SILVER weekly special report based on 1.00 Lot Calculation:

GEOPOLITICAL TENSIONS ESCALATE:

- MIDDLE EAST TENSIONS RISE: IRANIAN PROTESTS ENTER 18TH DAY AS TRUMP SIGNALS POSSIBLE INTERVENTION (JANUARY 14). Iran faces its 18th consecutive day of nationwide protests, with violent street clashes and authorities cutting internet and international phone access. Protesters are openly calling for the overthrow of Supreme Leader Ayatollah Ali Khamenei and the return of Reza Pahlavi.

- RUSSIA-UKRAINE CONFLICT WORSENS: RUSSIA RETALIATES AGAINST UKRAINE USING ORESHNIK MISSILES (JANUARY 9). Responding to Ukraine’s drone attack targeting Vladimir Putin’s residence in late December, Russia has used the intermediate-range ballistic missile “Oreshnik” as part of a massive overnight strike on Ukraine, about 60km from the Polish border.

- GREENLAND ISSUE: US PRESIDENT TRUMP RENEWED PUSH TO ANNEX GREENLAND (JANUARY 8). According to Reuters, US officials are expected to meet leaders of Denmark and Greenland this week (January 12 – January 17), but the US signaled no retreat from President Donald Trump's aim to take over Greenland.

EVENTS:

- WEDNESDAY, JANUARY 14 AT 13:30 GMT: US RETAIL SALES (NOVEMBER). Because the US is a consumption-driven economy, this data is very important since it signals the overall health of the economy. If the data comes out low, it could point to more interest rate cuts by the FED, thus supporting silver prices.

- THURSDAY, JANUARY 22 AT 16:00 GMT: U.S. PCE PRICE INDEX (NOVEMBER). This is the Federal Reserve’s preferred inflation measure. U.S. inflation has been cooling, with PCE inflation holding at 2.8%. Another soft reading would reinforce expectations of further interest rate cuts, a background that typically supports silver prices.

SILVER MARKET: HIGHER DEMAND AMID SUPPLY SHORTAGES LEADS TO A WIDENING DEFICIT

- MARKET DEFICIT: SILVER MARKET REMAINS IN DEFICIT SINCE AT LEAST 2016. The silver market faced a deficit of around 300 million ounces in 2025, according to recent reports from The Silver Institute. While the market has been in deficit since 2016, the gap has grown significantly since 2022.

- SUPPLY CONSTRAINTS: SILVER PRODUCTION REMAINS AROUND 800 MILLION OUNCES PER YEAR. Annual production has held near 800 million ounces, remaining largely unchanged since 2016. There is no clear indication that output will be meaningfully higher in 2026 or the following years.

- DEMAND REMAINS STRONG: SOLAR PANELS, ELECTRIC VEHICLES, AND A.I. INFRASTRUCTURE. Silver demand is expected to increase in 2026 and beyond due to rising demand from solar production, electric vehicles, and rapidly expanding A.I. data center infrastructure.

SILVER MARKET: NEWS

- NEWS: CHINA ANNOUNCED EXPORT RESTRICTIONS STARTING IN 2026. According to Global Times, China will introduce a new export licensing system from 2026, potentially limiting silver exports. As China accounts for 13% of global production and 11% of exports, the move could tighten global silver supply.

TECHNICAL ANALYSIS

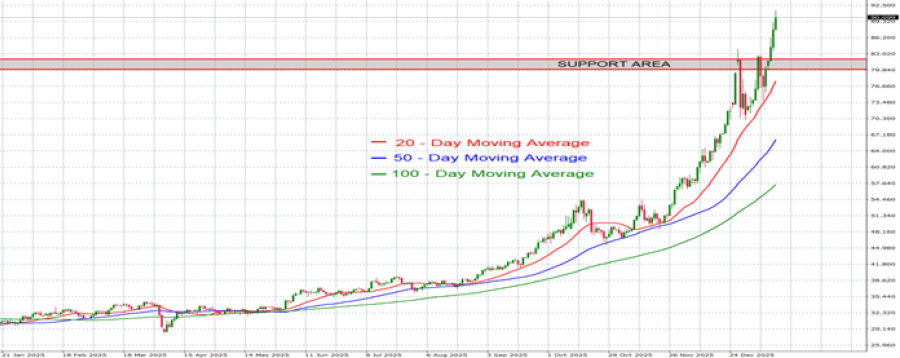

- SILVER PRICE HIT A NEW ALL-TIME HIGH ON JANUARY 12, 2026 ($91.488). Silver price has broken out to a new all-time high of $91.488, confirming the strong uptrend since the beginning of 2025, trading well above moving averages. The zone between $80 and $82 has now become silver’s new support area.

- ANALYSTS’ OPINION: Citigroup forecasts $100.

GRAPH (Daily): January 2025 – January 2026

Please note that past performance does not guarantee future results

SILVER, January 14, 2026

Current Price: 90

|

SILVER |

Weekly |

|

Trend direction |

|

|

110 |

|

|

105 |

|

|

100 |

|

|

85 |

|

|

84 |

|

|

83 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

200,000 |

150,000 |

100,000 |

-50,000 |

-60,000 |

-70,000 |

|

Profit or loss in €2 |

171,714 |

128,785 |

85,857 |

-42,928 |

-51,514 |

-60,100 |

|

Profit or loss in £2 |

148,689 |

111,517 |

74,344 |

-37,172 |

-44,607 |

-52,041 |

|

Profit or loss in C$2 |

277,815 |

208,361 |

138,908 |

-69,454 |

-83,345 |

-97,235 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 09:30 (GMT) 14/01/2026

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.