Palladium weekly special report based on 1.00 Lot Calculation:

PALLADIUM USE AND MARKET SHARE:

- Palladium is mostly used in catalytic converters by the car industry to reduce harmful gas emissions while tightening regulation is forcing automakers to put more Palladium into each vehicle, which in turn could keep the demand outlook positive. Palladium has also been used in fuel cells to generate power.

- MARKET SHARE (PRODUCERS): Russia is the largest producer holding 43% of the markets, while South Africa is the second largest with 33.00% of the markets. Canada is third on the list with 9.5% of the global production.

- MARKET SHARE (CONSUMERS): China is the largest Palladium consumer with 31%, while Europe and North America (USA) hold 20% each. Japan stands at 11%.

- RUSSIA EXPECTED TO CUT PRODUCTION IN 2024: NORNICKEL, THE LARGEST PALLADIUM PRODUCER IN THE WORLD, TO CUT PRODUCTION IN 2024. The Russian miner said the output of the metal may fall almost 15% to as low as 2.3 million ounces. The company said that its production was down 17% year on year in Q4 of 2023.

EVENTS (CHINA): ECONOMIC DATA (MONTHLY) FOR JULY

- WEDNESDAY, AUGUST 7 AT 04:00 GMT+1: CHINA EXPORTS/IMPORTS DATA (PREVIOUS EXPORTS: -2.3%; PREVIOUS IMPORTS: 8.6%)

- FRIDAY, AUGUST 9 AT 02:30 GMT+1: CHINA INFLATION (CPI) (EXPECTED: 0.4%; PREVIOUS: 0.2%)

- THURSDAY, AUGUST 15 AT 0.3:00 GMT+1: CHINA INDUSTRIAL PRODUCTION (PREVIOUS: +5.3%)

EVENTS (USA): ECONOMIC DATA

- THURSDAY, AUGUST 8 AT 13:30 GMT+1: US INITIAL JOBLESS CLAIMS: The US will report its weekly initial jobless claims. Jobless claims have been rising, indicating a slowing job market. This could cause a dovish shift in the Federal Reserve’s interest rate stance and may increase gold prices. However, the price could decline.

- WEDNESDAY, AUGUST 14 AT 13:30 GMT+1: US INFLATION (CPI) (JYLY). The US inflation continued falling, marking a decline from 3.5% to current 3.0% since April. If inflation continues falling, this could encourage the US Fed to start cutting its benchmark interest soon, which in return could put the US dollar under negative pressure. In this case, the Palladium price could come under upward pressure.

TECHNICAL ANALYSIS:

- BREAKING: PALLADIUM HAS TESTED ITS LOWEST RATE SINCE JUNE 2017 (810.50).

- PALLADIUM PRICES HAVE TESTED LVELS BELOW THE MARK OF $900 ONLY 2 TIMES IN 2024. This is the 3th time the Palladium prices were fluctuating below the mark of $900 in 2024.

GRAPH (Daily): January 2024 – August 2024

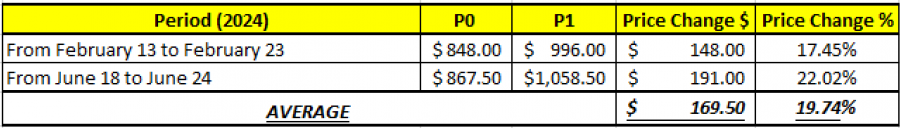

- 2024 STATISTICS: PALLADIUM TENDS TO RECOVER BY AROUND 19.74% AFTER TESTING LOWS BELOW THE MARK OF $900.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

PALLADIUM, August 6, 2024

Current Price: 830

|

PALLADIUM |

Weekly |

|

Trend direction |

|

|

1200 |

|

|

1000 |

|

|

900 |

|

|

770 |

|

|

750 |

|

|

730 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

37,000 |

17,000 |

7,000 |

-6,000 |

-8,000 |

-10,000 |

|

Profit or loss in €2 |

33,841 |

15,549 |

6,402 |

-5,488 |

-7,317 |

-9,146 |

|

Profit or loss in £2 |

29,049 |

13,347 |

5,496 |

-4,711 |

-6,281 |

-7,851 |

|

Profit or loss in C$2 |

51,184 |

23,517 |

9,684 |

-8,300 |

-11,067 |

-13,834 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 10:00 (GMT+1) 06/08/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.