The Eurodollar dropped to a fresh six-month low as the dollar pushed higher against its peers. In the US the threat of a government shutdown supported the greenback, but traders were relieved when lawmakers agreed to fund the government until November 17th.

The British pound dollar currency pair fell again recording its worst month since the currency crisis caused by former Prime Minister Truss in September last year.

The USD/Yen pair kept climbing and drew close to a one year high. As the yen continues to fall traders have been speculating at which point the Japanese government will intervene. The bank of Japan shows little sign of changing its low interest rate policy.

Gold prices traded low as traders continued to worry about inflation and higher interest rates.

US stocks fell as traders grew increasingly concerned over a potential US government shutdown. Meanwhile Meta held its AI linked Connect event on September 27th. The company showcased its Quest virtual reality headset and its RayBan AI smart glasses which will go on sale in mid-October.

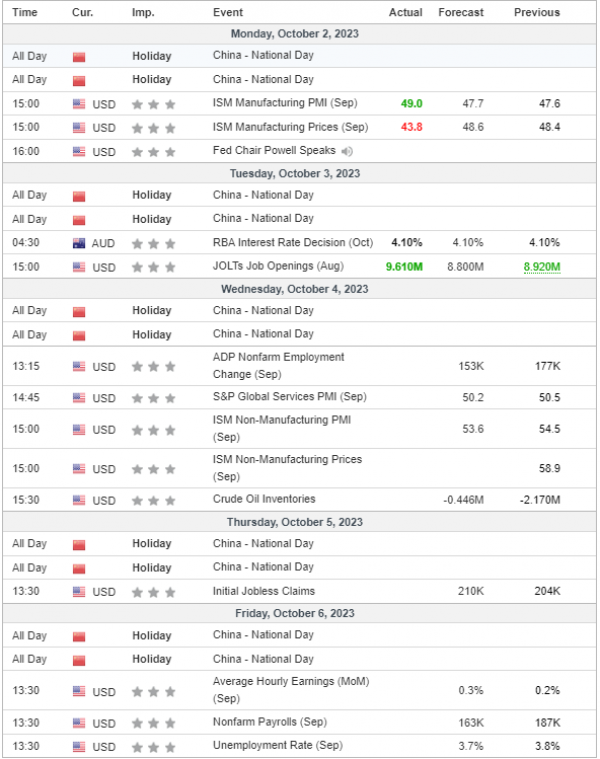

Oil prices soared upwards to hit a one year high after Chinese data appeared to show that its economy would continue to grow. In China the “Golden Week” holiday has begun. Traditionally this marks a period of very high demand for jet fuel and gasoline as people travel around and outside the country.