Fundamental analysis

08 July, 2022

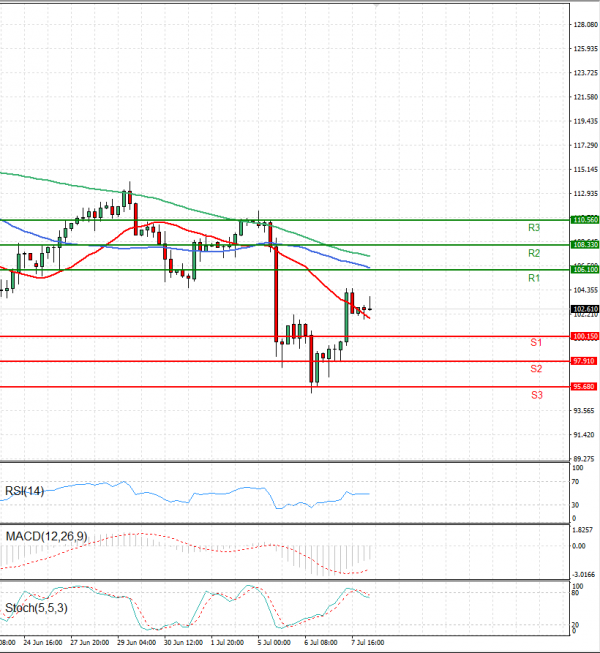

Oil prices slipped in Asian trade on Friday as recession fears continued to weigh on sentiment, though worries over tight global supplies capped price declines. Both contracts are set for their second straight weekly loss. Trade this week was marked by a sharp sell-off on Tuesday, when WTI slid 8% and Brent tumbled 9%. Brent's $10.73 drop was the third biggest for the contract since it started trading in 1988. Data from U.S. Energy Information Administration (EIA) showed on Thursday that product supplied, the best proxy for U.S. consumer demand, rose to 20.5 million barrels per day in the most recent week. Overall gasoline and distillate demand over the past four weeks, however, was down a little more than 5% from the year-ago period. U.S. crude inventories rose by 8.2 million barrels in the week to July 1, EIA data showed, driven by an increase in inventories and as refiners cut output.