PLATINUM weekly special report based on 1.00 Lot Calculation:

PATINUM USE AND MARKET SHARE:

- PLATINUM has been a key element in autocatalysts for over forty years. The automotive sector is its largest consumer, accounting for about 40% of annual demand.

- MARKET SHARE (PRODUCERS): BIGGEST PLATINUM PRODUCERS IN THE WORLD: South Africa is the largest producer, holding 72.8% of the global market share, while Russia is the second with 8-10% of the market. Zimbabwe is third with 5%.

- MARKET SHARE (CONSUMERS): China is the world's largest platinum consumer, with 34%, while Europe holds 22% and North America 16% of the platinum consumed worldwide.

GEOPOLITICS: TRADE PROGRESS

- USA-CHINA TRADE DEAL SIGNED (JUNE 27): President Trump announced that the United States and China have officially signed a trade agreement, aiming to de-escalate tensions between the world’s two largest economies. For commodities, the agreement is particularly supportive of platinum prices, as improved U.S.-China relations raise expectations for stronger Chinese industrial demand, especially in automotive sectors.

USA: TRUMP’S BIG TAX CUT BILL EXPECTED TO PASS IN CONGRESS

- TRADITIONAL CAR MAKERS THAT USE PLATINUM TO BENEFIT: According to CNBC, the new tax cut bill would end tax breaks (subsidies) for consumers who buy or lease Electric Vehicles (EV) after September 30, 2025. Lawmakers would eliminate a $7,500 tax credit for the purchase or lease of a new EV, and a $4,000 credit for the purchase of a used Electric Vehicles. This could decrease consumer demand for Electric Vehicles, pushing consumers towards cars that run on petrol or diesel.

EVENTS:

- THURSDAY, JULY 3, AT 13:30 GMT+1: US NON-FARM PAYROLL (NFP) AND UNEMPLOYEMENT RATE (JUNE). A lower than expected result should prove positive for platinum, because it could point to the further FED interest rate cuts. This data measures the change in the number of people emplyed during the previous month, excluding the farming industry. The data for the previous month came in at 139,000, which was lower than for the month before (147,000).

- WEDNESDAY, JULY 9 AT 02:30 GMT+1: CHINA INFLATION (CPI) (JUNE): A higher-than-expected CPI reading may indicate strengthening domestic demand and economic activity in China, which could have a supportive effect on platinum prices, given China's role as the world’s largest consumer of the metal. If inflation picks up from the previous reading of -0.1%, it could reinforce optimism about economic stabilization and increased commodity demand. (PREVIOUS: -0.1%)

- TUESDAY, JULY 15 AT 03:00 GMT+1: CHINA GDP (Q2): A reading above the previous 5.4% growth would reinforce expectations of a stable economic rebound in the world’s largest platinum consumer. Stronger GDP growth supports infrastructure spending, manufacturing activity, and overall commodity demand, lifting platinum prices. (PREVIOUS: +5.4%)

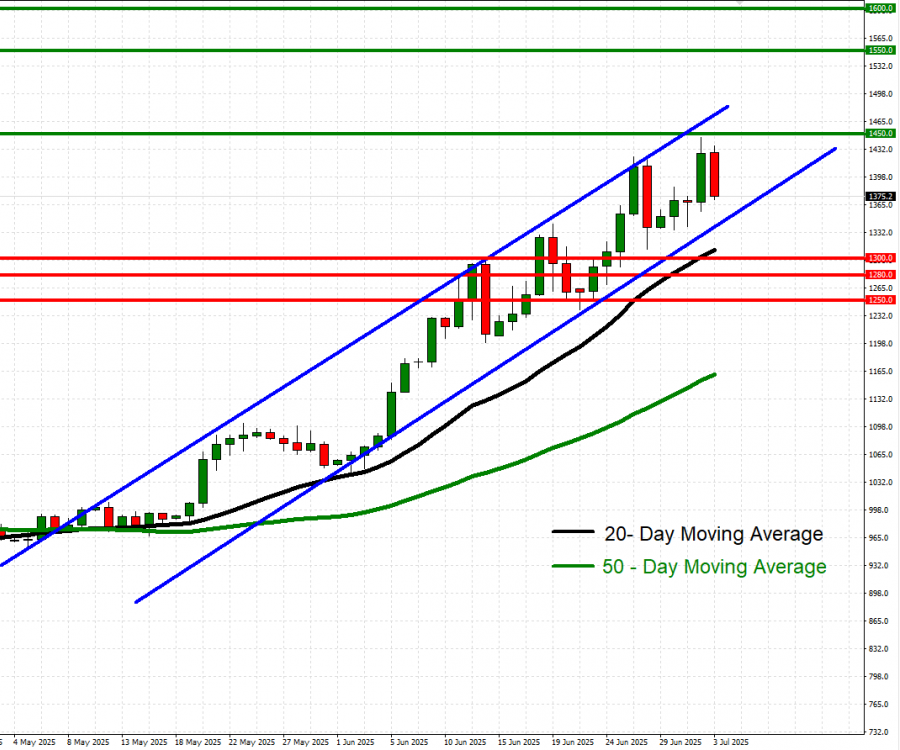

TECHNICAL ANALYSIS:

- UPTREND CHANNEL: As depicted by the daily chart below, the platinum price has kept trading withing its blue-lined uptrend channel, which has been in place since May 2025. there remains a risk of a potential breakout below this level if market conditions change.

- 20- AND 50-DAY MOVING AVERAGE POINT TO AN UPTREND: The 20- and 50- Day Moving Average continued to point to an uptrend as the platinum price has remained steady above them.

- PLATINUM HIT AN ALL-TIME HIGH OF $2,300 (March, 2008): Platinum has traded around $1372, and if a full recovery takes place, the price of platinum could rise around $930. Although the price could decline as well.

GRAPH (Daily): April 2025 – July 2025

Please note that past performance does not guarantee future results

PLATINUM, JULY 3, 2025

Current Price: 1,372

|

PLATINUM |

Weekly |

|

Trend direction |

|

|

1,600 |

|

|

1,550 |

|

|

1,450 |

|

|

1,300 |

|

|

1,280 |

|

|

1,250 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

22,800 |

17,800 |

7,800 |

-7,200 |

-9,200 |

-12,200 |

|

Profit or loss in €2 |

19,337 |

15,096 |

6,615 |

-6,106 |

-7,802 |

-10,347 |

|

Profit or loss in £2 |

16,695 |

13,034 |

5,711 |

-5,272 |

-6,737 |

-8,933 |

|

Profit or loss in C$2 |

30,985 |

24,190 |

10,600 |

-9,785 |

-12,503 |

-16,579 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 10:10 (GMT+1) 03/07/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.