Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

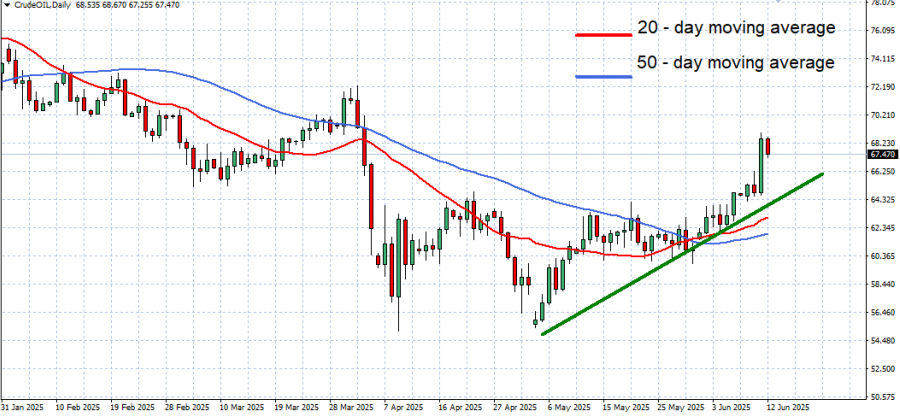

- 20- DAY MOVING AVERAGE INDICATES UPTREND: THE CRUDE OIL PRICE HAS CROSSED ABOVE THE 20-DAY MOVING AVERAGE (RED LINE) which is now sloping upward, indicating ongoing uptrend.

- 50- DAY MOVING AVERAGE INDICATES UPTREND: THE PRICE HAD MOVED ABOVE THE 50-DAY MOVING AVERAGE (BLUE LINE). The 50- day Moving Average is beginning to curve upward, indicating ongoing uptrend, as well.

- UPTREND SINCE EARLY MAY 2025: As depicted by the daily chart below, the crude oil price has kept trading above the mid-term green- lined uptrend line, confirming its mid-term trend is up.

GRAPH (Daily): February 2025 – June 2025

Please note that past performance does not guarantee future results

GEOPOLITICS:

- MIDDLE EAST TENSIONS RISE AHEAD OF 6TH ROUND OF U.S. – IRAN NUCLEAR TALKS ON SUNDAY (JUNE 15). A CBS News reporter said that US officials have been told Israel is fully ready to launch an operation into Iran. This is part of the reason the US advised some Americans to leave the region. The US anticipates Iran could retaliate on certain US sites in Iraq. Iranian military and government officials have already met to discuss their response to a potential Israeli strike, according to a senior Iranian official. The official said that Tehran had devised a response plan that would involve an immediate counterstrike on Israel with hundreds of ballistic missiles.

GLOBAL TRADE:

- BREAKING (JUNE 10): U.S. AND CHINA HAVE REACHED A DRAFT TRADE AGREEMENT. The draft includes a freeze on tariff hikes, the temporary resumption of rare-earth mineral exports from China, and continued access for Chinese students to U.S. universities. As a result, oil prices have come upward pressure, reflecting improved market sentiment and expectations of stronger global economic activity, especially in manufacturing and transportation sectors that depend heavily on energy.

EVENTS (OIL)

- TUESDAY, JUNE 17 AT 21:30 GMT+1: AMERICAN PETROLEUM INSTITUTE (API) WEEKLY OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected. However, the price could decline.

- WEDNESDAY, JUNE 18 AT 15:30 GMT+1: ENERGY INFORMATION ADMINISTRATION (EIA) OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected. However, the price could decline.

Crude Oil, June 12, 2025

Current Price: 67.00

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

75.00 |

|

|

72.00 |

|

|

70.00 |

|

|

64.20 |

|

|

63.50 |

|

|

63.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

8,000 |

5,000 |

3,000 |

-2,800 |

-3,500 |

-4,000 |

|

Profit or loss in €² |

6,933 |

4,333 |

2,600 |

-2,414 |

-3,017 |

-3,448 |

|

Profit or loss in £² |

5,901 |

3,688 |

2,213 |

-2,058 |

-2,573 |

-2,940 |

|

Profit or loss in C$² |

10,930 |

6,831 |

4,099 |

-3,815 |

-4,768 |

-5,450 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 09:46 (GMT+1) 12/06/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.