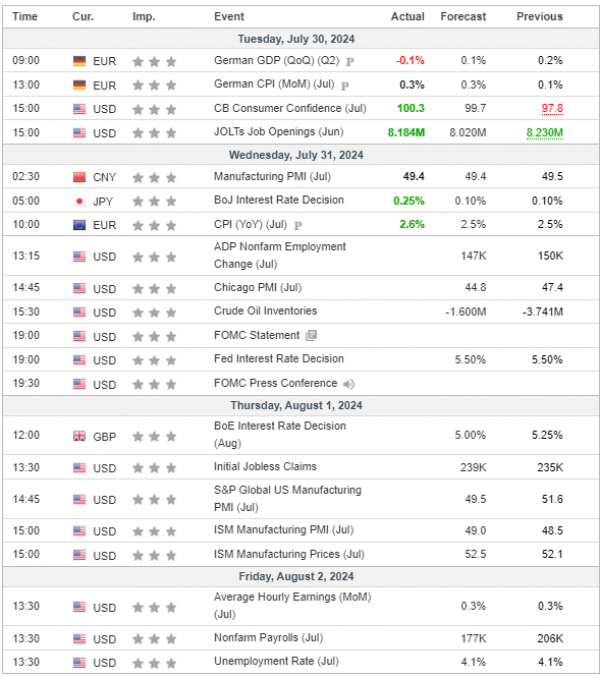

The Eurodollar rose ahead of this week's Federal Reserve meeting. The Fed is widely expected to keep rates steady at this meeting, but a quarter-point cut is expected at the following meeting in September.

GBP/USD hit a new two-week low as investors await the Bank of England's monetary policy meeting on Thursday. The BoE is anticipated to lower its interest rates by 25 basis points to 5%, marking the first rate cut by the BoE in over four years.

The USD/JPY remained fairly steady after the Japanese yen saw its strongest weekly rally since late April. The yen is strongly supported by increasing speculation about a possible interest rate hike by the Bank of Japan this week.

Gold prices are stabilizing following sharp declines last week, with traders closely watching the upcoming Federal Reserve meeting for any indications about interest rate changes. Signals regarding when the Fed might begin reducing rates will be carefully monitored.

U.S. indexes prices increased in anticipation of upcoming tech earnings reports and this week’s Federal Reserve meeting. Although no changes are expected from tomorrow's Fed meeting, Morgan Stanley suggests that Jerome Powell is likely to signal that the Fed is approaching a rate cut. Increased volatility may be ahead, with earnings reports from Apple, Amazon, Intel and Meta Platforms due later this week.

Oil prices fell to $75.5, extending previous losses amid concerns about demand in China, the world's largest crude importer. The prices weaken after Israel indicated that its response to a Hezbollah rocket strike in the Israeli-occupied Golan Heights on Saturday would be measured to avoid dragging the region into an all-out war.