WEEKLY TREND: UP

COMPANY: Tesla Inc. designs, manufactures, and sells high-performance electric vehicles and electric vehicle powertrain components. Tesla sells more than five fully electric cars, among others, the Model S sedan and the Model X SUV, and the Model 3 sedan, which is among the world's top-selling electric cars.

NEXT (EXPECTED) EARNINGS RELEASE DATE (Q4): January 27, 2021 (AFTERMARKET): Tesla is expected to release its last quarter financial results on January 27, 2021. The company will be expected then to come up with new car delivery estimates for 2021.

TESLA HAS BEEN INCLUDED IN THE S&P 500 INDEX ON DECEMBER 21, 2020: Its inclusion meant investment funds indexed to the S&P 500 will have to sell about $100 billion worth of shares of companies already in the S&P 500 and use that money to buy shares of Tesla, so that their portfolios correctly reflect the index. Tesla accounts for about 1.5% of the index.

Additionally, actively managed investment funds that try to beat the S&P 500 will be forced to decide whether to buy Tesla shares. Such funds manage trillions of dollars in additional assets.

TESLA CAR DELIVERY (Q4) (TESLA BROKE NEW RECORDS IN 2020): Tesla beat Wall Street Estimates, but fell short of Musk’s expectations: Tesla said that it delivered 180,570 electric vehicles in the fourth quarter (Q4), beating its previous record as well as Wall Street expectations (174,000). For the year, Tesla delivered 499,550 vehicles in 2020, slightly missing its most recent guidance of 500,000 vehicles. Wall Street expected 481,261 vehicles. Analysts also said that Tesla could by 2022 deliver one million vehicles, as the China market continues to expand, along with the new Giga-factories in Berlin, Germany and Austin, Texas, U.S.

TESLA STARTED SELLING MODEL Y IN CHINA: Tesla won Chinese authorities’ approval to start selling Shanghai-assembled Model Y SUVs in the country, according to a statement on the website of the Ministry of Industry and Information Technology. The approval is the final major regulatory step before the U.S. carmaker can begin sales of the new model. With that being said, Tesla's market is to expand further, which could bode well for its stock.

TESLA TO START DELIVERING MODEL 3 IN INDIA: Tesla will also launch Model 3 in India in June, with bookings to start in January 2021. India is the second largest country in the world by population after China, which could bode well for Tesla’s aspiration to continue to expand globally.

WHAT JOSEPH BIDEN U.S. PRESIDENCY COULD MEAN FOR TESLA: During the campaign, Joseph Biden showed that he cares about the climate change advocating clean environment and therefore favoring battery supported electric vehicles over gasoline/diesel engines. In this respect, his administration could help the US improve its EV infrastructure, which could prove positive for the Tesla business. Therefore, Tesla may continue to outperform the market under Biden’s administration.

ANALYSTS OPINION: Wedbush analyst Dan Ives has boosted his base-case price target to $950, and said he envisions a (bull-case) scenario in which the electric vehicle market leader’s stock reaches $1,250.

TESLA STOCK PRICE ACTION: Tesla rose around 743% in 2020 and added around 20% more in 2021.

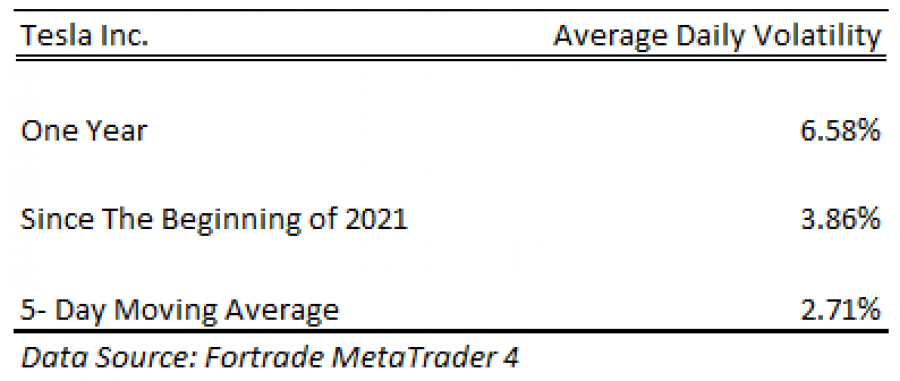

Tesla Inc. stock price daily volatility

- Daily stock price volatility in 2020 increased to 6.57%.

- Daily stock price volatility in 2021 has stood at 3.86%.

- As of January 22, the five-day Moving Average Daily Volatility has stood at 2.71%.

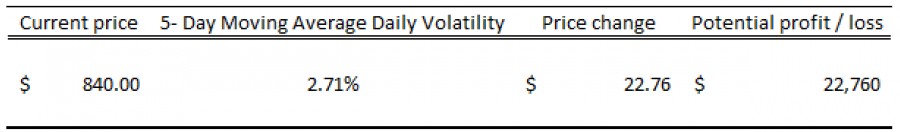

- Example of calculation based on Volatility for 1.00 Lot (1 lot = 1000 stocks)

- Technical Outlook (Tesla Inc., Daily, 2019-2020)

Source: Bloomberg

Current Price: 840

|

Tesla Inc. |

Weekly |

|

Trend direction |

|

|

1150 |

|

|

1050 |

|

|

950 |

|

|

730 |

|

|

700 |

|

|

650 |

Example of calculation based on trend direction for 1.00 Lot*

|

Tesla Inc. |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

310,000.00 |

210,000.00 |

110,000.00 |

-110,000.00 |

-140,000.00 |

-190,000.00 |

|

Profit or loss in €** |

254,814.77 |

172,616.45 |

90,418.14 |

-90,418.14 |

-115,077.64 |

-156,176.79 |

|

Profit or loss in £** |

226,359.99 |

153,340.64 |

80,321.29 |

-80,321.29 |

-102,227.09 |

-138,736.77 |

|

Profit or loss in C$** |

393,845.70 |

266,798.70 |

139,751.70 |

-139,751.70 |

-177,865.80 |

-241,389.30 |

* 1.00 lot is equivalent of 1000 units

** Calculations for exchange rate used as of 9:00 a.m. (GMT) 25/01/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details