During Asian trading, the Euro eased against the dollar. NFP data showed a much worse state of the US labor market (than expected) in August, which was a signal that the US Federal Reserve will continue its ultra-light monetary policy in the future. First of all, the Fed will refrain from gradually reducing the program of buying bonds from the open market, an amount of 120 billion dollars a month. At around 08:30, the euro is exchanged for 1,1870 dollars, which represents a weakening of the common European currency by 0,03% since the beginning of trading last night. A regular meeting of the ECB on monetary policy is being held on Thursday.

Euro - Dollar Analysis

EU Session Analysis for CFD Instruments 06/09/2021

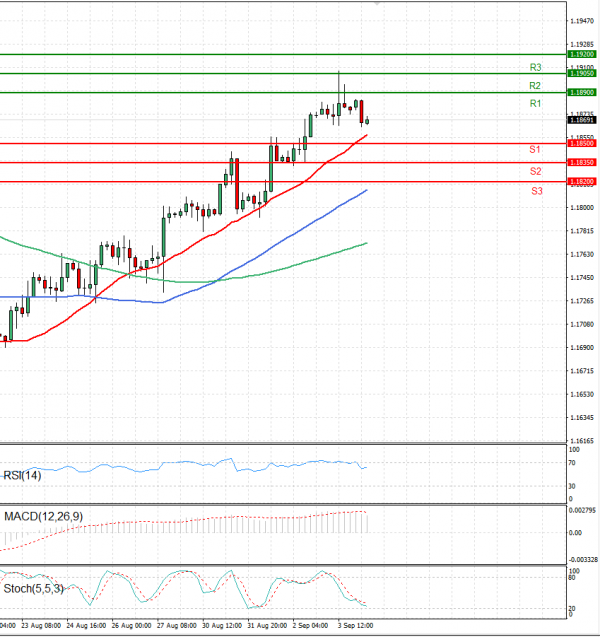

Technical analysis

Time Frame: 1 hour

EURUSD Support & Resistance Table - 06/09/2021

| Support & Resistance | Level | Explanation |

| Resistance 2 | 1.1905 | Daily R2 |

| Resistance 1 | 1.1890 | Daily R1 |

| Support 1 | 1.1850 | Daily S1 |

| Support 2 | 1.1835 | Daily S2 |

EURUSD Indicator Table - 06/09/2021

| Indicator | Signal |

| SMA 20 | Buy |

| SMA 50 | Buy |

| SMA 100 | Buy |

| MACD( 12;26;9) | Buy |

| RSI (14) | Buy |

| Stochastic ( 9;6;3) | Sell |

EURUSD Indicator / Period Table - 06/09/2021

| Indicator / Period | Day - Buy | Week - Sell | Month - Buy |

| MACD( 12;26;9) | Buy | Sell | Buy |

| RSI (14) | Buy | Neutral | Neutral |

| SMA 20 | Buy | Sell | Buy |

EURUSD 06/09/2021 - Reference Price : 1.1869

| Buy |

|

Ready for trading?Start Now