Crude Oil weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: MIDDLE EAST TENSIONS KEEP MARKETS NERVOUS

- ISRAEL- HAMAS WAR ESCALATES: According to Reuters, Israel will go after the remaining Hamas battalions in Rafah despite strong international criticism and is preparing a plan to get civilians out of harm’s way. Israel is preparing for a new ground assault on Rafah, a small city on the southern border with Egypt where over half of Gaza's 2.3 million people are now living, mostly in makeshift tents. Egypt warned of "dire consequences" of a potential Israeli military assault on Rafah.

- RED SEA, SUEZ CANAL WERE AVOIDED BY SHIPPING AND OIL TANKER COMPANIES. Middle East tensions, compounded by the ongoing Israeli ground offensive of the Gaza Strip, keep many oil investors nervous. Meanwhile, Yemen’s Houthis continue to pose a threat to the many ships transiting through the Red Sea. Some analyses show that around 9 million barrels a day of oil transits through the Red Sea. This is almost 10% of total global oil demand. Therefore, many investors fear the worst: oil delivery delays and higher oil prices thereafter. The Houthis have already claimed responsibility for many attacks on ships bound for Israel and have shown no signs of backing down.

EVENTS:

- NEXT EVENT (EARLY MARCH): OPEC+ MEETING TO DECIDE ON PRODUCTION CUT POLICY FOR Q2. According to Bloomberg, OPEC+ nations plan to decide in early March whether to extend oil output cuts into the second quarter. Seven coalition members have pledged supply curbs totaling about 900,000 barrels a day this quarter, in tandem with a 1 million-barrel reduction by group leader Saudi Arabia. They will review whether to continue the curbs in March.

- OPEC OIL MONTHLY REPORT (DECEMBER): A 1.8 MILLION BARRELS A DAY OF DEFICIT EXPECTED IN 2024. December oil price drop was mainly driven by selling pressure from speculators.

- OPEC+ STARTED CUTTING ITS OIL PRODUCTION BY AROUND 1,000,000 BARRELS A DAY FROM JANUARY 1, 2024. OPEC+, consisting of OPEC and some non-OPEC oil producers, is responsible for almost 50% of the total global oil supply. The Organization of Petroleum Exporting Countries (OPEC), is led by Saudi Arabia, while the non-OPEC part is led by Russia.

ANALYST EXPECTATIONS 2024

CITIGROUP: OIL COULD HIT $100 WITHIN THE NEXT 12- 18 MONTHS. According to CNBC, the catalysts for oil to hit $100 per barrel include higher geopolitical risks, deeper OPEC+ cuts and supply disruptions from key oil-producing regions. Major oil producer Iraq has been impacted by the conflict and any further escalation could hurt other major OPEC+ suppliers in the region.

SOURCE: Bloomberg

TECHNICAL REVIEW:

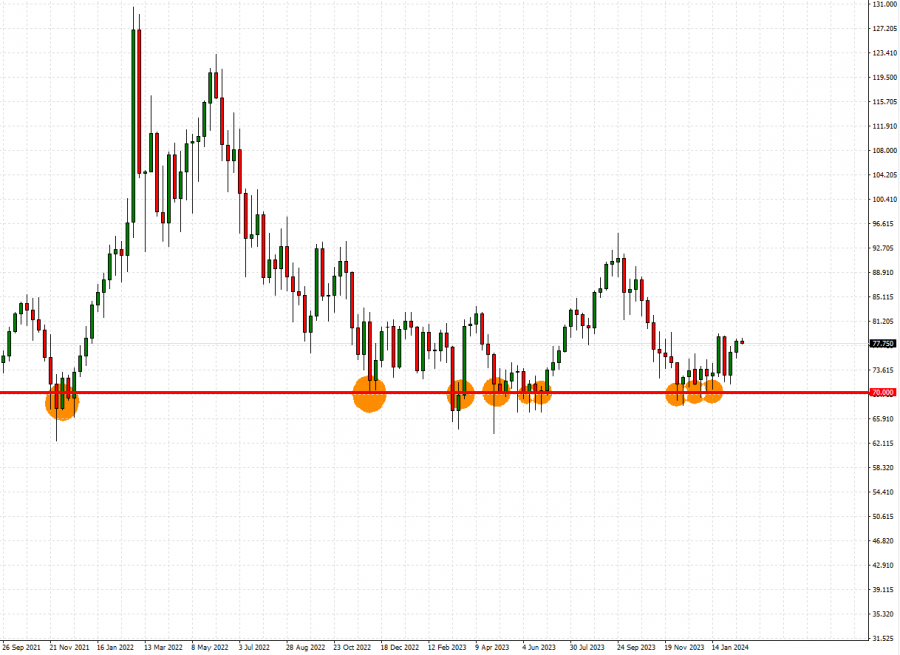

- SUPPORT AT $70: CRUDE OIL HAS TESTED $70 OR NEAR NINE TIMES SINCE NOVEMBER 2021. After testing the region, Crude oil would come back up above the mark of $70, to target the $80- $100 range.

Graph (Weekly): Crude Oil (November 2021- February 2024)

Please note that past performance does not guarantee future results.

Crude Oil, February 20, 2024

Current Price: 77.60

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

100.00 |

|

|

90.00 |

|

|

83.00 |

|

|

72.50 |

|

|

71.00 |

|

|

70.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

22,400 |

12,400 |

5,400 |

-5,100 |

-6,600 |

-7,600 |

|

Profit or loss in €2 |

20,752 |

11,488 |

5,003 |

-4,725 |

-6,114 |

-7,041 |

|

Profit or loss in £2 |

17,774 |

9,839 |

4,285 |

-4,047 |

-5,237 |

-6,031 |

|

Profit or loss in C$2 |

30,229 |

16,734 |

7,287 |

-6,883 |

-8,907 |

-10,256 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:30 (GMT) 20/02/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Managerregarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail