GER40 Weekly Special Report based on 1.00 Lot Calculation:

GER40:

- The GER40 represents the DAX 40 in Germany, which includes companies such as Adidas, Bayer, Mercedes-Benz, Deutsche Bank, Siemens, BMW, E.ON, etc. In essence, GER40 includes the most valuable and advanced companies in Germany, the largest economy in Europe.

DECEMBER THORUGH JANUARY PERIOD TENDS TO BE POSITIVE FOR GER40

- EVENTS:

- Christmas Shopping Season (Early December to December 24) – The peak retail period across Europe, with German retailers seeing strong demand in electronics, apparel, luxury goods, and online sales. This surge traditionally supports sentiment in consumer-focused stocks within the GER40.

- New Year Sales (January 1–31) – One of Germany’s biggest discount periods, when retailers run aggressive clearance campaigns. Increased consumer activity across January helps sustain momentum into the new year, which can positively influence market sentiment toward the GER40.

- PREVIOUS YEAR (2024): GER40 PRICE ROSE 11.97% FROM DECEMBER 1ST (2024) TO JANUARY 31ST (2025). According to MetaTrader4, the GER40 rose +11.97% in 2024, reflecting robust year-end consumer activity, upbeat sentiment across European markets, and solid momentum from Germany’s export and manufacturing sectors. This seasonal strength highlights how the holiday and post-holiday period provides support for the GER40.

Please note that past performance does not guarantee future results

GER40: EVENTS

- MONDAY, DECEMBER 8 AT 7:00 GMT: GERMAN INDUSTRIAL PRODUCTION DATA (OCTOBER). A stronger-than-expected reading would signal healthy activity in Germany’s manufacturing sector, supporting broader European economic growth and providing a positive sentiment for the GER40. (Previous: 1.3%)

- FRIDAY, DECEMBER 12 AT 7:00 GMT: GERMAN CONSUMER PRICE INDEX (CPI) (NOVEMBER). An uptick in inflation would point to healthier spending activity across the Germany, reinforcing expectations of steady growth. Such a development could strengthen investor confidence and help maintain upward momentum in the GER40. (Previous: 2.3%)

- THURSDAY, DECEMBER 18 AT 13:15 GMT: EUROPEAN CENTRAL BANK INTEREST RATE DECISION. The ECB is widely expected to hold rates steady, reinforcing financial stability heading into 2026. A steady policy stance would signal confidence in the Eurozone’s economic trajectory and help maintain favorable financing conditions for German corporations. Such stability typically boosts investors’ appetite for equities, providing support for further gains in the GER40. (Current rate: 2.15%)

TECHNICAL ANALYSIS:

-

-

-

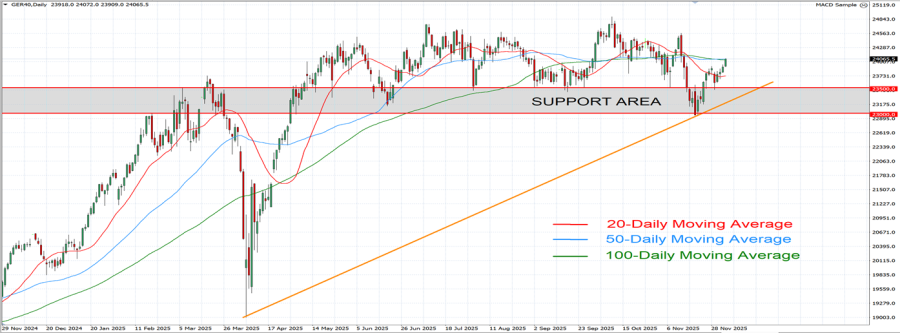

- LONGER-TERM UPTREND: The orange-uptrend channel depicted by the chart below shows that GER40 prices have maintained their uptrend since March of 2025. However, there remains a risk of a potential breakout below this level if market conditions change.

- SUPPORT AREA: 23,000-23,500: GER40 prices have formed a psychological support level between 23,000 and 23,500. However, there remains a risk of a potential breakout below this level if market conditions change.

- THE GER40 HIT AN ALL-TIME HIGH OF 24,888.3 (OCTOBER 9, 2025). Currently, GER40 is trading around 24,000, so if prices recover back to the previous all-time high level, the upside potential would be around 4.00%. However, the price could also decline.

-

-

GRAPH (Daily): November 2024 – December 2025

GRAPH (Daily): November 2024 – December 2025

Please note that past performance does not guarantee future results

GER40, December 5, 2025.

Current Price: 24,000

|

GER40 |

Weekly |

|

Trend direction |

|

|

25,500 |

|

|

25,000 |

|

|

24,500 |

|

|

23,500 |

|

|

23,250 |

|

|

23,000 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

GER40 |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

17,473 |

11,649 |

5,824 |

-5,824 |

-8,736 |

-11,649 |

|

Profit or loss in €² |

15,000 |

10,000 |

5,000 |

-5,000 |

-7,500 |

-10,000 |

|

Profit or loss in £² |

13,102 |

8,735 |

4,367 |

-4,367 |

-6,551 |

-8,735 |

|

Profit or loss in C$² |

24,368 |

16,245 |

8,123 |

-8,123 |

-12,184 |

-16,245 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 11:00 (GMT) 5/12/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.