Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

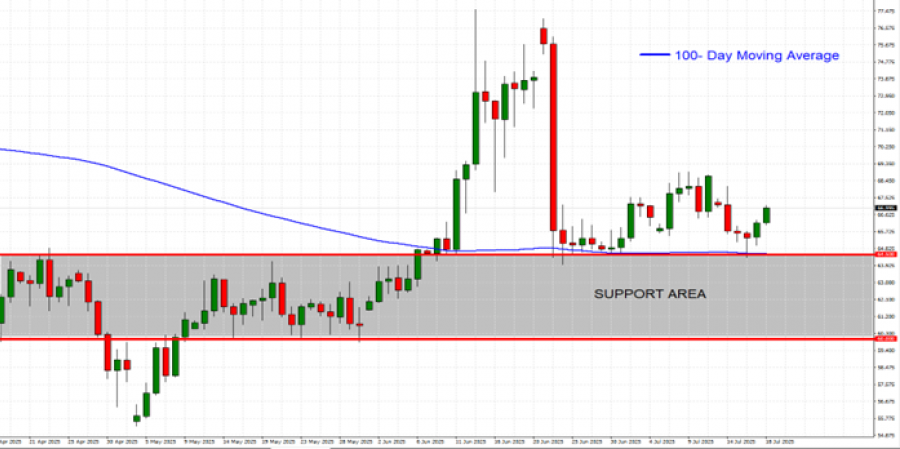

- SUPPORT AREA: $64.50 - $60.00. Crude oil prices have developed support area between $64.50 and $60.00, which has been in place since mid-April 2025.

- 100-DAY MOVING AVERAGE: The crude oil prices have remained above the mid-term daily moving average (100-day moving averages), pointing to ongoing positive sentiment. Although the sentiment could change should oil prices fall below the 100-day moving averages.

GRAPH (Daily): April 2025 – July 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: TRADE PROGRESS

- US TARIFF DEADLINE EXTENDED TO AUGUST 1 FROM THE PREVIOUS JULY 9. The US is still expected to announce more deals after clinching deals with the UK, Vietnam and Indonesia. Next on the list could be Japan, the E.U., India, Canada, Mexico, and South Korea, where announcements are expected to be made by August 1.

- BREAKING (JULY 15): U.S. AND INDONESIA REACHED A TRADE DEAL. President Donald Trump said the United States has struck a trade deal with Indonesia. The agreement includes a 19% U.S. tariff on Indonesian goods.

- BREAKING (JULY 2): U.S. AND VIETNAM REACHED A TRADE DEAL. President Donald Trump said the United States has struck a trade deal with Vietnam. The agreement includes a 20% U.S. tariff on Vietnamese goods.

- BREAKING (MAY 8): U.S. AND U.K. ANNOUNCED A TRADE DEAL ON MAY 8. President Trump said this is the first of many to follow.

GEOPOLITICS: TENSIONS RISE BETWEEN THE USA AND RUSSIA

- BREAKING (JULY 14): US PRESIDENT DONALD TRUMP THREATENED 100% TARIFFS ON RUSSIAN GOODS AND HIGH SECONDARY TARIFFS FOR COUNTRIES THAT BUY RUSSIAN OIL IF NO CEASEFIRE DEAL WITH UKRAINE IS REACHED WITHIN NEXT 50 DAYS. According to Reuters, Trump gave the Russian president a new deadline of 50 days to make peace or face 100% tariffs on Russian goods, and more importantly, sweeping secondary tariffs, implying that trade sanctions would be imposed on countries that continue importing Russian oil and other commodities.

CHINA: RECENT POSITIVE ECONOMIC DATA COULD IMPROVE THE OIL DEMAND OUTLOOK

- BREAKING (JULY 15): CHINA REPORTED HIGHER THAN EXPECTED Q2 GDP DATA (5.2%. VS. 5.1% EXPECTED). China is the second largest oil consumer in the world after USA, and the largest oil importer in the world. As the economic activity in China improves, the demand outlook for oil could also be expected to improve.

- BREAKING (JULY 15): CHINA REPORTED HIGHER THAN EXPECTED INDUSTRIAL PRODUCTION DATA (JUNE) (6.8%. VS. 5.6% EXPECTED). China is the second largest oil consumer in the world after USA, and the largest oil importer in the world. As the economic activity in China improves, the demand outlook for oil could also be expected to improve.

EVENTS (ECONOMIC CALENDAR):

- TUESDAY, JULY 22 AT 21:30 GMT+1: AMERICAN PETROLEUM INSTITUTE (API) WEEKLY OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected. However, the price could decline.

- WEDNESDAY, JULY 23 AT 15:30 GMT+1: ENERGY INFORMATION ADMINISTRATION (EIA) OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected. However, the price could decline.

Crude Oil, July 18, 2025.

Current Price: 66.70

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

73.00 |

|

|

71.00 |

|

|

69.00 |

|

|

64.50 |

|

|

63.50 |

|

|

62.50 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

6,300 |

4,300 |

2,300 |

-2,200 |

-3,200 |

-4,200 |

|

Profit or loss in €² |

5,415 |

3,696 |

1,977 |

-1,891 |

-2,750 |

-3,610 |

|

Profit or loss in £² |

4,689 |

3,200 |

1,712 |

-1,637 |

-2,382 |

-3,126 |

|

Profit or loss in C$² |

8,646 |

5,901 |

3,157 |

-3,019 |

-4,392 |

-5,764 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 10:30 (GMT+1) 18/07/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.