PLATINUM Weekly Special Report based on 1 Lot Calculation:

TECHNICAL ANALYSIS:

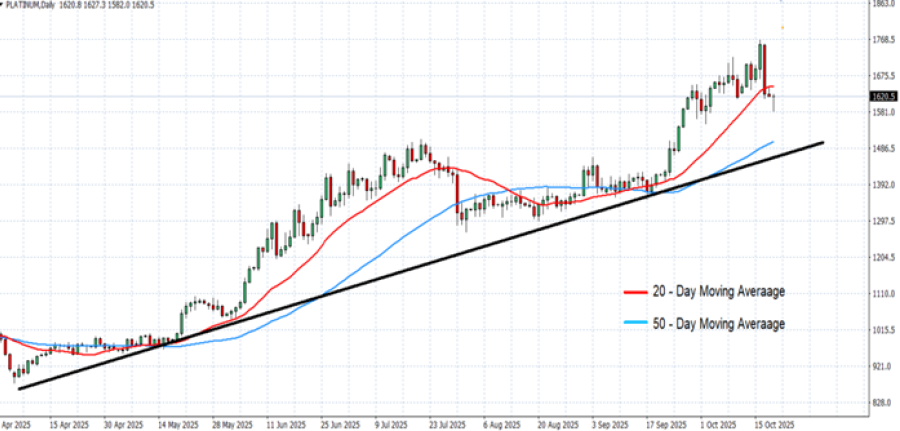

- DAILY MOVING AVERAGES (MA) CONFIRM UPTREND: The 50-day moving average (blue) trends higher and remains below the current price, confirming strong medium-term support. Price action staying above both moving averages suggests sentiment remains positive.

- UPTREND STRUCTURE: The rising trendline (black) extending from April 2025 remains firmly intact. Recent pullbacks have found support near the 20-day MA. As long as platinum holds above the 50-day MA and the trendline, the broader outlook stays constructive, with potential for another leg higher toward recent highs.

- PRICE ACTION: Platinum price hit an all-time high of $2,300 (March 2018). Currently, platinum price is trading around $1,620 and if a full recovery follows the previous all-time high, platinum prices then could see an upside potential of 42%. Although, prices could decline, too.

GRAPH (Daily): April 2025 - October 2025

Please note that past performance does not guarantee future results

PLATINUM USE AND MARKET SHARE:

- PLATINUM has been a key element in auto catalysts for over forty years, especially for diesel engines, and is increasingly vital in hydrogen fuel cells. The automotive sector is its largest consumer, accounting for about 40% of annual demand.

- MARKET SHARE (PRODUCERS): BIGGEST PLATINUM PRODUCERS IN THE WORLD: South Africa is the largest producer, holding 72.8% of the global market share, while Russia is the second with 8-10% of the market. Zimbabwe is third with 5%.

- MARKET SHARE (CONSUMERS): China is the world's largest platinum consumer, with 34%, while Europe holds 22 and North America 16% of the platinum consumed worldwide.

GEOPOLITICS (EVENTS):

- THIS WEEK, OCTOBER 20 - OCTOBER 24: US TREASURY SECRETARY SCOTT BESSENT TO MEET CHINA VICE PREMIER HE LIFENG IN MALAYSIA. According to the CNBC, U.S. Treasury Secretary Scott Bessent said that he expects to meet with Chinese Vice Premier He Lifeng in Malaysia this week to help prevent a further escalation of U.S. tariffs on Chinese goods, which the U.S. President has described as unsustainable

- EXPECTED: THURSDAY, OCTOBER 23: HIGH LEVEL U.S.-RUSSIA MEETING LED BY US SECRETARY OF STATE MARCO RUBIO AND RUSSIA FOREIGN MINISTER SERGEI LAVROV. President Trump said that this week high level talks will take place between US Secretary of State Marco Rubio and Russia’s Foreign Minister Sergei Lavrov.

- OCTOBER 31 - NOVEMBER 1: US PRESIDENT TRUMP TO MEET CHINA PRESIDENT XI at the Asia-Pacific Economic Cooperation (APEC) summit in South Korea.

EVENTS:

- FRIDAY, OCTOBER 24 AT 13:30 GMT+1: US INFLATION (CPI) (SEPTEMBER). Despite the ongoing US government shutdown, latest reports have said that US inflation data could be still released, with the office workers expected to work harder to get the data out. In August, US inflation rose to 2.90%, up from July’s 2.70%. This would be the last inflation report before the Fed's interest rate decision on October 29.

- WEDNESDAY, OCTOBER 29 AT 19:00 GMT+1: US FED INTEREST RATE DECISION. Interest rates are expected to be further cut to 4.00%. The US federal reserve cut interest rate to 4.25% from 4.50% in September, its first interest rate cut since December 2024. The Federal Reserve policymakers said they expect to see 2 more rate cuts by the end of 2025, to slash current rates to 3.75%. A softer dollar would, in turn, likely support higher platinum prices. However, the opposite scenario is also possible.

- FRIDAY, OCTOBER 31 AT 2:30 GMT+1: CHINA MANUFACTURING PMI (OCTOBER). China’s manufacturing activity continued to recover in September, rising to 49.8 from August’s 49.4 and July’s 49.3. Investors will be watching closely to see whether this recovery extended into October.

Platinum, October 20, 2025.

Current Price: 1,620

|

PLATINUM |

Weekly |

|

Trend direction |

|

|

2,300 |

|

|

1,900 |

|

|

1,750 |

|

|

1,500 |

|

|

1,475 |

|

|

1,450 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

68,000 |

28,000 |

13,000 |

-12,000 |

-14,500 |

-17,000 |

|

Profit or loss in €² |

58,339 |

24,022 |

11,153 |

-10,295 |

-12,440 |

-14,585 |

|

Profit or loss in £² |

50,707 |

20,879 |

9,694 |

-8,948 |

-10,813 |

-12,677 |

|

Profit or loss in C$² |

95,470 |

39,311 |

18,252 |

-16,848 |

-20,358 |

-23,867 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 12:45 (GMT+1) 20/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.