Fundamental analysis

20 December, 2021

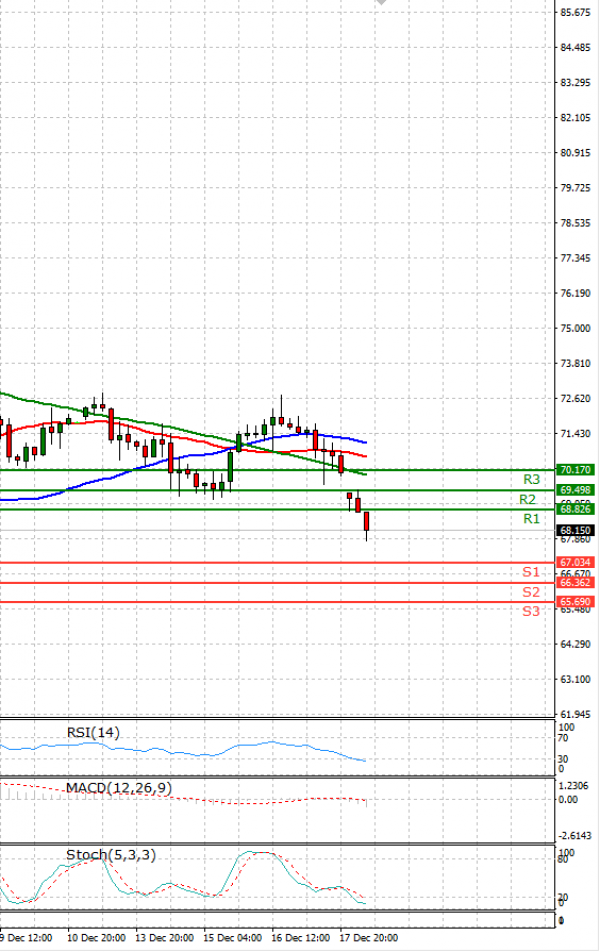

Oil prices slumped by more than 2% on Monday as surging cases of the Omicron coronavirus variant in Europe and the United States stoked investor worries that new restrictions on businesses to combat its spread may hit fuel demand. The Netherlands went into lockdown on Sunday and the possibility of more COVID-19 restrictions being imposed ahead of the Christmas and New Year holidays loomed over several European countries. U.S. health officials urged Americans on Sunday to get booster shots, wear masks and be careful if they travel over the winter holidays, as the Omicron variant raged across the world and was set to take over as the dominant strain in the United States. Meanwhile, U.S. energy firms this week added oil and natural gas rigs for a second week in a row. The oil and gas rig count, an early indicator of future output, rose by three to 579 in the week to Dec. 17, its highest since April 2020, energy services firm Baker Hughes Co said in its closely followed report on Friday. Still, lower exports are expected from Russia with exports and transit of oil from the country planned at 56.05 million tonnes in the first quarter of 2022 versus 58.3 million tonnes in the fourth quarter of 2021, a quarterly export schedule seen by Reuters showed on Friday.