AMAZON (#AMAZON) weekly special report based On 1.00 Lot Calculation:

AMAZON: THE COMPANY

Amazon is an American multinational technology company focusing on e-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence.

ARTIFICIAL INTELLIGENCE:

- One of Amazon’s biggest focuses is in cloud computing, where the company’s Amazon Web Services is a market leader with 34% of market share, ahead of Microsoft Azure (24%), Google Cloud (10%) and Alibaba Cloud (5%).

- The Cloud industry is expected to grow at a compounded annual growth rate at 17.9% until 2028, to $791.49B, with Amazon Web Services set to maintain dominance. The online tech and retail giant has also built in-house chips to power the cloud and has partnered with OpenAI rival Anthropic on infrastructure that enables large-scale AI modeling.

- Amazon Bedrock is a machine learning platform used to build generative AI applications on the Amazon Web Services cloud computing platform. Bedrock uses foundation models to simplify the creation of these apps and make the process more efficient. Amazon and NVIDIA announced strategic collaboration to offer new supercomputing infrastructure, software and services for generative AI.

AMAZON: ANALYSIS AND EVENTS

- EVENT: AMAZON WILL REPLACE WALGREENS BOOTS ALLIANCE IN THE DOW JONES INDUSTRIAL AVERAGE. Index funds and ETFs that track a specific index will rebalance their holdings when the index composition changes. The increased demand from these fund rebalancing activities can contribute to a rise in the stock price. The change goes into effect prior to the market open on Feb. 26.

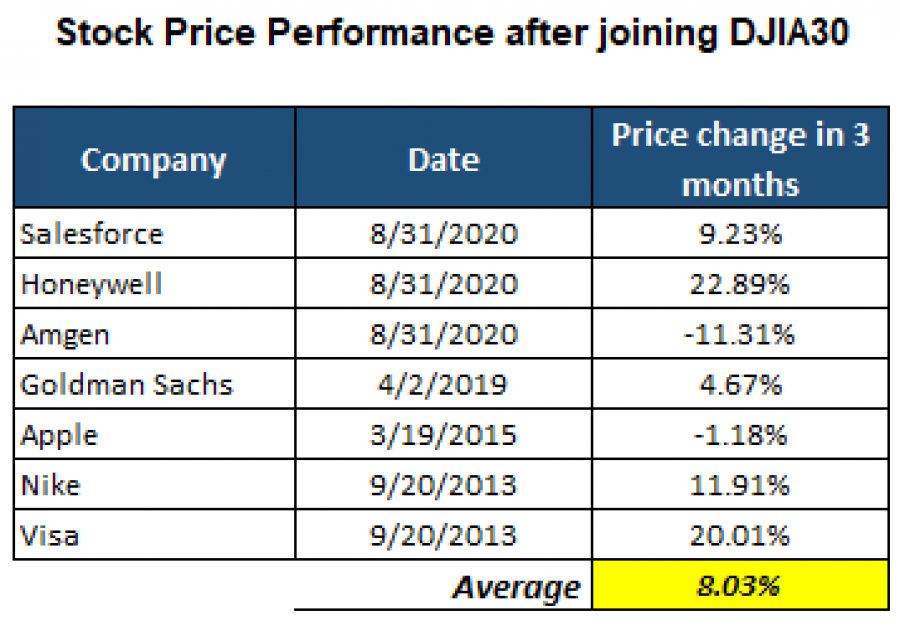

Over the past decade, only seven additional companies have been admitted to this index. The table below illustrates the stock performance in the subsequent three months following each inclusion event.

Source: MT4

Please note that past performance does not guarantee future results.

- ANALYST OPINION: JP Morgan’s price target is $225. Oppenheimer is targeting $210. Barcleys is targeting $220 while UBS targets $198.

- STOCK PRICE ACTION: Amazon stock made its all-time high of $188.65 in July, 2021. The stock currently trades around $171 which is around 9.35% below the record high. If a full recovery follows, the stock could increase around 10.3%. However, it could go lower.

AMAZON, February 22, 2024

Current Price: 171.00

|

Amazon |

Weekly |

|

Trend direction |

|

|

225.000 |

|

|

210.000 |

|

|

190.000 |

|

|

153.000 |

|

|

145.000 |

|

|

140.000 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Amazon |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

5,400.00 |

3,900.00 |

1,900.00 |

-1,800.00 |

-2,600.00 |

-3,100.00 |

|

Profit or loss in €² |

4,974.00 |

3,592.33 |

1,750.11 |

-1,658.00 |

-2,394.89 |

-2,855.45 |

|

Profit or loss in £² |

4,258.52 |

3,075.60 |

1,498.37 |

-1,419.51 |

-2,050.40 |

-2,444.71 |

|

Profit or loss in C$² |

7,264.51 |

5,246.59 |

2,556.03 |

-2,421.50 |

-3,497.73 |

-4,170.37 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 11:50 (GMT) 22/02/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail