GOLD weekly uptrend opportunity based On 1.00 Lot Calculation:

- EVENT: FEDERAL RESERVE MEETING (Wednesday, January 26). December 15: INTEREST RATE: Interest rate stays in the range between 0.00% and 0.25%, but they signaled 3 interest rate hikes in 2022, instead of 2, and three more hikes are expected in 2023, too. Two more hikes in 2024. BOND STIMULUS PROGRAMME: 120 billion dollars’ stimulus programme will begin tapering at faster pace starting January 2022 (the tapering will speed up from 15 billion to 30 billion dollars per month).

- EVENT: DECEMBER U.S. INFLATION RATE ROSE TO 7.00%, WHICH IS THE HIGHEST SINCE 1982. Inflation has continued to rise, moved up by high stimulus packages provided by the US Federal Reserve and the US Congress. A rising inflation usually increases demand for gold as the asset is traditionally considered a store of value, which tends to protect the purchasing power of people’s wealth amid higher inflation.

- EVENT: Physical demand for GOLD in China and India rises this period of the year due to wedding festivals in India (Starts second half of January runs through April and May) and Lunar New Year in China.

- GEOPOLITICS: US-RUSSIA talks over Ukraine last week ended with no breakthrough announced (January 10-14). The effort ended without clear breakthroughs over the tens of thousands of Russian troops amassed on the Ukrainian border. Both US and Russian officials sounded a pessimistic note over the talks following the meeting in Vienna at the Organization for Security and Cooperation in Europe (OSCE). Russian Deputy Foreign Minister Sergey Ryabkov suggested the talks had reached "a dead-end or a difference in approaches''.

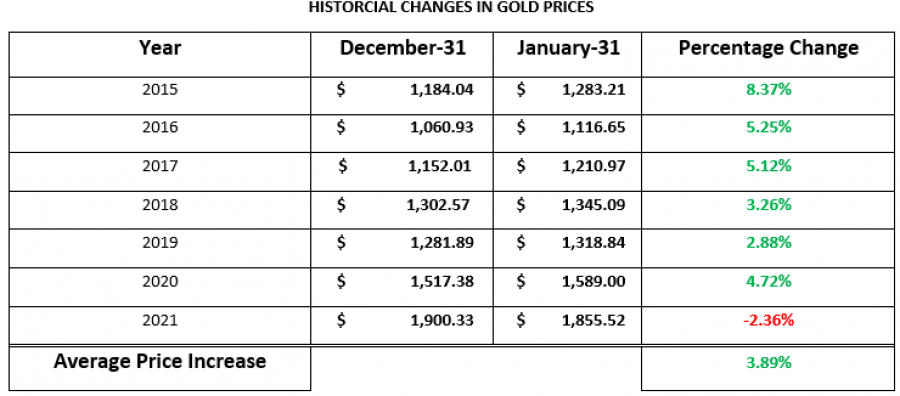

- STATISTICS: GOLD TENDS TO RISE IN JANUARY: The table below tells us that gold prices historically rose in the period between December 31 and January 31. After calculating the average price changes over the same period starting 2015, we found an average increase of 3.89%. So far in January 2022, Gold has risen around 0.75% (Data Source: Fortrade MetaTrader4).

However, please note that past performance does not guarantee future results.

- ANALYSTS OPINION (GOLDMAN SACHS/CITIGROUP/WELLS FARGO/COMMERZBANK/CREDIT SUISSE/ BANK OF AMERICA): GOLDMAN SACHS said that Gold is well placed for a boom, targeting still $2000. CITIGROUP sees Gold at $1950. Wells Fargo (The third largest bank in the US by assets) sees Gold at $2100-$2200. Commerzbank expected gold prices to return to $2000. CREDIT SUISSE targets the area 1959-1966, potentially could extend to $2075. BANK OF AMERICA expects the Gold price to reach $1900 in the Q4 2021.

GOLD, January 20, 2022

Current Price: 1832

|

GOLD |

Weekly |

|

Trend direction |

|

|

1910 |

|

|

1890 |

|

|

1870 |

|

|

1795 |

|

|

1780 |

|

|

1765 |

Example of calculation base on weekly trend direction for 1.00 Lot*

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

7,800.00 |

5,800.00 |

3,800.00 |

-3,700.00 |

-5,200.00 |

-6,700.00 |

|

Profit or loss in €** |

6,869.64 |

5,108.20 |

3,346.75 |

-3,258.68 |

-4,579.76 |

-5,900.85 |

|

Profit or loss in £** |

5,723.93 |

4,256.26 |

2,788.58 |

-2,715.20 |

-3,815.95 |

-4,916.71 |

|

Profit or loss in C$** |

9,743.92 |

7,245.48 |

4,747.04 |

-4,622.11 |

-6,495.94 |

-8,369.77 |

* 1.00 lot is equivalent of 100 units

** Calculations for exchange rate used as of 08:45 (GMT) 20/01/2022

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details