL, NBA, and MLB, events like the FIFA World Cup, and college competitions. This consolidation could lead to higher prices and reduced choices for fans.

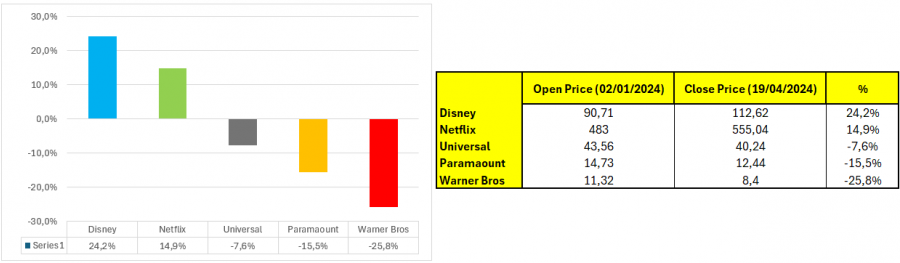

- STOCK PRICE IS CURRENTLY RISING (APRIL 19, 2024): Of the five major media companies, Disney has seen their stock soar this year, up 24.2% adding nearly $50 billion in market cap in four and a half months.

Source: Bloomberg

STOCK PRICE ACTION:

- STOCK PRICE ACTION: Walt Disney stock hit an all-time high of $202.95 on March 8, 2021. The current price stands at $113. The stock is trading around 44% below its all-time high. If a full recovery follows to all- time highs, the stock could see an upside of around 79%. However, the price could decline further.

- ANALYST OPINION: Wells Fargo forecasts $141. JP Morgan forecasts $140. Needham forecasts $145.

Walt Disney, April 25, 2024

Current Price: 113.00

|

Disney |

Weekly |

|

Trend direction |

|

|

200.00 |

|

|

160.00 |

|

|

125.00 |

|

|

102.00 |

|

|

100.00 |

|

|

98.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Disney |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

87,000.00 |

47,000.00 |

12,000.00 |

-11,000.00 |

-13,000.00 |

-15,000.00 |

|

Profit or loss in €² |

81,103.76 |

43,814.67 |

11,186.73 |

-10,254.50 |

-12,118.95 |

-13,983.41 |

|

Profit or loss in £² |

69,483.82 |

37,537.24 |

9,583.98 |

-8,785.31 |

-10,382.64 |

-11,979.97 |

|

Profit or loss in C$² |

118,949.88 |

64,260.28 |

16,406.88 |

-15,039.64 |

-17,774.12 |

-20,508.60 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 09:48 (GMT+1) 25/04/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail