Silver Weekly Special Report based on 1.00 Lot Calculation:

- EVENT: US NFP and Unemployment (Friday, April 5th, 2024 at 13:30 GMT+1): The United States will be releasing nonfarm payrolls and unemployment. Nonfarm payrolls have been trending lower recently, while unemployment has been inching higher. If the Nonfarm payrolls continue to fall while unemployment rises, there could be extended US dollar weakness and may push silver price higher.

- US Inflation (Wednesday, April 10th, 2024 at 13:30 GMT+1) The United States will report its CPI for March. February CPI came in at 3.2%, Year-over-Year, well below its peak of 9.1% peak in 2022. Inflation continues to trend lower, with levels approaching the Federal Reserve’s 2% target. The lower inflation could be positive for silver.

- US Federal Reserve Interest Rate Decision (May 1st, 2024): The Federal Reserve Bank will meet on May 1st to set the Fed Funds rate target. According to the most recent estimates, analysts are expecting the Federal Reserve to hold interest rates at the current level of 5.50%. Jerome Powell will hold a press conference following the Interest Rate decision at 19:30 GMT to answer potential questions and clarify the Federal Reserve’s stance on interest rate policy.

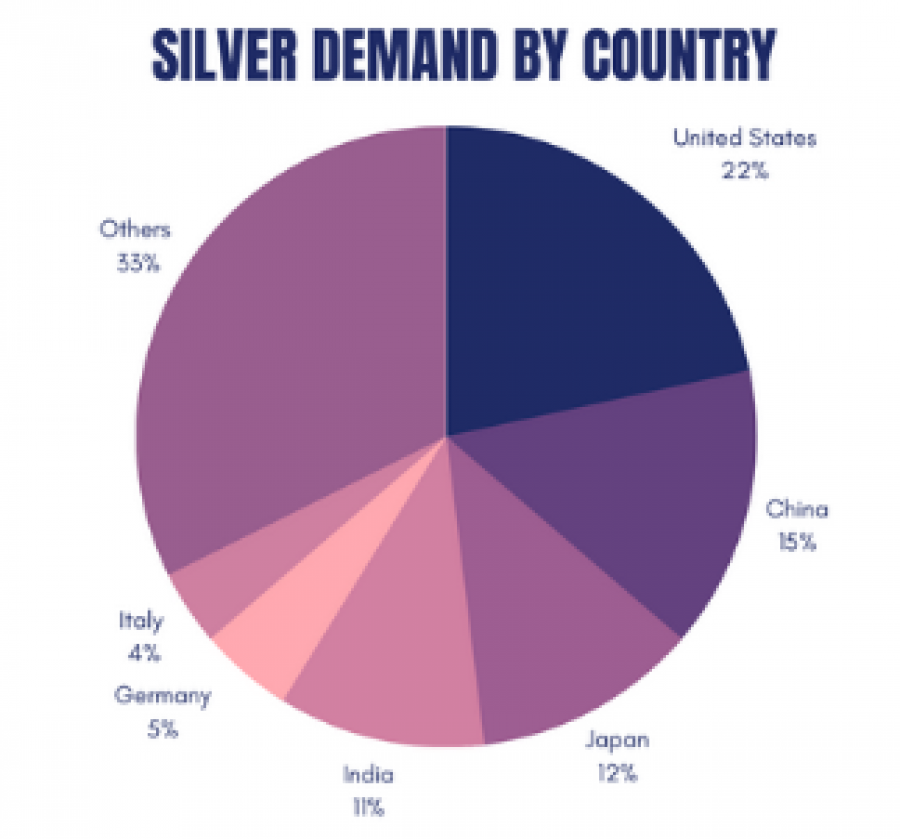

- Silver demand: The United States remains the most important market with 22% of global demand for silver, while China represents 15% of global demand of silver. China's economy could potentially grow about 5%. Silver price was fueled by increased safe haven demand, as geopolitical tensions in the Middle East and Ukraine intensified. Additional support for the metal came from hopes for higher use in the solar industry, which currently takes up around a third of silver supply.

Source: Bloomberg

Silver, April 4, 2024

Current Price: 27.00

|

SILVER |

Weekly |

|

Trend direction |

|

|

32.00 |

|

|

30.00 |

|

|

28.10 |

|

|

25.90 |

|

|

25.50 |

|

|

25.00 |

Example of calculation based on trend direction for 1.00 Lot*

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

50,000.00 |

30,000.00 |

11,000.00 |

-11,000.00 |

-15,000.00 |

-20,000.00 |

|

Profit or loss in €2 |

46,071.06 |

27,642.64 |

10,135.63 |

-10,135.63 |

-13,821.32 |

-18,428.42 |

|

Profit or loss in £2 |

39,502.58 |

23,701.55 |

8,690.57 |

-8,690.57 |

-11,850.78 |

-15,801.03 |

|

Profit or loss in C$2 |

67,537.25 |

40,522.35 |

14,858.20 |

-14,858.20 |

-20,261.18 |

-27,014.90 |

1. 1.00 lot is equivalent of 10.000 units

2. Calculations for exchange rate used as of 10:00 (GMT) 04/04/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail