SILVER weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

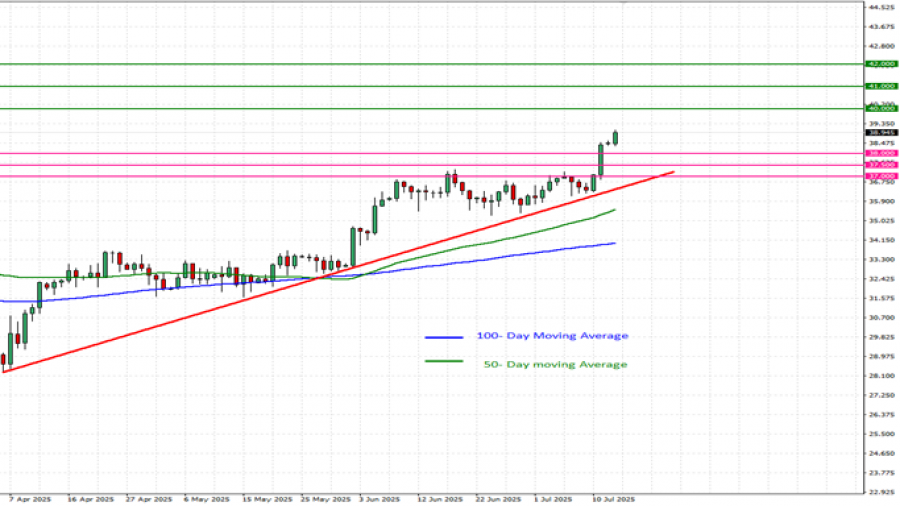

- DAILY MOVING AVERAGES POINT TO AN UPTREND: Silver prices have remained above the 50 - and 100-day moving averages, pointing to an ongoing uptrend. However, silver prices can also change their trend if prices fall below the 50 - and 100 - day moving averages.

- MID–TERM UPTREND: As depicted by the daily chart below, the silver price has kept trading above the mid-term red-lined uptrend line, confirming its mid-term trend is up. However, there remains a risk of a potential breakout below this level if market conditions change

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, Silver trades around $39.00 and if full recovery is made this could offer an upside potential of around 28%. However, the price could decline.

GRAPH (Daily): April 2025 – July 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: RUSSIA – UKRAINE WAR

- EVENT (MONDAY, JULY 14): U.S. PRESIDENT DONALD TRUMP TO SPEAK ON RUSSIA AND POSSIBLY ANNOUNCE NEW SANCTIONS ON RUSSIA. According to Bloomberg and SeekingAlpha, President Donald Trump will make a “major statement” on Russia on Monday (July 14). President Trump has repeated his criticism of Russian President Vladimir Putin. He also expressed confidence that the US Senate will pass a tough new sanctions bill targeting Russia.

GEOPOLITICS: US TAX CUT BILL

- BREAKING (JULY 4): U.S. PRESIDENT DONALD TRUMP SIGNED THE NEW TAX BILL INTO LAW. The new “Big Beautiful Bill” has been signed into law. The bill includes $4.5 trillion in tax cuts aimed at boosting the U.S. economy. It is expected to serve as a significant economic stimulus. This is the largest fiscal package since the COVID-19 era and substantially larger than Trump’s 2017 tax cuts ($1.5 trillion in 2017).

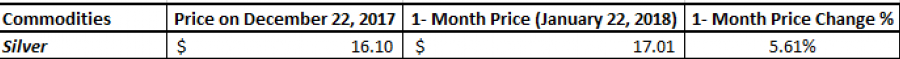

- STATISTICS (2017 – 2018): SILVER ROSE 5.61% WITHIN ONE MOTNH AFTER US PRESIDENT DONALD TRUMP SIGNED THE TAX CUT BILL ON DECEMBER 22, 2017.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

EVENTS:

- TUESDAY, JULY 15, AT 13:30 GMT+1: US INFLATION (CPI) (JUNE). A lower than expected reading should be taken as positive for silver, as it will increase the odds of a future interest rate cut by the FED. This data measures the change in the price of goods and services from the perspective of the consumer. The data for the previous month was 2.4% which was higher than the month before (2.3%).

- THURSDAY, JULY 17, AT 13:30 GMT+1: US RETAIL SALES (JUNE): A lower than expected reading should be positive for silver, because it could point to the FED cutting interest rates sooner in order to stimulate economic activity.

SILVER, July 14, 2025.

Current Price: 39.00

|

SILVER |

Weekly |

|

Trend direction |

|

|

42.00 |

|

|

41.00 |

|

|

40.00 |

|

|

38.00 |

|

|

37.50 |

|

|

37.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

30,000 |

20,000 |

10,000 |

-10,000 |

-15,000 |

-20,000 |

|

Profit or loss in €2 |

25,690 |

17,127 |

8,563 |

-8,563 |

-12,845 |

-17,127 |

|

Profit or loss in £2 |

22,249 |

14,833 |

7,416 |

-7,416 |

-11,125 |

-14,833 |

|

Profit or loss in C$2 |

41,066 |

27,378 |

13,689 |

-13,689 |

-20,533 |

-27,378 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 10:00 (GMT+1) 14/07/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.