Nvidia (#NVDA) Weekly Special Report based on 1 Lot Calculation:

THE COMPANY:

- NVIDIA develops and produces three-dimensional graphics processors and other related software. The company also produces graphics processing units, which are critical components when developing artificial intelligence and self-driving autonomous vehicles.

- NVIDIA IS THE MOST VALUABLE COMPANY IN THE WORLD: Nvidia currently is the largest company in the world, which earlier in October reached a market capitalization of more the 5 trillion dollars. With that, Nvidia’s company value managed to surpass the GDPs of some big countries such as Germany, Japan or the UK.

- STOCK INDEX PARTICIPATION (USA100, USA500, USA30): NVIDIA stock belongs to the three most important US stock indices, including the NASDAQ 100 (USA100) index, the S&P 500 (USA500) index, and the DOW JONES INDUSTRIAL 30 (USA30).

- NVIDIA’S LATEST PRODUCT PIPELINE FOR THE AI CHIP SECTOR: Nvidia plans to release a new family of AI chips yearly. The current pipeline includes the Blackwell chip, released in 2024 and the Blackwell Ultra, released in Q2 of 2025; The Rubin chip, set for 2026; and the Rubin Ultra, set for 2027.

NVIDIA: MARKET SHARE

- NVIDIA HOLDS AROUND 80% OF THE AI CHIP INDUSTRY. Mizuho Securities estimates that Nvidia controls between 70% and 95% of the market for AI chips, while Nasdaq.com reported that Nvidia holds 80% market share. Other rivals such as AMD, Intel, Broadcom, Alphabet, or Amazon seem to be still far behind Nvidia.

NVIDIA: FINANCIALS

- BREAKING (NOVEMBER 19): NVIDIA REPORTED ANOTHER BLOCKBUSTER QUARTERLY EARNINGS RESULTS

Q3 REPORT: Nvidia printed $57 billion in revenue (a new record high), up around 62.50% from the same period last year ($35.08 billion). Nvidia printed $31.91 billion in net income (a new record high), up around 65% from the same period last year ($19.31 billion).

FORWARD GUIDANCE (Q4): The company is expected to see revenue figures of $64.77 billion, up 64.70% from a year ago, and net income of $35.80 billion, up around 62% from a year ago.

BLACKWELL A.I. CHIP: SALES ARE OFF THE CHARTS. Blackwell sales are off the charts, and cloud GPUs (Graphics Processing Units) are sold out. Nvidia’s Blackwell A.I. chip generation is the latest generation of A.I. chips available today.

RUBIN VERA A.I. CHIP: AVAILABLE IN Q3 OF 2026. The next-generation A.I. chip and A.I. platform comes in 2026, and CEO Jensen Huang said the interest already today is huge.

CHINA MARKET EXPECTED TO BE BACK: CEO Jensen Huang said that China could be a very valuable market to Nvidia, potentially worth 50 billion dollars of sales per year. The recent US–China trade deal reached between Presidents Trump and Xi should be able to open the China market door again to Nvidia.

NVIDIA: PRICE ACTION

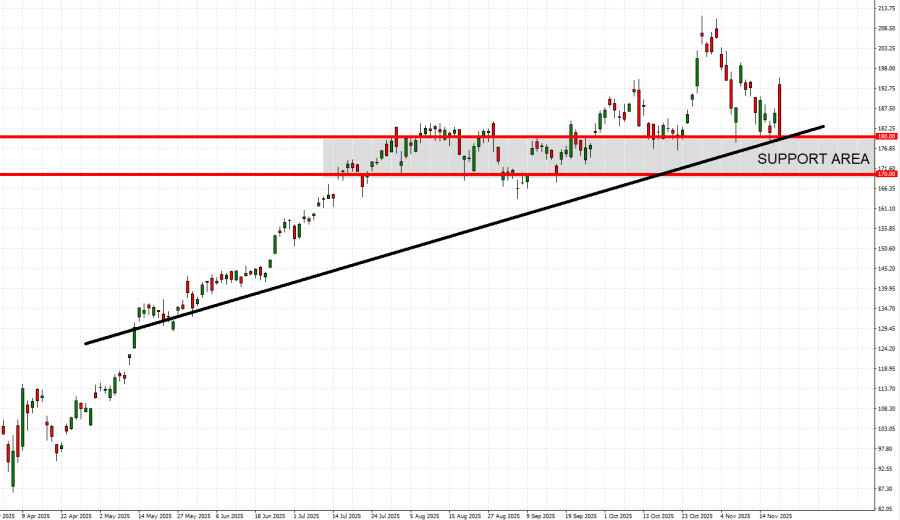

- SUPPORT AREA: $180 - $170. Since July 2025, the stock price has maintained a strong support area between $180 and $170.

- NVIDIA STOCK PRICE HIT AN ALL-TIME HIGH OF $211.69 (October 29, 2025): The stock was last trading around 177, and if a full recovery to the recent all-time high happens, it could see around 20% upside potential. However, the stock price could decline.

- ANALYST OPINION: HSBC forecasts $320; Goldman Sachs forecasts $250; KeyBanc Capital forecasts $275; Barclays forecasts $275; Citi forecasts $270; JP Morgan forecasts $250; Well Fargo forecasts $265;

GRAPH (Daily): April 2025 – November 2025

Please note that past performance does not guarantee future results

#NVDA, November 21, 2025

Current Price: 177

|

NVIDIA |

Weekly |

|

Trend direction |

|

|

250 |

|

|

230 |

|

|

200 |

|

|

160 |

|

|

155 |

|

|

150 |

Example of calculation based on weekly trend direction for 1 Lot1

|

NVIDIA |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

73,000 |

53,000 |

23,000 |

-17,000 |

-22,000 |

-27,000 |

|

Profit or loss in €2 |

63,423 |

46,047 |

19,983 |

-14,770 |

-19,114 |

-23,458 |

|

Profit or loss in £2 |

55,951 |

40,622 |

17,628 |

-13,030 |

-16,862 |

-20,694 |

|

Profit or loss in C$2 |

102,930 |

74,730 |

32,430 |

-23,970 |

-31,020 |

-38,070 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 12:00 (GMT) 21/11/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.