The euro added minor gains against the dollar. However, France posted a record number of Covid-19 infections, while rising Treasury yields helped the dollar to keep pace with the shared currency. The British pound strengthened against the dollar. The UK government reassured investors with no fresh restrictions during the holiday season, while new post-Brexit fishing rules and the announcement of £75 million funding for British ports and processing facilities, supported the British currency.

The Japanese yen weakened as US bond yields continued to rise last week making the difference between the Japanese and US bonds even larger. The USD/JPY is very sensitive to interest rates differentials between the two countries.

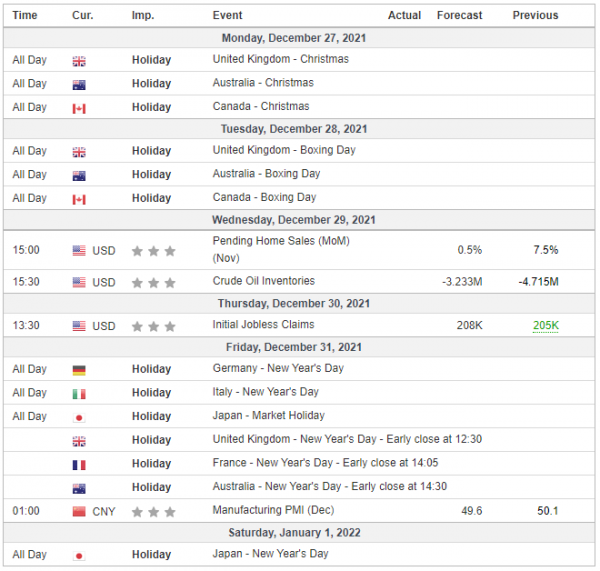

This week is shorter due to New Years’ Eve and there will be no major economic releases.

Gold price rose and consolidated above the $1,800 level. Persistently high inflation and worries over Omicron provided a boost to the yellow metal price.

US stock indexes touched new all-time highs as data showed the Omicron variant being less deadly than feared, while new pills approved to fight COVID-19 also spurred risk appetite. Excellent on-line sales in the US during the Christmas shopping season helped risk on sentiment.

Oil prices rose last week on hopes that the Omicron coronavirus variant will have a limited impact on global demand in 2022, even as surging cases caused flight cancellations. Oil traders are now looking to the next OPEC+ meeting on January 4, at which the cartel will decide whether to go ahead with a planned 400,000 barrels-per-day production increase in February.