GER 40 Weekly Special Report based on 1.00 Lot Calculation:

GER 40:

- The GER40 represents the DAX 40 in Germany, which includes companies such as Adidas, Bayer, Mercedes-Benz, Deutsche Bank, Siemens, BMW, E.ON, etc. In essence, GER40 includes the most valuable and advanced companies in Germany, the largest economy in Europe.

TECHNICAL ANALYSIS:

-

-

-

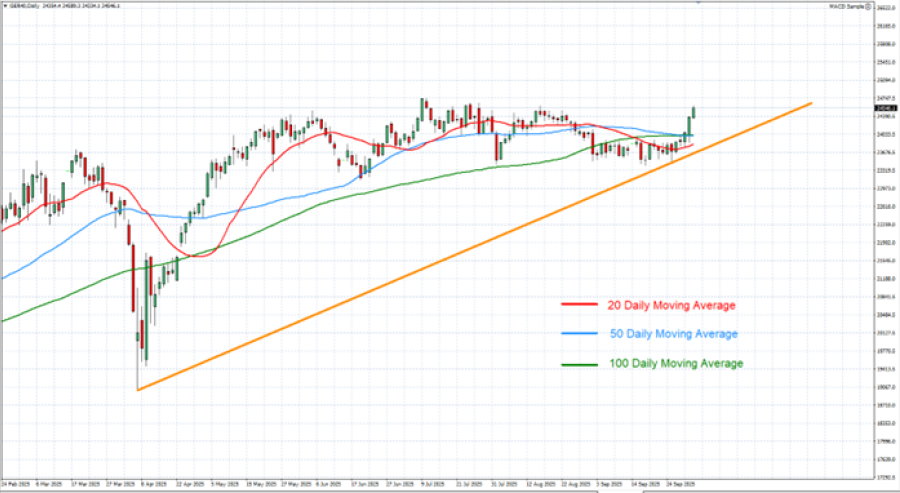

- LONGER-TERM TREND LINE: The orange trend line depicted by the chart below shows that GER40 prices have maintained their uptrend in general since April 2025. However, there remains a risk of a potential breakout below this level if market conditions change.

- GER40 REMAINS ABOVE 20-, 50-, AND 100-DAY MOVING AVERAGES: The daily graph below shows that GER40 has remained above all three, technically, crucial moving averages, indicating an ongoing uptrend. Although the trend could change if prices fall below the 20-, 50-, and 100-Day Moving Averages.

- THE GER40 HIT AN ALL-TIME HIGH OF 24,746.1 (JULY 10, 2025). Currently GER40 is trading around 24,530, so if prices recover back to the previous all-time high level, the upside potential would be around 1%.

-

-

GRAPH (Daily): February 2025 – October 2025

Please note that past performance does not guarantee future results

Q3 EARNING SEASON BEGINS (OCTOBER 15-NOVEMBER 15)

- DEUTSCHE BANK AG: 29/10/25, Before Market, Confirmed

- AIRBUS SE: 10/29/25, Before Market, Confirmed

- BASF SE: 10/29/25, Before Market, Confirmed

- ADIDAS AG: 10/29/25, Before Market, Confirmed

- VOLKSWAGEN AG: 30/10/25, Before Market, Confirmed

Source: Bloomberg

GER40: EVENTS

- FRIDAY, OCTOBER 3 AT 8:55 GMT+1: GERMAN SERVICES PURCHASING MANAGERS INDEX (PMI) (SEPTEMBER). This release will provide a fresh look at the strength of Germany’s services sector, which is crucial for overall economic momentum. A stronger result would reinforce confidence in Europe’s largest economy, support broader eurozone sentiment, and could provide an additional lift to the GER40.

- WEDNESDAY, OCTOBER 8 AT 7:00 GMT+1: GERMAN INDUSTRIAL PRODUCTION (MONTH-ON-MONTH) (AUGUST). Industrial output is a key driver of Germany’s export-oriented economy and a major influence on GER40 performance. A solid reading would signal stronger manufacturing activity and support confidence in the recovery.

GER40, October 2, 2025.

Current Price: 24,530

|

GER40 |

Weekly |

|

Trend direction |

|

|

26,000 |

|

|

25,500 |

|

|

25,000 |

|

|

24,100 |

|

|

23,900 |

|

|

23,700 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

GER40 |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

17,272 |

11,397 |

5,522 |

-5,052 |

-7,402 |

-9,752 |

|

Profit or loss in €² |

14,700 |

9,700 |

4,700 |

-4,300 |

-6,300 |

-8,300 |

|

Profit or loss in £² |

12,804 |

8,449 |

4,094 |

-3,745 |

-5,487 |

-7,229 |

|

Profit or loss in C$² |

24,076 |

15,887 |

7,698 |

-7,043 |

-10,318 |

-13,594 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 11:30 (GMT+1) 02/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.