Date: February 24, 2022

TREND EXPECTATIONS: UP

Metals: Gold, Silver, Palladium, Platinum, Copper

Energy Products: Crude Oil, Brent Oil, Gasoline, Heating Oil, Natural Gas

- GEOPOLITICS: RUSSIA ATTACKS UKRAINE (OIL, NATURAL GAS, GOLD, SILVER, PALLADIUM, PLATINUM). President Vladimir Putin announced an attack on Ukraine early Thursday local time, days after he recognized two breakaway regions of Russia’s neighbor as independent. Attacks are occurring in Kyiv, Odessa, Mariupol and other locations in Ukraine

- COMMON FOR COMMODITIES (GOLD, SILVER, OTHER TO BENEFIT TOO): Inflation Hedge.

Inflation in the US rose to the highest in 40 years (7.00%), while the Eurozone inflation rose to 5.00% (its highest since 1991). Inflation in the UK rose to its highest since 1992 (5.4%). In times of high inflation, commodity and energy markets tend to rise as investors buy safe-haven assets such as Gold and Silver to protect their wealth from losing value. Goldman Sachs raised Gold price target from 2000 to 2150. On the other hand, demand for energy products inflates up as business sectors buy more today as they are not sure if tomorrow will be enough.

- RISING INVESTMENTS IN GLOBAL INFRASTRUCTURE (COPPER, OIL):

The US passed a bill worth 1 trillion dollars to improve infrastructure, while ongoing investments in China only to improve (China grew by 8.1% in 2021). Copper and oil demand in particular to rise.

- IMPROVEMENTS IN GLOBAL CAR INDUSTRY AS CHIP SHORTAGES EXPECTED TO EASE (PALLADIUM, PLATINUM, COPPER)

The chip shortage saga could end in 2022 and therefore some car manufacturers are now stocking up more Platinum and Palladium while still cheaper so to better prepare for eventual increase in car production rate. Meanwhile, Toyota said that they will produce record 11 million cars in 2022, sending a signal that chip supply issues are about to go away.

- OPEC+ FAILS TO INCREASE OIL SUPPLY ACCORDING TO ITS POLICY DUE TO LACK OF CAPACITY (OIL, GASOLINE, HEATING OIL).

Evidence continues to mount that OPEC and Russia don't have the capacity to continue to add oil according to their policy. They have not invested enough in oil maintenance capex for a number of years. With stronger demand coming, this situation could lead to a structural undersupply going forward. Oil prices move in positive correlation with other petroleum products such as Gasoline and Heating Oil.

- GOLDMAN SACHS: 10-YEAR COMMODITY SUPERCYCLE STARTS WITH MASSIVE INVESTMENTS IN GREEN ENERGY (COPPER, PLATINUM, SILVER)

Supercycles occur after a long period of depression. That was the case in the 2000s after the depression of the 1980s and 1990s. Goldman Sachs says that the biggest beneficiary of the ongoing commodity supercycle are metals, which he has compared to oil in the 2000s thanks mainly to green energy investments. They said that clean energy transition is massive, with nearly all of the world's nations pursuing clean energy goals at the same time, making copper one of the most important commodities of this cycle.

SELECTED COMMODITY MARKET POTENTIALS: BANK FORECASTS

- CRUDE OIL (UPSIDE: 55.44%) Current Price: $96.50

OIL PRICES STILL EXPECTED TO APPROACH THE $100 MARK: JPMorgan sees Oil at $125 in 2022 and $150 in 2023 (due to capacity-led shortfalls in OPEC+ production). Bank of America sees Oil at $120 by the end of June 2022. Goldman Sachs says Oil could possibly hit $100. In addition, they said that Oil could go as high as $110 as demand destruction occurs to slow the market. Morgan Stanley raised its price target to $100 as well (by Q3 2022). Oil prices move in positive correlation with other petroleum products such as Gasoline and Heating Oil.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

CRUDE OIL |

||||||

|

Pivot Points |

||||||

|

Levels |

150.00 |

125.00 |

110.00 |

85.00 |

83.00 |

78.00 |

|

Profit or loss in $ |

53,500.00 |

28,500.00 |

13,500.00 |

-11,500.00 |

-13,500.00 |

-18,500.00 |

|

Profit or loss in €2 |

47,578.82 |

25,345.72 |

12,005.87 |

-10,227.22 |

-12,005.87 |

-16,452.49 |

|

Profit or loss in £2 |

39,694.91 |

21,145.88 |

10,016.47 |

-8,532.55 |

-10,016.47 |

-13,726.28 |

|

Profit or loss in C$2 |

68,480.00 |

36,480.00 |

17,280.00 |

-14,720.00 |

-17,280.00 |

-23,680.00 |

- 1.00 lot is equivalent of 1000 units

- GOLD (UPSIDE: 11%) Current Price: $1940

GOLDMAN SACHS raised its 12-month gold target to $2150 from $2000. Wells Fargo (The third largest bank in the US by assets) sees Gold at $2100. Commerzbank expected gold prices to return to $2000. CREDIT SUISSE targets the area 1959-1966, potentially could extend to $2075.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Levels |

2150 |

2100 |

2000 |

1900 |

1870 |

1850 |

|

Profit or loss in $ |

21,000.00 |

16,000.00 |

6,000.00 |

-4,000.00 |

-7,000.00 |

-9,000.00 |

|

Profit or loss in €2 |

18,675.80 |

14,229.18 |

5,335.94 |

-3,557.29 |

-6,225.27 |

-8,003.91 |

|

Profit or loss in £2 |

15,581.18 |

11,871.37 |

4,451.77 |

-2,967.84 |

-5,193.73 |

-6,677.65 |

|

Profit or loss in C$2 |

26,880.00 |

20,480.00 |

7,680.00 |

-5,120.00 |

-8,960.00 |

-11,520.00 |

- 1.00 lot is equivalent of 100 units

- SILVER (UPSIDE: 20.50%) Current Price: 24.90

Analysts at Canada’s Scotiabank predict the silver price in 2022 could average $25 per ounce. Commerzbank sees silver reaching $26 an ounce in 2022. Goldman Sachs kept its target at $30 per ounce.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Levels |

30.00 |

28.00 |

27.00 |

23.50 |

23.00 |

22.55 |

|

Profit or loss in $ |

51,000.00 |

31,000.00 |

21,000.00 |

-14,000.00 |

-19,000.00 |

-24,000.00 |

|

Profit or loss in €2 |

45,355.51 |

27,569.03 |

18,675.80 |

-12,450.53 |

-16,897.15 |

-21,343.77 |

|

Profit or loss in £2 |

37,840.00 |

23,000.79 |

15,581.18 |

-10,387.45 |

-14,097.26 |

-17,807.06 |

|

Profit or loss in C$2 |

65,280.00 |

39,680.00 |

26,880.00 |

-17,920.00 |

-24,320.00 |

-30,720.00 |

- 1.00 lot is equivalent of 10000 units

- PLATINUM (UPSIDE: 21.63%) Current Price: $1100

BANK OF AMERICA sees Platinum prices around $1,338 an ounce in 2022.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Levels |

1338 |

1300 |

1200 |

1010 |

980 |

950 |

|

Profit or loss in $ |

23,800.00 |

20,000.00 |

10,000.00 |

-9,000.00 |

-12,000.00 |

-15,000.00 |

|

Profit or loss in €2 |

21,165.90 |

17,786.47 |

8,893.24 |

-8,003.91 |

-10,671.88 |

-13,339.86 |

|

Profit or loss in £2 |

17,658.67 |

14,839.22 |

7,419.61 |

-6,677.65 |

-8,903.53 |

-11,129.41 |

|

Profit or loss in C$2 |

30,464.00 |

25,600.00 |

12,800.00 |

-11,520.00 |

-15,360.00 |

-19,200.00 |

- 1.00 lot is equivalent of 100 units

- PALLADIUM (UPSIDE: 20.6%) Current Price: $2500

Palladium hit an all-time high of $3015 in May 2021.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PALLADIUM |

||||||

|

Pivot Points |

||||||

|

Levels |

3015 |

2900 |

2750 |

2300 |

2250 |

2200 |

|

Profit or loss in $ |

51,500.00 |

40,000.00 |

25,000.00 |

-20,000.00 |

-25,000.00 |

-30,000.00 |

|

Profit or loss in €2 |

45,800.17 |

35,572.95 |

22,233.09 |

-17,786.47 |

-22,233.09 |

-26,679.71 |

|

Profit or loss in £2 |

38,210.98 |

29,678.43 |

18,549.02 |

-14,839.22 |

-18,549.02 |

-22,258.83 |

|

Profit or loss in C$2 |

65,920.00 |

51,200.00 |

32,000.00 |

-25,600.00 |

-32,000.00 |

-38,400.00 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 08:15 (GMT) 24/02/2022

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Client Manager for more detail

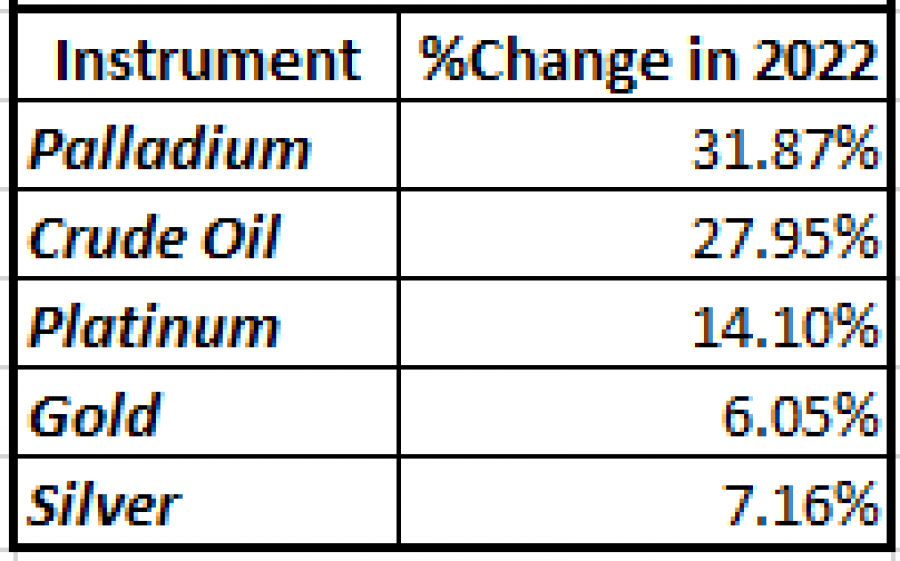

COMMODITY MARKET: METAL AND ENERGY MARKET PERFORMANCE SINCE THE BEGINNING OF 2022

Data Source: Fortrade MetaTrade4

Please note that past performance does not guarantee future results.