Crude Oil weekly special report based On 1.00 Lot Calculation:

TECHNICAL REVIEW:

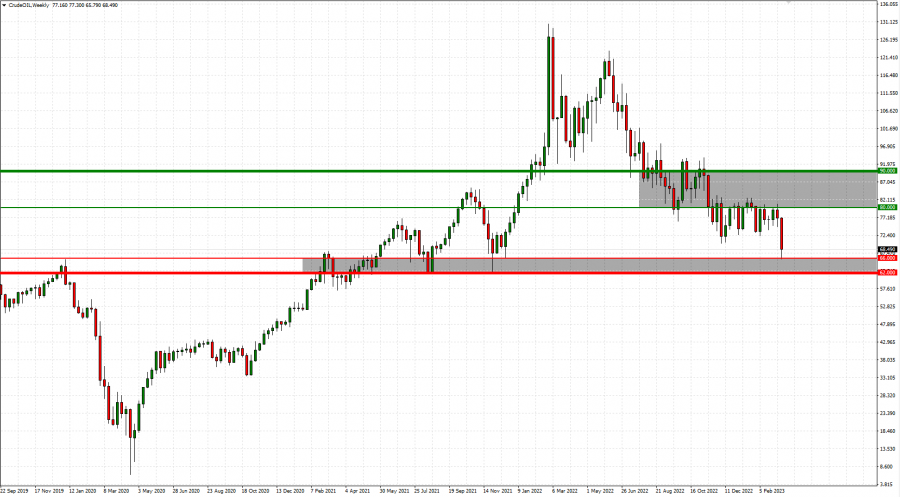

- STATISTICS: CRUDE OIL HAS TESTED THE RANGE OF $62- $66 THREE TIMES SINCE FEBRUARY 2021. This is the fourth time to test the region. After testing the region, Crude oil would come back up to target the $80- $90 range.

Graph (Weekly): Crude Oil

Please note that past performance does not guarantee future results.

DOWNWARD PRESSURE:

- US STRATEGIC PETROLEUM RESERVES (SPR) TO REFILL AT $68 - $72. The Biden administration will start buying crude to replenish the strategic petroleum reserve when prices fall to $68- $72 per barrel. President Biden ordered the release of a total of 180 million barrels of crude this year in response to a price rally caused by Russia’s invasion of Ukraine. Currently, the Strategic Petroleum Reserves stand at 371.6 million barrels, its lowest since early 1980’s.

- SAUDI ARABIA: Saudi Arabia, de facto OPEC leader, maintains a fiscal breakeven oil price of around $80 a barrel.

SUPPLY EXPECTATIONS:

- EVENT (MARCH): RUSSIA STARTS CUTTING THEIR OIL PRODUCTION BY 500,000 BARRELS IN MARCH. Russia cited ongoing sanctions as the main reason why would they reduce oil production. The International Energy Agency still believes that Russia may have to cut oil production by 1-2 million.

- EU BAN ON RUSSIAN OIL PRODUCT (DIESEL, NAPHTA) IMPORTS STARTED TAKING PLACE. The EU has already banned 90% crude oil imports from Russia on December 5, 2022. In addition, the European Commission agreed that from Feb. 5 the EU should apply a price cap of $100 (Currently moves between $90 and $113) per barrel on premium Russian oil products such as diesel and a $45 cap per barrel on discounted products such as fuel oil.

- DECEMBER 5, 2022: G-7 GROUP AND THE E.U. PRICE CAP ($60) HAS STARTED TAKING PLACE: The G7 (Group of Seven) consists of the UK, US, Canada, France, Germany, Italy and Japan. The introduction of a price cap on Russian oil means countries that sign up to the policy will only be permitted to purchase Russian oil and petroleum products transported via sea that are sold at or below the price cap ($60 a barrel).

DEMAND EXPECTATIONS:

- CHINA REOPENING STARTED: Travel inside China surged 74% from last year after authorities scrapped COVID-19 restrictions. Meanwhile, Gasoline consumption increased by 20% from a year ago, with record flows of cars on the nation’s highways. China is the largest oil importer in the world (importing more than 11 million barrels a day) and the second largest oil consumer in world (expected to consume a record 16 million barrels a day in 2023).

ANALYST OPINION:

- JPMorgan forecasts $90 in 2023. Goldman Sachs predicts $100 by the end of the year. Morgan Stanley Price Target stands at $100 in 2023. UBS forecasts $100 a barrel. Commerzbank targets $100 a barrel. Bank of America forecasts oil at $88 a barrel. Deutsche Bank forecasts $100.

Crude Oil, March 16, 2023

Current Price: 68.00

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

90.00 |

|

|

80.00 |

|

|

74.00 |

|

|

63.00 |

|

|

62.50 |

|

|

62.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

22,000 |

12,000 |

6,000 |

-5,000 |

-5,500 |

-6,000 |

|

Profit or loss in €2 |

20,716 |

11,299 |

5,650 |

-4,708 |

-5,179 |

-5,650 |

|

Profit or loss in £2 |

18,182 |

9,917 |

4,959 |

-4,132 |

-4,545 |

-4,959 |

|

Profit or loss in C$2 |

30,212 |

16,479 |

8,240 |

-6,866 |

-7,553 |

-8,240 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 08:50 (GMT) 16/03/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail