Apple weekly uptrend opportunity based On 1.00 Lot Calculation:

GLOBAL SMARTPHONE MARKET

-

MARKETS SIZE: There were 1.355 Billion smartphones sold in 2021. In 2027, that figure could be expected to rise to 1.715 billion smartphones. That is a compounded annual growth rate of 3.70% between 2022 to 2027.

-

MARKET SHARE BY COMPANY AND BY SALES (Q1 2022): The industry is dominated by a handful of players. Samsung has 23% of the market ($74.5 billion), Apple has 18% ($59.0 billion), Xiaomi has 12% ($39 billion), OPPO has 9% ($30.9 billion), vivo has 8% ($24.8 billion), and dozens of other smaller companies make up the last 30% ($98.1 billion).

U.S. SMARTPHONE MARKET

-

MARKET SIZE: There are 294.15 million smartphone users in the United States. 85% of American adults use smartphones.

-

MARKET SHARE: Apple is the number one smartphone in the US with 113 million iPhone users or 38.4% of total smartphone users.

APPLE: ANALYSIS AND EVENTS

-

Apple Inc. is one of the most successful companies in the world. It makes iPhones, computers, and other mobile computing devices. In September 2022, Apple introduced a brand new iPhone 14.

-

MOST VALUABLE COMPANY IN THE WORLD: Apple was worth more than Amazon, Alphabet (Google), Meta (Facebook) combined with a market capitalization of more than 2.2 trillion dollars.

-

Q4 REVENUE EXPECTATIONS (NEW RECORDS TO BE SET): $126.44 billion. Previous record was set in Q4 2021, when the company raked in $123.94 billion in revenue. Apple is expected to ship around 80 million iPhones in Q4 2022. iPhone sales make up to 50% of total Apple revenue.

-

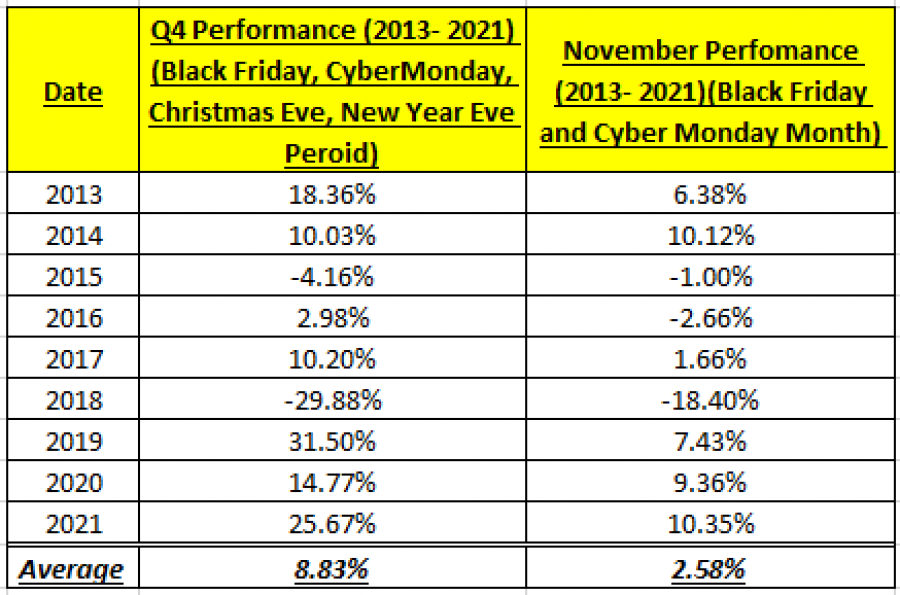

HOLIDAY SEASON (BLACK FRIDAY, CYBER MONDAY, CHRISTMAS EVE, NEW YEAR EVE): APPLE STOCK RISES ON AVEARGE 8.83% IN Q4 (2013- 2021) due to holiday season and always higher than previous quarter sales expectations. Black Friday, which falls in late November, would support the Apple stock by 2.58% on average over the same period.

Data Source: YahooFinance

*Please note that past performance does not guarantee future results

APPLE: PRICE ACTION

-

THE STOCK HAS HAD A DOWNWARD CORRECTION OF AROUND 30% FROM ITS ALL- TIME HIGH OF $183.23 (January 4, 2022). The stock fell to its lowest rate since June 2021 to $128.95. Apple was last trading around $138, and if a full recovery follows to recent all- time highs, the stock could see an upside of around 33%, however the price could also decline further.

-

ANALYST OPINION: JPMorgan forecasts $200 a share. Citigroup forecasts $175. Morgan Stanley forecasts $175. Deutsche Bank forecasts $170.

#APPLE, November 9, 2022

Current Price: 138

|

Apple |

Weekly |

|

Trend direction |

|

|

183 |

|

|

175 |

|

|

154 |

|

|

128 |

|

|

125 |

|

|

120 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Apple |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

4,500 |

3,700 |

1,600 |

-1,000 |

-1,300 |

-1,800 |

|

Profit or loss in €2 |

4,508 |

3,707 |

1,603 |

-1,002 |

-1,302 |

-1,803 |

|

Profit or loss in £2 |

3,926 |

3,228 |

1,396 |

-873 |

-1,134 |

-1,571 |

|

Profit or loss in C$2 |

6,080 |

4,999 |

2,162 |

-1,351 |

-1,757 |

-2,432 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 13:39 (GMT) 09/11/2022

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

-

You may wish to consider closing your position in profit, even if it is lower than suggested one

-

Trailing stop technique can protect the profit – Ask your Client Manager for more details