GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: POTENTIAL TRADE CONFLICTS FLARE UP AGAIN

- EVENT (EXPECTED: AUGUST 1): U.S. PRESIDENT DONALD TRUMP SET AUGUST 1 AS A NEW DEADLINE FOR TRADE DEALS TO BE REACHED. Meanwhile, US President Trump increased tariffs for Canada to 35%, on the EU to 30%, on Mexico to 30%, on Japan to 25% and said they will take effect on August 1 if no deals are reached by then.

- BREAKING (JULY 8): U.S. TO IMPOSE 50% TARIFFS ON COPPER IMPORTS ON AUGUST 1. Trade tensions increase insecurity, which in turn increases the demand for Gold as a safe-haven instrument. US President Donald Trump said that he will impose 50% tariffs on copper imports, which are expected to take effect ON August 1.

GEOPOLITICS: RUSSIA – UKRAINE WAR

- BREAKING (MONDAY, JULY 14): US PRESIDENT DONALD TRUMP THREATENED 100% TARIFFS ON RUSSIAN GOODS AND HIGH SECONDARY TARIFFS FOR COUNTRIES THAT BUY RUSSIAN GOODS IF NO CEASEFIRE DEAL IS REACHED WITHIN THE NEXT 50 DAYS. Trump gave the Russian president a new deadline of 50 days to make peace or face 100% tariffs on Russian goods, and more importantly, sweeping secondary tariffs, suggesting trade sanctions would be imposed on countries that continue to pay for Russian oil and other commodities.

GEOPOLITICS: US TAX CUT BILL

- BREAKING (JULY 4): U.S. PRESIDENT DONALD TRUMP SIGNED THE NEW TAX BILL INTO LAW. The bill includes $4.5 trillion in tax cuts aimed at boosting the U.S. economy. It is expected to serve as a significant economic stimulus. This is the largest fiscal package since the COVID-19 era and substantially larger than Trump’s 2017 tax cuts ($1.5 trillion in 2017).

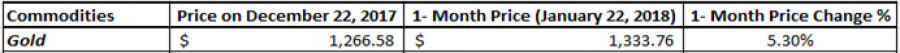

- LAST TIME (DECEMBER 22, 2017): US PRESIDENT TRUMP SIGNED THE 2017 TAX CUT BILL INTO LAW. The bill was 3 times smaller than the one from 2025, worth $1.5 trillion in tax cuts.

- STATISTICS (2017 – 2018): GOLD PRICE ROSE 5.30% OVER THE FIRST MONTH AFTER US PRESIDENT TRUMP SIGNED THE TAX CUT BILL INTO LAW. Gold price rose 5.30% between the day Trump signed the bill into law (December 22, 2017) and January 22, 2018.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

EVENTS:

- WEDNESDAY, JULY 30, AT 19:00 GMT+1: US FEDERAL RESERVE INTEREST RATE DECISION. Fed Chair Jerome Powell will hold a press conference the same day at 19:30 GMT+1. Investors will be eager to hear when the Fed will resume its cycle of interest rate cuts, and more importantly, how President Trump’s pressure on Fed Chair Jerome Powell to cut rates immediately could influence future decisions by the Fed.

TECHNICAL ANALYSIS:

- SUPPORT AREA BETWEEN $3,300 AND $3,200: Gold prices have seen near-term support at $3,300, and an extended support level at $3,200, meaning the area between $3,300 and $3,200 altogether acts as a near-term support area.

- LONG–TERM UPTREND: As depicted by the daily chart below, the gold price has kept trading above the long-term blue uptrend line, confirming its long-term trend is up. However, there remains a risk of a potential breakout below this level if market conditions change.

- 100-DAY MOVING AVERAGE POINTS TO AN UPTREND: The 100-Day Moving Average points to an uptrend as the gold price has remained steady above it. If, however, the gold price falls below the 100-day moving average, then its trend changes to negative.

- GOLD HIT A NEW ALL-TIME HIGH OF $3,499.76 (April 22, 2025): Gold has traded around $3,345, and if a full recovery takes place, the price of Gold could rise around $155. Although the price could decline as well.

GRAPH (Daily): January 2025 – July 2025

Please note that past performance does not guarantee future results

GOLD, JULY 18, 2025.

Current Price: 3,345

|

GOLD |

Weekly |

|

Trend direction |

|

|

3,500 |

|

|

3,450 |

|

|

3,400 |

|

|

3,300 |

|

|

3,290 |

|

|

3,280 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

15,500 |

10,500 |

5,500 |

-4,500 |

-5,500 |

-6,500 |

|

Profit or loss in €2 |

13,322 |

9,025 |

4,727 |

-3,868 |

-4,727 |

-5,587 |

|

Profit or loss in £2 |

11,536 |

7,815 |

4,094 |

-3,349 |

-4,094 |

-4,838 |

|

Profit or loss in C$2 |

21,273 |

14,410 |

7,548 |

-6,176 |

-7,548 |

-8,921 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 10:00 (GMT+1) 18/07/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.