Silver (#SILVER) Weekly Special Report based on 1 Lot Calculation:

GEOPOLITICS: MIDDLE EAST TENSIONS KEEP MARKETS NERVOUS

- ISRAEL EXPECTED TO RETALIATE AGAINST IRAN: Reuters reports that Prime Minister Benjamin Netanyahu has convened his war cabinet for the second time in less than 24 hours to discuss Israel's response to Iran's weekend missile and drone attack. Military Chief of Staff Herzi Halevi confirmed Israel's intention to retaliate, while allies advised against escalation. The cabinet is now deliberating the timing and extent of the retaliation.

- IRAN STRIKES ISRAEL: ISRAELI RETALIATION EXPECTED - FEARS OF FULL-SCALE CONFLICT RISE: Iran's unprecedented attack on Israel, the first by another country in over three decades, involved over 300 missiles and drones, including 170 drones, 30 cruise missiles, and 120 ballistic missiles. Although most were intercepted, it has raised concerns about escalating tensions between the two nations.

MARKET REACTION AHEAD OF WEEKEND SINCE APRIL 1 (ISRAEL STRIKE ON IRANIAN EMBASSY IN SYRIA)

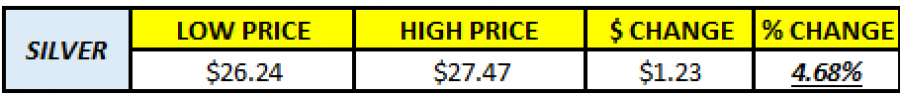

- FIRST WEEK: APRIL 4 - APRIL 5 (THURSDAY AND FRIDAY)

NEWS (APRIL 4, THURSDAY): IRAN COULD CONDUCT STRIKES ON ISRAEL OVER THE NEXT 72 HOURS

Source: MT4 Platform

Please note that past performance does not guarantee future performance.

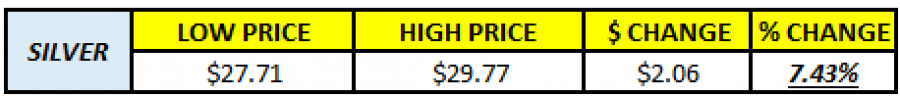

- SECOND WEEK: APRIL 11 - APRIL 12 (THURSDAY AND FRIDAY)

NEWS (APRIL 11, THURSDAY): IRAN COULD CONDUCT STRIKES ON ISRAEL OVER THE WEEKEND.

Source: MT4 Platform

Please note that past performance does not guarantee future performance.

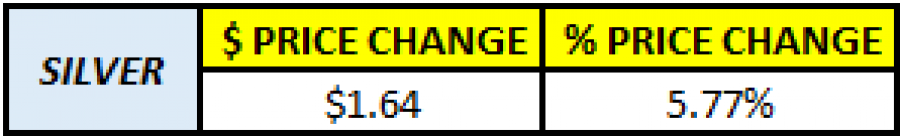

- POTENTIAL PRICE CHANGE BASED ON AVERAGE PREVIOUS CHANGES

LATEST NEWS: ISRAEL COULD RETALIATE AND ATTACK IRAN OVER THE COMING WEEKEND

Source: MT4 Platform

Please note that past performance does not guarantee future performance.

GOLD-SILVER RATIO AND RELATIONSHIP

- The gold-to-silver ratio is a simple way to compare the prices of gold and silver. It tells you how many ounces of silver it takes to take one ounce of gold. For example, if the ratio is 80, it means that it takes 80 ounces of silver to take one ounce of gold. Investors sometimes use this ratio to decide which metal could be a better investment at a given time. A higher ratio means that silver is relatively cheaper compared to gold, while a lower ratio means that gold is cheaper relative to silver.

- At current gold and silver prices, the ratio stands at ~84 which indicates that Silver is relatively undervalued compared to Gold.

ANALYST EXPECTATIONS

- The Silver Institute forecasts global silver demand to hit 1.2 billion ounces in 2024, the second-highest level ever recorded. The Institute believes Gold could rise initially, followed by a rapid surge in silver prices. The report asserts that silver consistently outperforms, albeit belatedly. The Silver Institute believes that silver could potentially reach $50, but only after gold surpasses $2,200, which it already has. Therefore, a Silver wave could be possible relatively soon. Although the price could go down.

PRICE ACTION

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, Silver trades around 28.35 and if full recovery is made this could offer an upside potential of around 76%. Although the price could go down.

SILVER (#SILVER) April 18, 2024

Current Price:28.35

|

SILVER |

Weekly |

|

Trend direction |

|

|

49.80 |

|

|

40.00 |

|

|

30.00 |

|

|

27.00 |

|

|

26.80 |

|

|

26.50 |

Example of calculation based on weekly trend direction for 1 Lot1

|

SILVER |

||||||

|

|

||||||

|

Profit or loss in $ |

214,500.00 |

116,500.00 |

16,500.00 |

-13,500.00 |

-15,500.00 |

-18,500.00 |

|

Profit or loss in €² |

200,885.96 |

109,105.89 |

15,452.77 |

-12,643.17 |

-14,516.23 |

-17,325.83 |

|

Profit or loss in £² |

171,973.53 |

93,402.87 |

13,228.73 |

-10,823.51 |

-12,426.99 |

-14,832.22 |

|

Profit or loss in C$² |

295,126.26 |

160,290.02 |

22,702.02 |

-18,574.38 |

-21,326.14 |

-25,453.78 |

- 1.00 lot is equivalent of 10000 units

- Calculations for exchange rate used as of 10:40 (GMT+1) 18/04/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail