NETFLIX (#NFLX) weekly special report based on 1 Lot Calculation:

NETFLIX: THE COMPANY

- NETFLIX is one of the world's leading streaming services, with over 300 million paid subscribers in over 190 countries. In the last 2 years, the company made a number of impactful changes and moves, like an increase in third-party licensing, a new ad plan membership, and success in cracking down on password-sharing issues.

- STOCK INDEX PARTICIPATION: Netflix stock is a part of the NASDAQ 100 (USA 100) index and S&P 500 (USA500).

NETFLIX: NEWS

- BREAKING (OCTOBER 30): NETFLIX ANNOUNCED A 10-FOR-1 STOCK SPLIT AND WILL TRADE UNDER NEW CONDITIONS STARTING MONDAY, NOVEMBER 17. Netflix completed a 10-for-1 stock split approved by its board on October 30, 2025. Shareholders received nine additional shares for each share held, and trading began on a split-adjusted basis on November 17. The split reduced the stock’s per-share price from roughly $1,140 on the preceding Friday to approximately $111, while leaving the company’s market capitalization unchanged. In the days following the split, Netflix shares have traded higher, gaining nearly 3% within the first three sessions of post-split trading.

- HISTORY: Netflix previously split its stock 2-for-1 in 2004 and 7-for-1 in 2015.

Source: YahooFinance.com

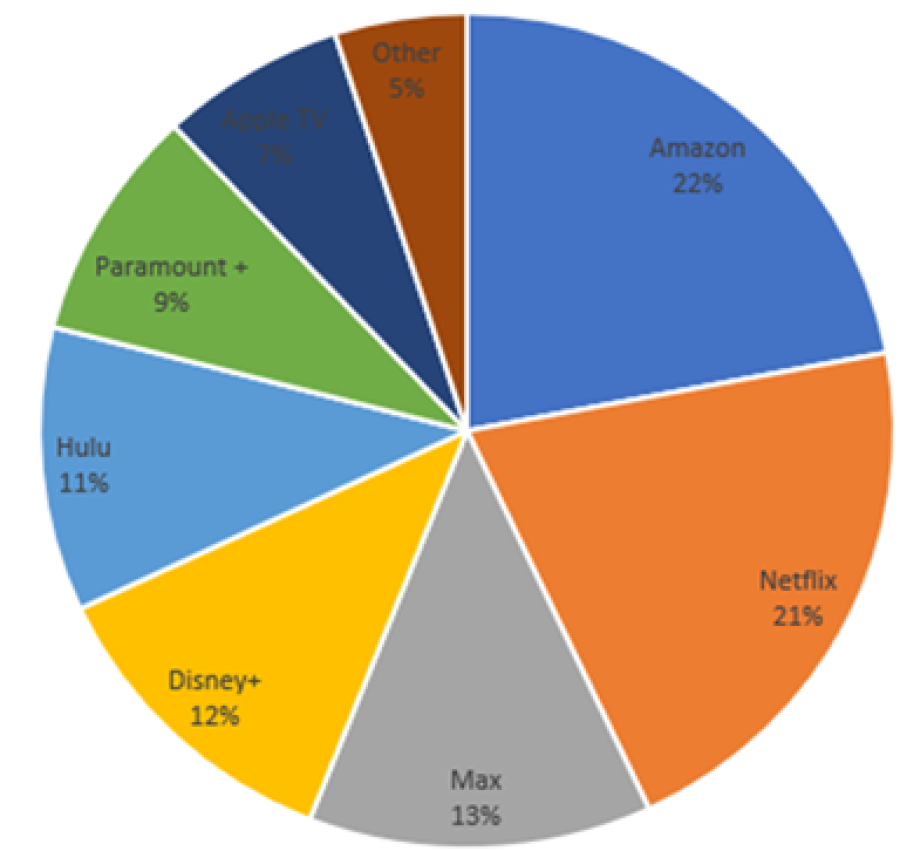

NETFLIX: MARKET SHARE (USA and WORLDWIDE)

- Netflix is the second-largest streaming platform in the United States, holding 21% of the market, just behind Amazon Prime at 22%. Globally, Netflix is projected to hold 23%, again ranking second to Amazon Prime at 24%.

Source: Evoca.tv and Statista

NETFLIX: FINANCIALS

- BREAKING (OCTOBER 21): Q3 EARNINGS REPORT. The company printed $11.51 billion in revenue (a new record high), up around 17% from the same period last year ($9.824 billion). The company reported a net income of $2.54 billion, up around 4% from the same period the previous year ($2.45 billion).

FORWARD GUIDANCE (Q4): The company is expected to print $11.97 billion (new record high) for Q4 of 2025, which would mark an increase of around 17% year on year.

NETFLIX: PRICE ACTION AND ANALYST OPINION

- NETFLIX STOCK HIT AN ALL-TIME HIGH $1,338.96 (JULY 1, 2025). Adjusted for the 10-for-1 stock split, this corresponds to a split-adjusted high of approximately $133.90. The stock now trades around $114.20, reflecting an increase of roughly 28% since the start of 2025.

- ANALYST OPINION: Rosenblatt Securities forecasts $153; Morgan Stanley forecasts $150; Wells Fargo forecasts $151; Jefferies forecasts $150; Wedbush forecasts $140; Goldman Sachs forecasts $130;

#NETFLIX, November 19, 2025.

Current Price: 114

|

Netflix |

Weekly |

|

Trend direction |

|

|

155 |

|

|

145 |

|

|

130 |

|

|

100 |

|

|

96 |

|

|

92 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Netflix |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

408,000 |

308,000 |

158,000 |

-142,000 |

-182,000 |

-222,000 |

|

Profit or loss in €² |

352,268 |

265,928 |

136,417 |

-122,603 |

-157,139 |

-191,675 |

|

Profit or loss in £² |

311,071 |

234,828 |

120,464 |

-108,265 |

-138,762 |

-169,259 |

|

Profit or loss in C$² |

571,489 |

431,418 |

221,312 |

-198,900 |

-254,929 |

-310,957 |

- 1.00 lot is equivalent of 10000 units

- Calculations for exchange rate used as of 11:40 (GMT) 19/11/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit