GOLD weekly special report based on 1.00 Lot Calculation:

UKRAINE – RUSSIA GEOPOLITICAL TENSIONS REMAIN HIGH

- BREAKING (DECEMBER 29): RUSSIA SAID UKRAINE TRIED TO ATTACK PRESIDENT PUTIN’S RESIDENCE. Higher geopolitical tensions could possibly lead to higher demand for Gold as a safe – haven instrument. According to Reuters, Russia’s Foreign Minister Sergei Lavrov claimed that Russian air defenses destroyed 91 long-range drones heading for Putin’s Dolgiye Borody residence in the Novgorod region. Russia has announced that its military has selected Ukrainian targets for retaliatory strikes.

- BREAKING (DECEMBER 29): US PRESIDENT TRUMP AND RUSSIAN PRESIDENT PUTIN HAD ANOTHER CALL AFTER THE TRUMP-ZELENSKY MEETING. According to Reuters, President Vladimir Putin told U.S. President Donald Trump that Russia would review its position in peace negotiations after what Moscow said was a Ukrainian drone attack on a Russian presidential residence.

EVENTS:

- THURSDAY, JANUARY 8 AT 13:30 GMT: US INITIAL JOBLESS CLAIMS. A higher-than-expected reading will indicate a deteriorating situation in the US labor market, which could motivate the FED to continue its interest rate cut cycle in 2026, possibly supporting gold prices. This data measures the number of individuals who filed for unemployment insurance for the first time during the past week.

- FRIDAY, JANUARY 9 AT 13:30 GMT: NON-FARM PAYROLLS AND UNEMPLOYMENT RATE (DECEMBER). A lower-than-expected reading could be positive for Gold because it will signal a worsening situation in the labor market, with the FED having more incentive to intervene by lowering interest rates, thus potentially supporting Gold. This category measures the number of people employed during the previous month, excluding the farming industry. The data for last month came in at 64.000.

PRICE ACTION

- GOLD PRICE HIT A NEW ALL-TIME HIGH ON DECEMBER 26, 2025 ($4,550.17). Since the beginning of 2025, the gold price has been rising solidly, hitting a fresh all-time high in December ($4,550.17), marking an increase of around 73%. However, the price could also decline. The current price of Gold stands around $4370, and if it recovers to its all-time highs, it could potentially rise by around 180 dollars. However, it could also decline.

- ANALYSTS’ OPINION: Bank of America forecasts $5,000; Societe Generale forecasts $5,000; Goldman Sachs forecasts $4,900; J.P. Morgan forecasts $5,055; HSBC forecasts $5,000.

TECHNICAL ANALYSIS AND ANALYSTS’ OPINION:

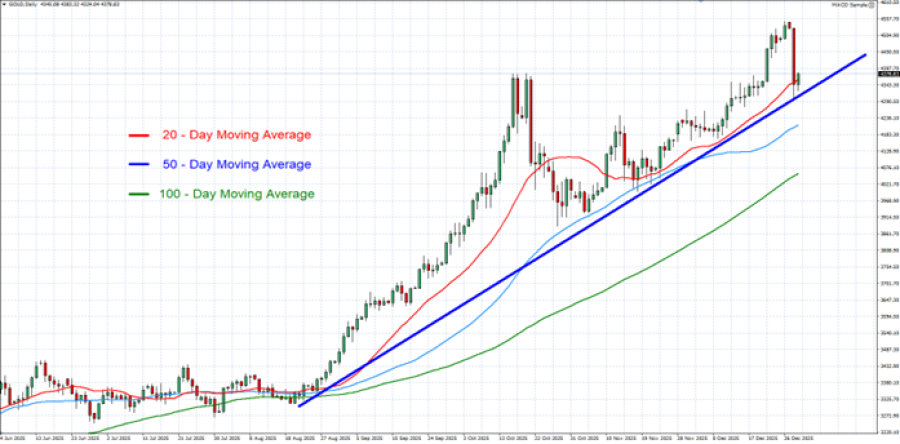

- GOLD TRADING ABOVE MOVING AVERAGES (MA). Gold has kept steady above its 20 -, 50 -, and 100-day moving averages, pointing to an uptrend. However, it could also decline.

- MID-TERM TREND IS UP. The overall trend of gold is up (dark blue trendline), since the beginning of the year, with the trend accelerating since mid – August of 2025.

GRAPH (Daily): June 2025 – December 2025

Please note that past performance does not guarantee future results

GOLD, December 30, 2025.

Current Price: 4,370

|

GOLD |

Weekly |

|

Trend direction |

|

|

4,700 |

|

|

4,600 |

|

|

4,500 |

|

|

4,250 |

|

|

4,240 |

|

|

4,230 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

33,000 |

23,000 |

13,000 |

-12,000 |

-13,000 |

-14,000 |

|

Profit or loss in €2 |

28,022 |

19,530 |

11,039 |

-10,190 |

-11,039 |

-11,888 |

|

Profit or loss in £2 |

24,410 |

17,013 |

9,616 |

-8,876 |

-9,616 |

-10,356 |

|

Profit or loss in C$2 |

45,163 |

31,477 |

17,791 |

-16,423 |

-17,791 |

-19,160 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 10:00 (GMT) 30/12/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.