SILVER weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: RUSSIA – UKRAINE CONFLICT

- US PRESIDENT DONALD TRUMP DISAPPOINTED IN RUSSIAN PRESIDENT PUTIN, CONSIDERING SELLING LONG-RANGE TO EUROPE/NATO, POSSIBLY ESCALATING TENSIONS IN UKRAINE. According to Reuters, US President Trump has used every occasion recently to say he is disappointed in Russian President Putin, as no peace deal with Ukraine has been reached. Changing rhetoric on Russia, US President Trump is now considering selling long-range weapons to Europe/Ukraine, which could lead to a new episode of escalation.

USA: WILL THERE BE A GOVERNMENT SHUTDOWN?

- EVENT (TUESDAY, SEPTEMBER 30): US GOVERNMENT SHUTDOWN DEADLINE EXPIRES AS US PRESIDENT TRUMP HEADS TO MEET TOP DEMOCRATIC AND REPUBLICAN LEADERS ON MONDAY (SEPTEMBER 29). According to Reuters, U.S. President Donald Trump will meet with the top Democratic and Republican leaders in Congress on Monday to discuss government funding ahead of a September 30 deadline to keep the government open. Without passage of funding legislation, parts of the government would close on Wednesday (October 1).

EVENTS:

- WEDNESDAY, OCTOBER 1 AT 13:15 GMT+1: US ADP NONFARM EMPLOYMENT CHANGE (SEPTEMBER). Data in August came in at 53,000, below the forecasted 73,000. Moreover, that was a decline from July’s 106,000. If data for September show another weak figure, it could then accelerate the rate cut cycle by the Fed.

- WEDNESDAY, OCTOBER 1 AT 15:00 GMT+1: US ISM MANUFACTURING PMI (SEPTEMBER). Investors will be willing to see which way the manufacturing activity is going in the USA as the Fed cut rates in September. Data for August came in at 49.1, and levels below that in September could accelerate the rate cut cycle by the Fed.

- FRIDAY, OCTOBER 3 AT 13:30 GMT+1: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (SEPTEMBER). The US labor market data remains one of the most important indicators used by the US Fed, which could potentially signal when new interest rate cuts could be implemented. The unemployment rate held above 4% in August, at 4.3%. Another weak reading could increase pressure on the U.S. dollar, supporting silver prices.

US FEDERAL RESERVE:

- BREAKING (SEPTEMBER 17): US FEDERAL RESERVE CUT INTEREST RATE TO 4.25% FROM 4.50%, ITS FIRST INTEREST RATE CUT SINCE DECEMBER 2024. The Federal Reserve policymakers said they expect to see 2 more rate cuts by the end of 2025, to slash current rates to 3.75%.

- NEXT FEDERAL RESERVE MEETING AND INTEREST RATE DECISION: October 29. Interest rates are expected to be further cut to 4.00%.

- DECEMBER 10: The US Federal Reserve is expected to finish the year 2025 by cutting the rates to 3.75% on December 10.

TECHNICAL ANALYSIS:

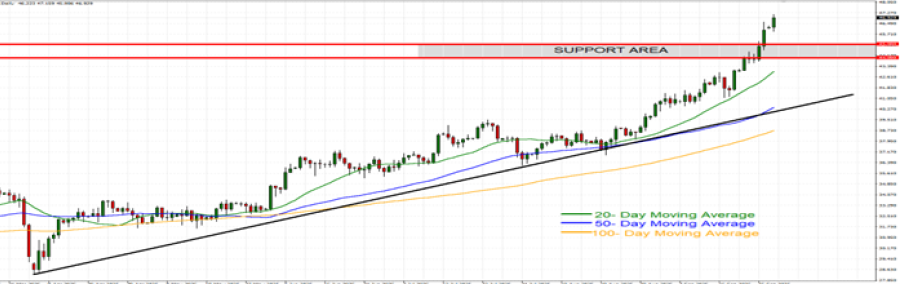

- SUPPORT AREA: $45 - $44. After hitting fresh 14-year highs ($47.159), silver prices have remained above the area defined by $45 - $44, which has now become its next psychological support. Silver was last trading around $47. However, there remains a risk of a potential breakout below this level if market conditions change.

- UPTREND SINCE APRIL 2025: After the March-April price pullback, silver prices have since been trading in an uptrend, as depicted by the daily chart below and the solid black uptrend line on the same chart. Since the beginning of 2025, silver prices have risen by around 63%.

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, silver trades around $46.80, and if a full recovery is made, this could offer an upside potential of around 6%. However, the price could decline.

GRAPH (Daily): March 2025 – September 2025

Please note that past performance does not guarantee future results

Silver, September 29, 2025.

Current Price: 46.80

|

Silver |

Weekly |

|

Trend direction |

|

|

52.00 |

|

|

50.00 |

|

|

48.00 |

|

|

45.70 |

|

|

45.30 |

|

|

45.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

52,000 |

32,000 |

12,000 |

-11,000 |

-15,000 |

-18,000 |

|

Profit or loss in €2 |

44,358 |

27,297 |

10,236 |

-9,383 |

-12,795 |

-15,355 |

|

Profit or loss in £2 |

38,684 |

23,806 |

8,927 |

-8,183 |

-11,159 |

-13,391 |

|

Profit or loss in C$2 |

72,373 |

44,537 |

16,701 |

-15,310 |

-20,877 |

-25,052 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 9:45 (GMT+1) 29/9/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.