Alibaba (#ALIBABA) weekly special report based on 1 Lot Calculation:

ALIBABA: COMPANY

- ALIBABA IS THE ONE OF THE LARGEST E-COMMERCE IN THE WORLD:

E-COMMERCE MARKET SHARE (COUNTRY) China is estimated to claim 52.1% of the global market, USA with 19%, UK with 4.8% and Japan with 3.0%. Rest of the world covers 21.1%.

E-COMMERCE MARKET SHARE (COMPANY) Alibaba (Taobao and Tmall) claimed 24.00%, while Amazon took up 13% of the global e- commerce market. JD.com claimed 9.20% of the market. - ALIBABA IN THE ARTIFICIAL INTELLIGENCE (AI) WORLD: Alibaba has showed off its generative Artificial Intelligence (AI) model (Tongyi Qianwen) (its version of the tech that powers Chabot sensation ChatGPT), and said it would be integrated into all of the company's apps in the near future. They have also invested into separate A.I. start- uo, valued at 2.5 billion dollars, which specializes in social A.I.

ALIBABA: ANALYSIS AND EVENTS

- CO- FOUNDER JACK MA INCREASES STAKE IN ALIBABA. Jack Ma bought more stocks in Alibaba, along with co- founder Joe Tsai. The total buying equaled around 210 million dollars, making the to one of the largest Alibaba stake holders owning more than 7% of the company together. The move was widely considered as a signal of confidence that the company is worth more than what the market thinks at the moment.

- CHINA GOVERNMENT PRESSURE ON ALIBABA REDUCED as Alibaba decides to split into six units. Alibaba plans to split into six business units and promises to yield several initial public offerings, while allowing quicker response to a rapidly-changing market environment. Analysts say the plan could offer another indication that the crackdown may be done and dusted.

ALIBABA: PRICE ACTION

- THE STOCK HAS TRADED 77% BELOW ITS ALL-TIME HIGH OF $319.32 (OCTOBER 2020). Alibaba was last trading around $72, and if a full recovery follows recent all-time highs, the stock could see an upside of around 343%, however, the price could also decline further.

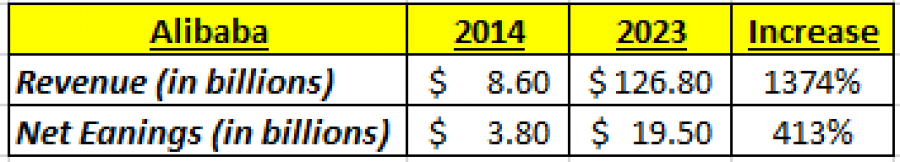

- ALIBABA STOCK TRADES CLOSE TO ITS 2014 IPO PRICE OF $68: Alibaba currently trades around $72, which is only around 4 dollars above its IPO (Initial Public Offering) price of $68. In other words, when Alibaba first became a public company in 2014, it started trading at $68. Almost 10 years later, Alibaba’s stock trades close to that rate again. In 2014 Alibaba’s revenue and net income stood at 8.6 billion dollars and 3.8 billion dollars, respectively. According to their latest reports, Alibaba made 126.8 billion dollars in revenue, and net earnings of 19.5 billion dollars in 2023. This is an increase of around 1400% in revenue and around 400% in net earnings.

Data Source: Bloomberg Terminal

However, please note that past performance does not guarantee future results.

- ANALYSTS OPINIONS: Goldman Sachs forecasts $105. JPMorgan forecasts $105. HSBC forecasts $118. Barclays forecasts $109. Citigroup forecasts $126.

ALIBABA: TECHNICAL REVIEW

- ALIBABA STOCK AT ITS LONG-TERM SUPPORT AREA ($57- $70). This is the fourth time to test the area. After testing the support of $80, Alibaba would tend to come back up to $120 (tested three time since February 2022), which is the upper boundary of this channel.

However, please note that past performance does not guarantee future results.

Graph: Alibaba stock (2014- 2024)

Source: MetaTrader 4 Platform

#ALIBABA, March 6, 2024

Current Price:72

|

Alibaba |

Weekly |

|

Trend direction |

|

|

120 |

|

|

100 |

|

|

80 |

|

|

65 |

|

|

63 |

|

|

60 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Alibaba |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

48,000 |

28,000 |

8,000 |

-7,000 |

-9,000 |

-12,000 |

|

Profit or loss in €2 |

44,162 |

25,761 |

7,360 |

-6,440 |

-8,280 |

-11,040 |

|

Profit or loss in £2 |

37,734 |

22,012 |

6,289 |

-5,503 |

-7,075 |

-9,434 |

|

Profit or loss in C$2 |

65,213 |

38,041 |

10,869 |

-9,510 |

-12,227 |

-16,303 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:00 (GMT) 06/03/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail