Fundamental analysis

10 August, 2021

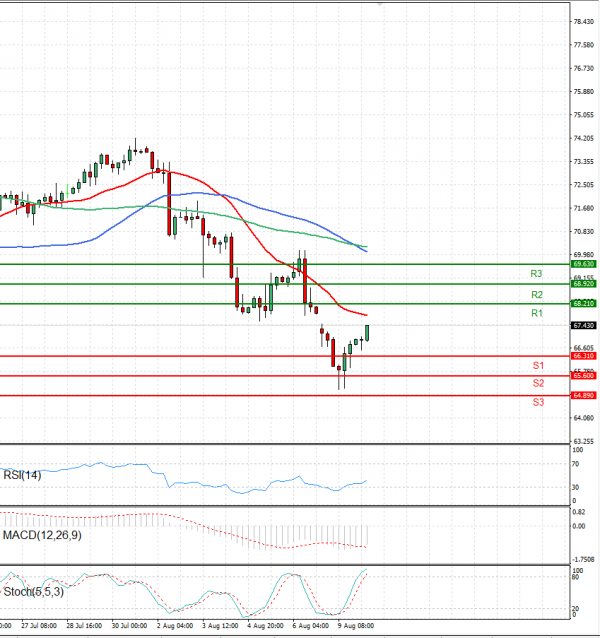

Oil prices rose on Tuesday, edging up from a three-week low in the previous session, but gains are likely to be limited on worries that rising COVID-19 cases and restrictions in China will dent fuel demand. China on Monday reported more COVID-19 infections in the latest outbreak of the disease that was first detected in the country in late 2019, in what analysts said was the biggest test of Beijing’s zero-infection strategy. In the United States, the Senate is set to vote on the passage of a $1 trillion infrastructure bill later on Tuesday, which, if passed would boost the economy and demand for oil products, analysts said. But surging cases of COVID-19 are blighting the outlook for economic growth and overall consumption. Still, U.S. crude, gasoline, and other product inventories are likely to have dropped last week, with gasoline stocks forecast to fall for a fourth consecutive period, a preliminary Reuters poll showed on Monday. Crude oil inventories are expected to have fallen by about 1.1 barrels in the week to Aug. 6, according to the average estimate of six analysts polled by Reuters.