PLATINUM weekly special report based On 1.00 Lot Calculation:

- BIGGEST PLATINUM PRODUCERS IN THE WORLD: South Africa (72.8%), Russia (8-10%), Zimbabwe (5%) and Canada (1%).

- EVENT (WEDNESDAY, SEPTEMBER 20 AT 19:00 GMT+1): U.S. FEDERAL RESERVE INTEREST RATE DECISION. The Federal Reserve raised interest rates to 5.50% last time (Its highest in 22 years). Fed Chair Powell said that they will go meeting by meeting depending on data to see if more hikes will be needed. The markets assign 99%** of probability to an outcome that will see no changes in interest rates in September.

- GLOBAL DEMAND FOR PLATINUM TO CLIMB SHARPLY DUE TO THE LARGEST ANNUAL DEFICIT ON RECORD, World Platinum Investment Council published on September 6. Total platinum demand is expected to climb by 27% by the end of the year, to an estimated 8.23 million ounces, while total supplies are expected to barely budge from last year to stand at 7.224 million ounces, the report said.

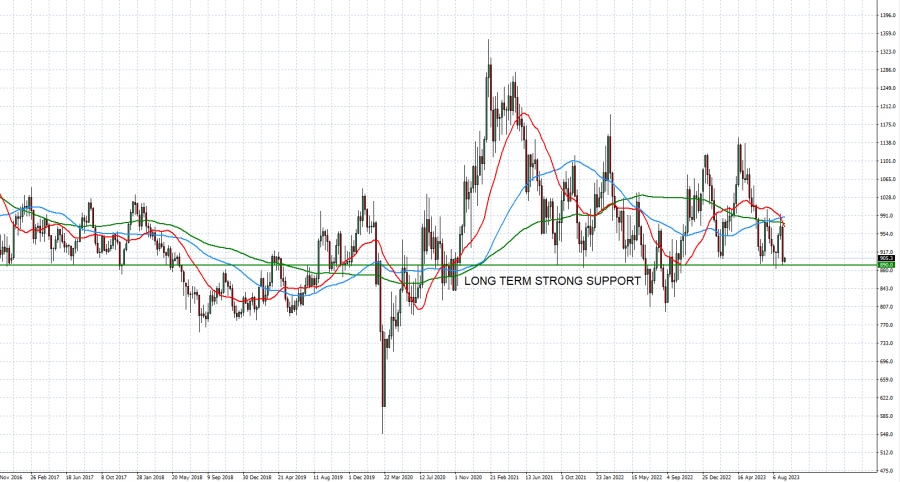

- TECHNICAL OUTLOOK: Current price of around $950 is near the long term support of $890. Since 2016, the price several times bounced back up after hitting it.

SOURCE: MT4

*Please note that past performance does not guarantee future results.

PLATINUM PRICE ACTION: Platinum reached $1350 in early 2021. The price is currently moving around $950 and if a recovery to 2021 highs happens, this could provide an increase of around 42.1%. However, the price could decline further.

Platinum, September 19, 2023

Current Price:950.00

|

Boeing |

Weekly |

|

Trend direction |

|

|

1050.00 |

|

|

1000.00 |

|

|

985.00 |

|

|

915.00 |

|

|

905.00 |

|

|

900.00 |

|

Boeing |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

10,000.00 |

5,000.00 |

3,500.00 |

-3,500.00 |

-4,500.00 |

-5,000.00 |

|

Profit or loss in €2 |

9,357.16 |

4,678.58 |

3,275.01 |

-3,275.01 |

-4,210.72 |

-4,678.58 |

|

Profit or loss in £2 |

8,068.16 |

4,034.08 |

2,823.86 |

-2,823.86 |

-3,630.67 |

-4,034.08 |

|

Profit or loss in C$2 |

13,388.25 |

6,694.13 |

4,685.89 |

-4,685.89 |

-6,024.71 |

-6,694.13 |

1 1.00 lot is equivalent of 1000 units

2 Calculations for exchange rate used as of 14:15 (GMT+1) 19/09/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

* You may wish to consider closing your position in profit, even if it is lower than suggested one

** Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail