ALPHABET(#GOOGLE) weekly uptrend opportunity based On 1 Lot Calculation:

WEB SEARCH INDUSTRY:

-

ALMOST 67% OF ALL INTERNET SEARCHES ARE PERFORMED ON GOOGLE. Other companies that can compete with Google are BING, DuckDuckGo and etc.

ONLINE ADVERTISEMENT:

-

MARKET SIZE: $465.5 BILLION IN 2021 AND EXPECTED TO GROW TO $1.089 TRILLION IN 2027. The global internet advertising market size was valued more than $465.5 billion in 2021, and is projected to reach $1.089 trillion by 2027, registering an average growth of 22.32% from 2021 to 2027.

-

GLOBAL MARKETS: Google, Meta (formerly Facebook) and Amazon accounted for more than $7 in $10 (74%) of global digital ad spending in 2021, which is 47% of all money spent on advertising over that period.

-

MARKET SHARE IN THE U.S.: Alphabet (Google) at 26.4%, META (Facebook) at 24.1%, Amazon 14.6%, Rest at 34.9%.

GOOGLE:

-

THE COMPANY: Alphabet (Google) is the fourth largest company by market capitalization in the world, worth $1.423 trillion dollars.

-

ONLINE ADVERTISEMENT: 81.3% OF TOTAL REVENUE IN 2021 COMES FROM ADVERTISING.

-

STRONG POSITIVE REVENUE TREND (23% AVERAGE GROWTH RATE PER ANNUM FOR THE PAST FIVE YEARS): The company’s revenue grew by around 23% on average per year over the past five years.

STOCK SPLIT EVENT:

-

EVENT (STOCK SPLIT: 20 to 1): EFFECTIVE ON (MONDAY) JULY 18, 2022. According to MarketWatch, investors view stock splits as a sign of confidence by management, because splits happen more often in stocks that have bullish momentum behind them. Splits also increase liquidity by making shares more accessible to a wider range of investors. To reinforce the thesis of stock splits intended to reach a wider range of investors, Alphabet (Google) CFO commented on the split “The reason for the split is it makes our shares more accessible.”

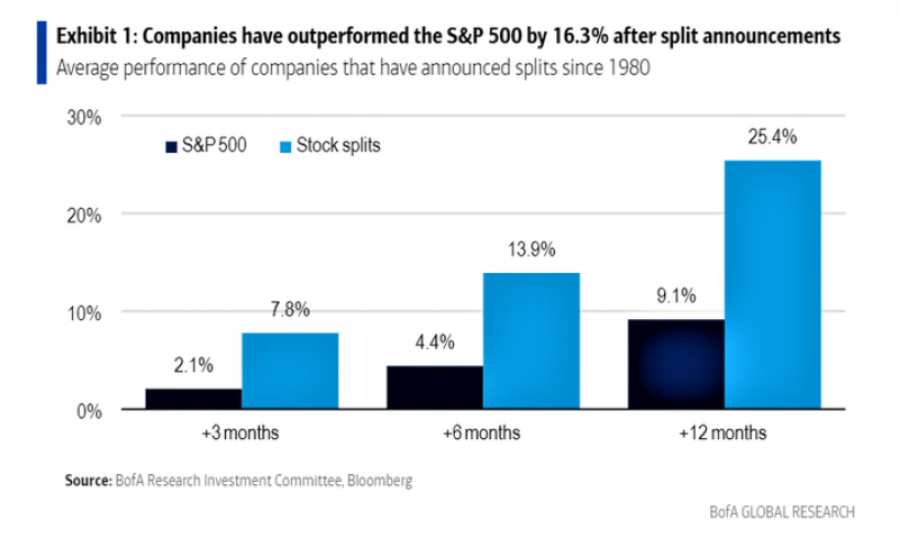

STATISTICS: Since 1980, the shares of companies that do stock splits are typically up 25% a year later, compared to 9% for the broader market, according to a recent study by Bank of America.

-

PERFORMANCE BEFORE THE STOCK SPLIT (TIME FRAME: ANNOUNCEMENT DATE TO STOCK SPLIT) (SOURCES: YahooFinance, Bloomberg, Fortrade MT4):

Tesla (STOCK SPLIT: 5-1 Announcement August 11, 2020): Tesla’s price appreciated around 60% from its announcement to the actual stock split date on the 31st of August 2020.

Apple (STOCK SPLIT: 2-1 Announcement July 30, 2020): Apple’s price increased around 30% since its split announcement on 30th of July 2020, until the effective date 31st August 2020.

NVidia (STOCK SPLIT: 4-1 Announcement May 21, 2021): Nvidia witnessed a percentage price increase of around 33% between its announcement date and the effective date of the split on July 20, 2021.

*Please note that past performance does not guarantee future results

-

STOCK PERFORMANCE AFTER STOCK SPLIT (SOURCES: YahooFinance, Bloomberg, Fortrade MT4):

Tesla (STOCK SPLIT: 5-1 effective August 31, 2020): 3 Months: +28%. 6 Months: +53%. 12 Months: +65.91%

Apple (STOCK SPLIT: 2-1 effective August 31, 2020): 3 Months: -4.5%. 6 Months: +2.11%. 12 Months: +22.00%

NVidia (STOCK SPLIT: 4-1 effective July 20, 2021): 3 Months: +17.60%. 6 Months: +30%. 12 Months

*Please note that past performance does not guarantee future results

OTHER EVENTS AND ANALYSIS:

-

PRICE ACTION: THE STOCK HAS HAD A DOWNWARD CORRECTION OF AROUND 33.00% FROM ITS ALL TIME HIGH OF $3060. The stock has fallen to its lowest rate in more than year, to $2043. Alphabet (Google) was last trading around $2250, and if full recovery follows to recent all- time highs, the stock could see an upside of around 36%.

-

ANALYST OPINION: Wells Fargo forecasts $3400. Morgan Stanley forecasts $3270. Credit Suisse forecasts $3400. JPMorgan forecasts $3200.

ALPHABET(#GOOGLE), May 31, 2022

Current Price: 2,250.00

|

|

Weekly |

|

Trend direction |

|

|

3,200.00 |

|

|

3,060.00 |

|

|

2,550.00 |

|

|

2,040.00 |

|

|

1,900.00 |

|

|

1,800.00 |

Example of calculation based on weekly trend direction for 1 Lot1

|

|

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

95,000.00 |

81,000.00 |

30,000.00 |

-21,000.00 |

-35,000.00 |

-45,000.00 |

|

Profit or loss in €2 |

86,491.01 |

73,744.97 |

27,312.95 |

-19,119.07 |

-31,865.11 |

-40,969.43 |

|

Profit or loss in £2 |

71,961.52 |

61,356.66 |

22,724.69 |

-15,907.28 |

-26,512.14 |

-34,087.04 |

|

Profit or loss in C$2 |

119,274.40 |

101,697.12 |

37,665.60 |

-26,365.92 |

-43,943.20 |

-56,498.40 |

-

1.00 lot is equivalent of 100 units

-

Calculations for exchange rate used as of 10:30 (GMT+1) 31/05/2022

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

-

You may wish to consider closing your position in profit, even if it is lower than suggested one

-

Trailing stop technique can protect the profit – Ask your Client Manager for more detail