- Q1’ 24 EARNINGS SEASON IS EXPECTED TO OFFICIALLY START ON APRIL 12. Each season, the banking sector led by Citigroup, JPMorgan, Wells Fargo and Goldman Sachs report their earnings results first.

- WHAT IT BRINGS: The companies’ quarterly earnings reports bring about high volatility as the companies release their Earnings Per Share (EPS) and Revenue figures for the past quarter. They also report their future outlook in the form of Forward Guidance regarding EPS and revenue. The forward guidance usually covers expectations for the quarter to come.

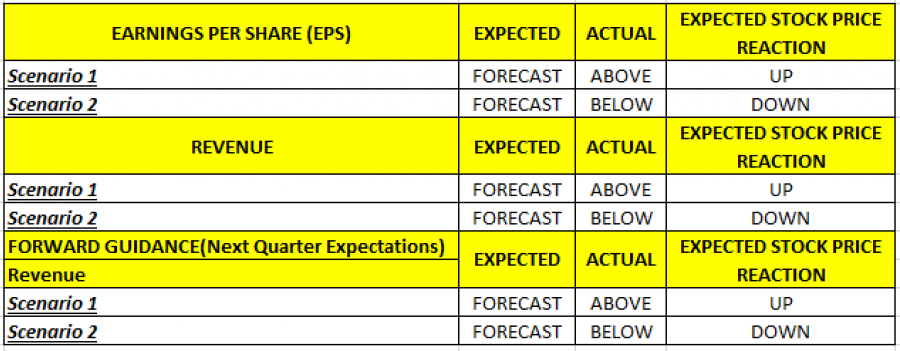

- BASIC RULES: RESULTS VS. EXPECTED PRICE REACTION. Analysts on Wall Street usually come up with their own forecasts when it comes to Earnings Per Share and Revenue for a company set to release their earnings report. The actual number reported on the earnings date usually differs from Analysts’ forecast, which drives stock volatility therefore, and that is due to unexpected new information. Some of the basic rules are illustrated in Table I.

Table I: Expected Stock Price Reaction to Various Scenarios.

Source: Investopedia.com

US STOCK MARKET: MOST RECENT SIX QUARTERS

- MOST RECENT QUARTERS IMPACTED BY THE ARTIFICIAL INTELLIGENCE (A.I). Since late 2022, when OpenAI first released its ChatGPT platform, many other companies announced projects, investments and advancements in the area of Artificial Intelligence. Among others, Nvidia kept releasing new A.I. chips, Meta (Facebook) released their own Lamma A.I. platform, Google released Bard and Gemini etc. Their future revenue outlooks started to improve and their shares recorded among the best performance since late 2022.

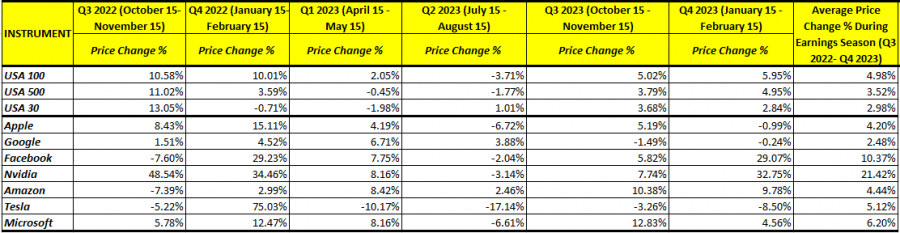

- US STOCKS DURING QUARTERLY EARNINGS SEASONS (PERIOD: Q3 2022 to Q4 2023). The table below illustrates price reactions of major technology stocks and major US stock indices. On Average, the USA 100 index has risen by 4.98% each quarterly earnings season since Q3 2022. Over the same period, the USA500 index rose 3.52%, while the USA30 index climbed around 3.00%. Individually, Facebook and Nvidia would on average rose 10.37% and 21.42%, respectively. Google would on average experience the weakest performance, rising only by 2.48%.

Table II: US Stocks and their price changes during Quarterly Earnings Season (Period: Q3 2022 to Q4 2023).

Data Source: MetaTrader 4 Platform