GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS:

- INDIA – PAKISTAN CONFLICT: INDIA STRIKES PAKISTAN WITH “OPERATION SINDOOR”, PAKISTAN RETALIATED. On May 7, India’s army has launched “Operation Sindoor”, hitting nine sites in Pakistan and Pakistan-administered Kashmir. Pakistan retaliated by launching multiple attacks along the India’s western border on May 9. Fears have recently risen as both Pakistan and India have at their disposal a significant number of nuclear warheads.

- MIDDLE EAST TENSIONS RISE AS LATEST ROUND OF TALKS GETS POSTPONED. Oman, which has mediated the latest rounds of nuclear talks between Iran and the USA, said there will be delays in talks.

- U.S.A. WITHDRAWAL FROM UKRAINE - RUSSIA PEACE NEGOTIATIONS: President Donald Trump has withdrawn the United States from formal peace negotiations between Ukraine and Russia.

CENTRAL BANKS INCREASE GOLD RESERVES:

- CHINA GOLD RESERVES UP TO 73.77 MILLION OUNCES IN APRIL: China has managed to increase its gold reserves from 73.70 million ounces in March to a new, 73.77 million ounces in April. This is their sixth consecutive increase of gold reserves on a monthly basis.

- CENTRAL BANKS GLOBALLY HAVE BEEN INCREASING GOLD RESERVES MACH FASTER SINE 2021: Recent statistics from the World Gold Council have shown that Central Banks have been increasing their gold reserves by in total around 1,000 tons annually since 2021. This is up more than 100% compared to the ten-year average of around 350 tons in the period before 2021. Central Banks have continued increasing their gold reserves in 2025 as well.

ANALYSTS’ OPINION:

- J.P. MORGAN HAS A PRICE TARGET OF $3,675 (2025). Prices in 2026, by Q2, could rise to $4000, however, it could move in the opposite direction.

- GOLDMAN SACHS RAISED THE GOLD PRICE TARGET TO $3,700, FROM $3,300, WITH A TARGET RANGE OF $3,650 AND $3,950. UNDER EXTREME SCENARIOS, GOLD COULD RISE TO $4,500 BY THE END OF 2025. However, it could also move in the opposite direction.

- UBS RAISED GOLD PRICE TARGET TO $3,500 FROM $3,200. However, it could also move in the opposite direction.

Source: Reuters, Bloomberg, CNBC

EVENTS:

- TUESDAY, MAY 13, AT 13:30 GMT+1: US CONSUMER PRICE DATA (CPI) (APRIL): A lower-than-expected reading could be positive for gold, as it will motivate the FED to cut interest rates more aggressively. The CPI Index measures the change in the price of goods and services from the perspective of the consumer.

TECHNICAL ANALYSIS:

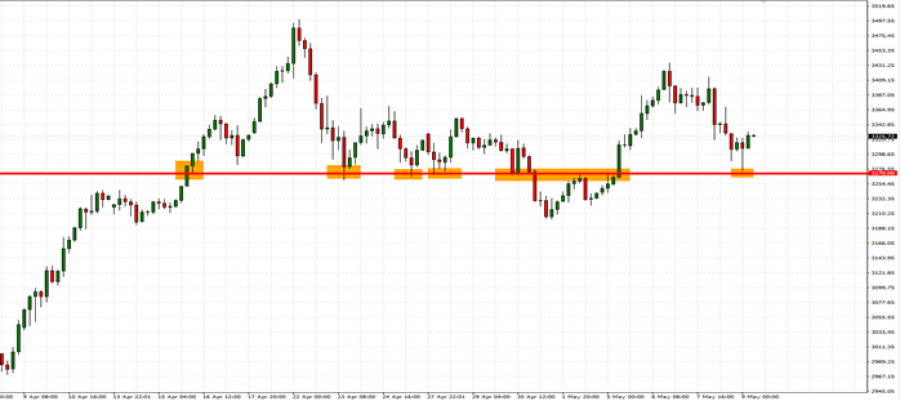

- NEAR-TERM SUPPORT AT $3,270. Gold has tested the mark of $3,270 or near five times since mid- April.

- GOLD HIT AN FRESH ALL TIME HIGH OF $3,499.76 (April 22, 2025). Gold has traded around $3,310 and if a full recovery takes place, Gold could rise around 190 Dollars. Although, the price could decline as well.

GRAPH (H4): April 9, 2025 – May 9, 2025

Please note that past performance does not guarantee future results

GOLD, May 9, 2025

Current Price: 3,310

|

GOLD |

Weekly |

|

Trend direction |

|

|

4,000 |

|

|

3,700 |

|

|

3,400 |

|

|

3,230 |

|

|

3,215 |

|

|

3,200 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

69,000 |

39,000 |

9,000 |

-8,000 |

-9,500 |

-11,000 |

|

Profit or loss in €2 |

61,337 |

34,669 |

8,000 |

-7,112 |

-8,445 |

-9,778 |

|

Profit or loss in £2 |

52,036 |

29,412 |

6,787 |

-6,033 |

-7,164 |

-8,296 |

|

Profit or loss in C$2 |

95,986 |

54,253 |

12,520 |

-11,129 |

-13,215 |

-15,302 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 09:30 (GMT+1) 09/05/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.