Silver Weekly Special Report based on 1.00 Lot Calculation:

EVENTS:

- FRIDAY, DECEMBER 6 AT 13:30 GMT: US NONFARM PAYROLLS AND UNEMPLOYMENT RATE (NOVEMBER). The US Unemployment rate is expected to stay above 4%. This could further support market expectations that the Fed could cut interest rates by 25 basis points in December.

- WEDNESDAY, DECEMBER 11, AT 13:30 GMT: U.S INFLATION (CPI) (NOVEMBER): The U.S is scheduled to report its CPI figure for the month of November. The CPI inflation data from the last month of October came out at 2.6%, up from the 2.4% in September. If it comes below the recent 2.6%, then Silver could be expected to rise in value.

CENTRAL BANKS: INTEREST RATE CUT DECISION

- BREAKING (NOVEMBER 7): FEDERAL RESERVE ANNOUNCED ITS SECOND INTEREST RATE CUT IN 2024. The US Federal Reserve decided to cut its benchmark interest rate by 0.50% points in September and 0.25% points in November. The bank expects to cut rates one more time in 2024 to slash its benchmark rate to 4.5% by the end of 2024. The bank expects rates to fall to 3.5% in 2025 and further down to 2.9% in 2026.

- NEXT FED INTEREST RATE DECISION: December 18, 2024 at 19:00 GMT. As of November 28, the market sees high chances for 25 basis points interest rates cut. This could bring current rates of 4.75% down to 4.50%.

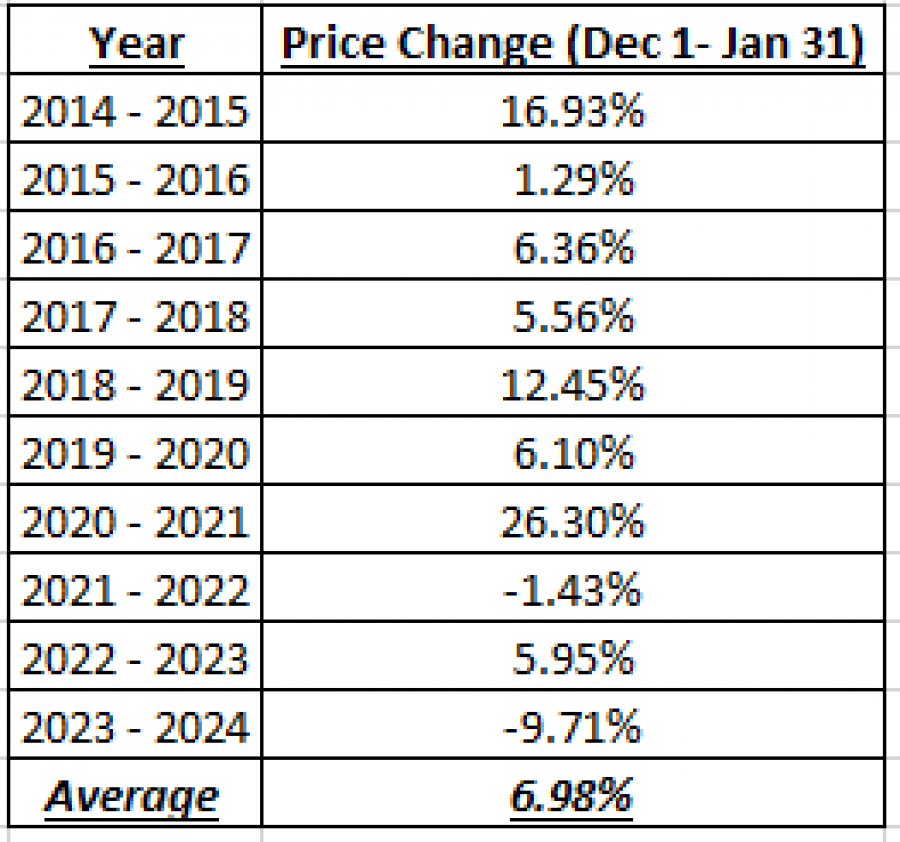

SEASONAL TRADE: DECEMBER - JANUARY (2014- 2024)

- STATISTICS: SILVER ROSE 6.98% ON AVERAGE BETWEEN DECEMBER AND JANUARY (2014- 2024)

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

TECHNICAL ANALYSIS:

- STRONG SUPPORT AT $30. Silver has maintained strong support at $30 since May 2024. Since then, Silver would resist staying below $30 as bargain hunters come back to send price up back above $30.

ANALYST EXPECTATIONS

- UBS: The bank targets a price of $36.

- CITIGROUP: The bank targets a price of $40.

- JP Morgan: The bank targets a price of $34.

PRICE ACTION

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, Silver trades around $29.80 and if full recovery is made this could offer an upside potential of around 67%. However, the price could decline further.

Silver, November 28, 2024

Current Price: 29.80

|

SILVER |

Weekly |

|

Trend direction |

|

|

49.8 |

|

|

40.0 |

|

|

31.0 |

|

|

28.7 |

|

|

28.4 |

|

|

28.0 |

Example of calculation based on trend direction for 1.00 Lot*

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

200,000.00 |

102,000.00 |

12,000.00 |

-11,000.00 |

-14,500.00 |

-18,000.00 |

|

Profit or loss in €2 |

189,890.00 |

96,843.90 |

11,393.40 |

-10,443.95 |

-13,767.03 |

-17,090.10 |

|

Profit or loss in £2 |

158,104.00 |

80,633.04 |

9,486.24 |

-8,695.72 |

-11,462.54 |

-14,229.36 |

|

Profit or loss in C$2 |

280,512.00 |

143,061.12 |

16,830.72 |

-15,428.16 |

-20,337.12 |

-25,246.08 |

1. 1.00 lot is equivalent of 10.000 units

2. Calculations for exchange rate used as of 9:35 (GMT) 28/11/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.