GOLD weekly special report based on 1.00 Lot Calculation:

US FEDERAL RESERVE:

- BREAKING (WEDNESDAY, DECEMBER 10): US FEDERAL RESERVE CUT THEIR INTEREST RATE TO 3.75% FROM THE PREVIOUS 4.00%. This is their third consecutive rate cut, following those on September 17 and October 29, 2025. It marks the lowest rate since September 2022.

- EARLIER:

OCTOBER 29, 2025: US FEDERAL RESERVE CUT INTEREST RATE TO 4.00% FROM 4.25%.

SEPTEMBER 17, 2025: US FEDERAL RESERVE CUT INTEREST RATE TO 4.25% FROM 4.00%.

GOLD PRICE ACTION: LAST TWO TIMES TIME (SEPTEMBER AND OCTOBER): Following the last two interest rate cuts (September and October 2025) by the FED, gold rose on average by 4.53% after ten days and 10.79% after one month.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

EVENTS

- TUESDAY, DECEMBER 16 AT 13:30 GMT: NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (NOVEMBER). A weaker-than-expected NFP reading would point to a softer U.S. labor market, increasing expectations for additional Fed rate cuts. The U.S. unemployment rate has recently gone up to 4.4%, which is the highest rate since November 2021.

- THURSDAY, DECEMBER 18 AT 13:30 GMT: U.S. INFLATION (CPI) (NOVEMBER). A softer CPI reading would point to easing inflation and increase expectations for more Fed rate cuts, which typically support gold prices.

PRICE ACTION

- GOLD PRICE HIT A NEW ALL-TIME HIGH ON OCTOBER 20, 2025 ($4,381.34). Since the beginning of 2025, the gold price has been rising solidly, hitting a fresh all-time high in October ($4,381.34), marking an increase of around 67%. However, the price could also decline.

- ANALYSTS’ OPINION: Bank of America forecasts $5,000; Societe Generale forecasts $5,000; Standard Chartered forecasts $4,500; Goldman Sachs forecasts $4,900; J.P. Morgan forecasts $5,055; Morgan Stanley forecasts $4,400; HSBC forecasts $5,000; Deutsche Bank forecasts $4,450.

TECHNICAL ANALYSIS AND ANALYSTS’ OPINION:

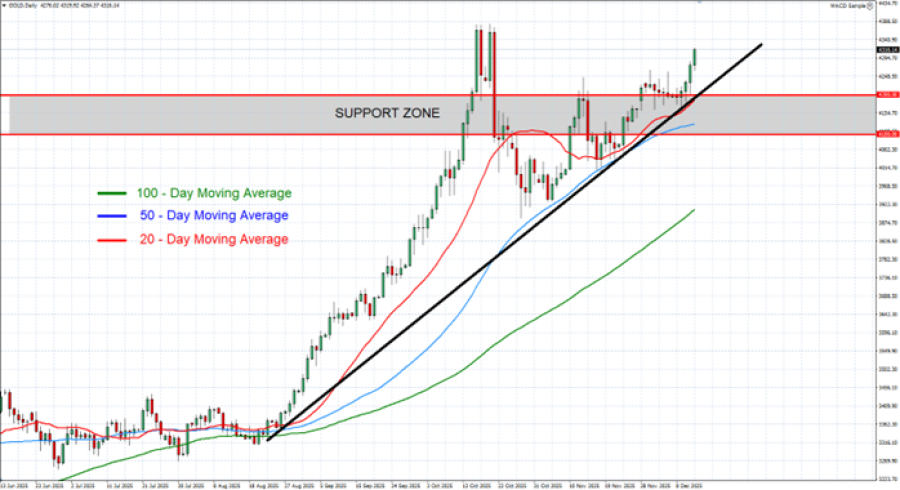

- TECHNICAL SUPPORT: $4,200 - $4,100. Since late November, after the most recent decline in gold prices, gold prices have tried to maintain near-term support between $4,200 and $4,100.

- GOLD TRADING ABOVE MOVING AVERAGES (MA). Gold has kept steady above its 20 -, 50 -, and 100-day moving averages, pointing to an uptrend. However, it could also decline.

GRAPH (Daily): June 2025 – December 2025

Please note that past performance does not guarantee future results

GOLD, December 12, 2025.

Current Price: 4,320

|

GOLD |

Weekly |

|

Trend direction |

|

|

4,600 |

|

|

4,500 |

|

|

4,420 |

|

|

4,230 |

|

|

4,210 |

|

|

4,200 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

28,000 |

18,000 |

10,000 |

-9,000 |

-11,000 |

-12,000 |

|

Profit or loss in €2 |

23,875 |

15,348 |

8,527 |

-7,674 |

-9,380 |

-10,232 |

|

Profit or loss in £2 |

20,931 |

13,455 |

7,475 |

-6,728 |

-8,223 |

-8,970 |

|

Profit or loss in C$2 |

38,521 |

24,764 |

13,758 |

-12,382 |

-15,133 |

-16,509 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 10:00 (GMT) 12/12/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.