Copper Weekly Special Report based on 1 Lot Calculation:

TECHNICAL ANALYSIS:

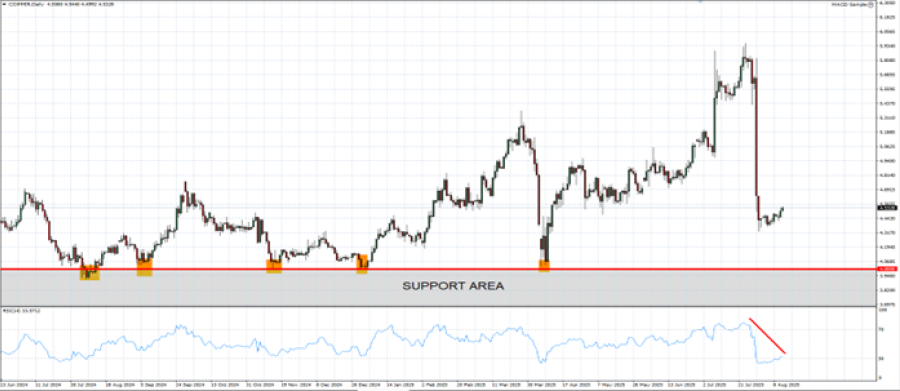

- 14-DAY RELATIVE STRENGTH INDEX (RSI) POINTS TO WEAKENED COPPER PRICE MOMENTUM: According to the daily chart below, the 14-Day RSI is trading near the 30 level, a threshold for an oversold territory, reflecting weaker recent price performance. Therefore, a price recovery could be expected next, although prices could go in the other direction as well.

- STRONG SUPPORT AT $4: Copper prices have tested the mark of $4 in total of 5 times since August 2024. This technical indicator indicates that the current downside potential remains limited, although if prices break below $4, then a negative trend could be observed.

- COPPER PRICE HIT AN ALL-TIME HIGH OF $5.9552 (July 24, 2025): The copper price currently trades around $4.52, and if a full recovery occurs, then copper prices could see an upside of around 32%. Although price could decline, too.

- COPPER PRICE HAS TESTED ITS LOWEST PRICE IN 3 AND A HALF MONTHS ($4.3302): After the most recent pullback of copper prices, losing more than 20% over two days, copper prices have tested their lowest levels in 3 and a half months ($4.3302).

GRAPH (Daily): June 2024 - August 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: US TARIFFS

- BREAKING (JULY 31): US PRESIDENT TRUMP ANNOUNCED 50% TARIFFS ON COPPER IMPORTS TO TAKE EFFECT AUGUST 1. US President Trump confirmed that a 50% tariff on some copper imports will be implemented, with enforcement beginning on August 1.

IMPORTANCE: U.S.A. RELIES ON IMPORTS FOR 45% OF ITS COPPER CONSUMPTION. The U.S. relies on imports for 45% of its copper consumption, and a 50% tariff could disrupt supply chains.

GEOPOLITICS: RUSSIA – UKRAINE WAR

- EVENT (FRIDAY, AUGUST 15): U.S. PRESIDENT TRUMP AND RUSSIAN PRESIDENT PUTIN MEETING IN ALASKA (USA): Following earlier threats of 100% secondary tariffs on countries importing Russian goods if no Russia–Ukraine ceasefire was reached by August 8, President Trump will now meet with President Putin in Alaska to discuss ending the conflict. Talks are expected to focus on potential territorial swaps, but with Russia demanding recognition of control over occupied territories, and Ukraine firmly rejecting those demands, markets see little chance of meaningful progress.

RUSSIA IS THE 4TH LARGEST REFINED COPPER EXPORTER IN THE WORLD. Russia is the 4th largest refined copper exporter in the world after Chile, Japan, and Australia. Russia’s refined copper is exported to China, Turkey, Italy, Egypt, and Germany.

TRADE: OPTIMISM PREVAILS

- BREAKING (AUGUST 11): US PRESIDENT TRUMP EXTENDED CHINA TARIFF TRUCE FOR ANOTHER 90 DAYS UNTIL MID-NOVEMBER. President Donald Trump signed an executive order delaying the reinstatement of higher U.S. tariffs on Chinese goods for an additional 90 days, moving the deadline to mid-November 2025.

EVENTS:

- FRIDAY, AUGUST 15 AT 03:00 GMT+1: CHINA INDUSTRIAL PRODUCTION (JULY): A strong result in China’s industrial production would reinforce optimism for copper demand, as expanding factory and manufacturing activity typically drives higher copper consumption. With China being the world’s largest consumer of copper, continued industrial growth would further strengthen the bullish momentum in copper prices.

- FRIDAY, AUGUST 15 AT 13:30 GMT+1: US RETAIL SALES (JULY). A lower-than-expected reading could be positive for U.S. stock prices, as it could indicate that the Federal Reserve could cut interest rates sooner and more aggressively. Retail Sales measure the change in the total value of sales at the retail level.

COPPER, August 13, 2025.

Current Price: 4.52

|

COPPER |

Weekly |

|

Trend direction |

|

|

6.00 |

|

|

5.50 |

|

|

5.00 |

|

|

4.20 |

|

|

4.10 |

|

|

4.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

COPPER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

14,800 |

9,800 |

4,800 |

-3,200 |

-4,200 |

-5,200 |

|

Profit or loss in €² |

12,619 |

8,356 |

4,093 |

-2,728 |

-3,581 |

-4,434 |

|

Profit or loss in £² |

10,903 |

7,219 |

3,536 |

-2,357 |

-3,094 |

-3,831 |

|

Profit or loss in C$² |

20,358 |

13,480 |

6,602 |

-4,402 |

-5,777 |

-7,153 |

- 1.00 lot is equivalent of 10 000 units

- Calculations for exchange rate used as of 11:30 (GMT+1) 13/08/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit