EUR/USD Weekly Special Report Based on 1 Lot Calculation:

US FEDERAL RESERVE:

- WEDNESDAY, JANUARY 28 AT 19:00 GMT: US FEDERAL RESERVE (FED) INTEREST RATE DECISION. Fed Chair Jerome Powell is scheduled to host a press conference at 19:30 GMT. The FED will be having its interest rate decision, with most analysts expecting the interest rate to remain unchanged at 3.75%. However, the FED’s forward guidance could influence the price of the US dollar as the markets are still uncertain about how many times the FED will cut interest rates in 2026.

- BREAKING (DECEMBER 10): US FEDERAL RESERVE CUT INTEREST RATE TO 3.75% FROM 4.00%. The Fed cut rates again in December after the one earlier in October. In total, last year, rates fell from 4.50% to the current 3.75%.

EUROPEAN CENTRAL BANK:

- THURSDAY, FEBRUARY 5 AT 13:15 (GMT): EUROPEAN CENTRAL BANK (ECB) INTEREST RATE DECISION. The ECB kept interest rates unchanged at 2.15% in December and did not indicate that it would cut rates in the near future. The ECB’s stance of not cutting rates anytime soon could provide further support to EUR/USD.

EVENTS:

- FRIDAY, JANUARY 30 AT 10:00 GMT: EUROZONE GROSS DOMESTIC PRODUCT (GDP) (Q4). Eurozone GDP fell in the third quarter from 1.5% to 1.4%. If the data comes out higher than expected, this could have a positive effect on the European currency and give a boost to the EUR/USD. The opposite scenario is also possible.

- MONDAY, FEBRUARY 2 AT 14:45 GMT: US MANUFACTURING PURCHASING MANAGERS INDEX DATA (PMI) (JANUARY). A weaker-than-expected PMI reading would signal falling factory activity in the U.S., putting negative pressure on the EUR/USD.

- FRIDAY, FEBRUARY 6 AT 13:30 GMT: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (JANUARY). Weaker-than-expected job growth and a higher unemployment rate could boost expectations of U.S. interest rate cuts, weighing on the dollar and supporting the EUR/USD.

TECHNICAL ANALYSIS

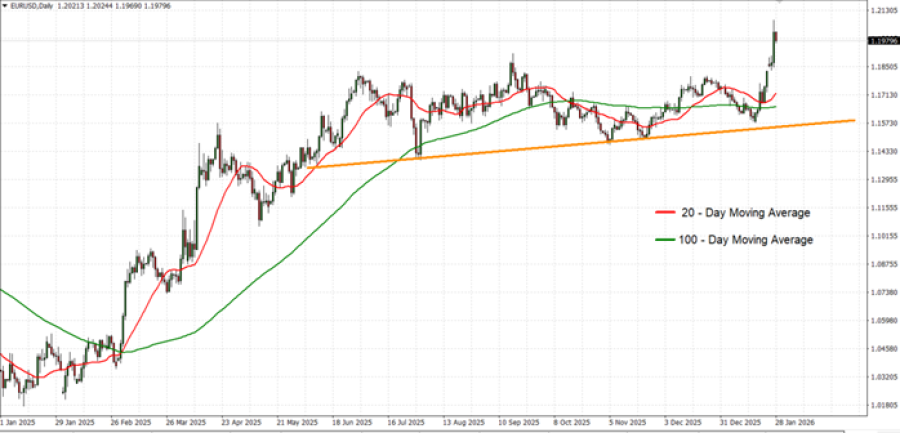

- DAILY MOVING AVERAGES: EUR/USD is trading above its key moving averages. The 20-day moving average (red) has turned higher again, signaling renewed upward momentum. The 100-day moving average (green) continues to slope upward, reinforcing overall trend stability.

- UP-TREND SINCE NOVEMBER 2025: EUR/USD remains in a medium-term uptrend, supported by a rising long-term trendline (orange).

- ANALYST OPINION: JP Morgan projects EUR/USD at 1.22 in early 2026; UBS expects the pair to rise toward 1.26 in 2026; Bank of America forecasts 1.25 during 2026; Morgan Stanley targets 1.26 by June 2026.

GRAPH (Daily): January 2025– January 2026

Please note that past performance does not guarantee future results

EURUSD, January 28, 2026

Current Price: 1.19850

|

EUR/USD |

Weekly |

|

Trend direction |

|

|

1.2500 |

|

|

1.2300 |

|

|

1.2200 |

|

|

1.1860 |

|

|

1.1810 |

|

|

1.1760 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

EUR/USD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

5,150 |

3,150 |

2,150 |

-1,250 |

-1,750 |

-2,250 |

|

Profit or loss in €² |

4,298 |

2,629 |

1,794 |

-1,043 |

-1,460 |

-1,878 |

|

Profit or loss in £² |

3,737 |

2,286 |

1,560 |

-907 |

-1,270 |

-1,633 |

|

Profit or loss in C$² |

6,686 |

4,089 |

2,791 |

-1,623 |

-2,272 |

-2,921 |

- 1.00 lot is equivalent of 100 000 units

- Calculations for exchange rate used as of 10:10 (GMT) 28/01/2026

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit