The euro continued to fall against the dollar. The European Union is considering a sixth round of sanctions to include Russian oil imports to hit the Kremlin's revenues. Last week the currency pair hit its lowest level since January 2017, below 1.05.

The British pound fell to an almost two year low ahead of the Bank of England meeting on Thursday. A further weakening of the British economy and the Fed-Bank of England monetary policy divergence also weighed on the pound.

The dollar Japanese yen currency pair weakened consolidating losses above 130, its lowest level since May 2002. The benchmark 10-year US Treasury bond yield retreated and is currently around 2.8%.

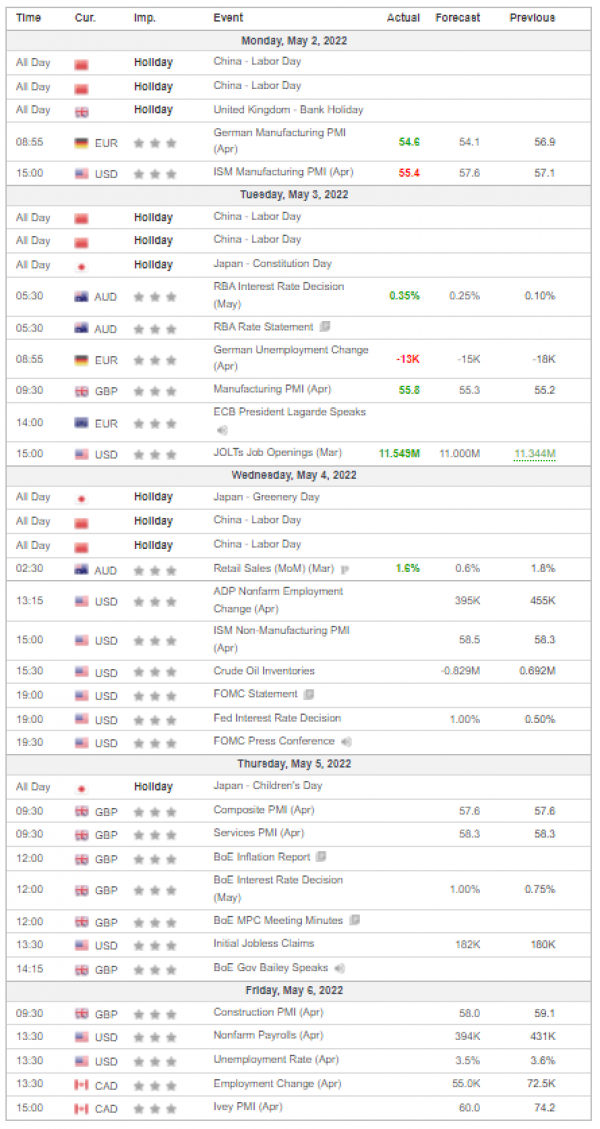

Gold retreated strongly as market participants priced in 3-4 interest rate hikes of half a percentage points in the US. The US Federal Reserve meeting is scheduled for May the 4th. However, rising inflation all across the world is supporting gold prices. A ceasefire in Ukraine is still out of reach, while military activities continued.

Last week, all major US stock indexes slumped. The earnings season is entering its fourth week with Pfizer, Airbnb and Starbucks reporting their quarterly results. Apple, Microsoft and Meta platforms (Facebook) released their Q1 financial statements last week providing support to falling indexes.

Oil prices were little changed last week pressured by COVID-19 lockdowns in China, on one hand, which potentially weigh on demand. However, they found support from a possible European oil embargo on Russia. A potential EU oil embargo could significantly cut supplies of the already diminishing availability of Russian crude.