Tesla (#TSLA) weekly special report based On 1 Lot Calculation:

GLOBAL EV MARKETS:

- ELECTRIC VEHICLES (EV) MADE ONLY AROUND 9.0% OF TOTAL CAR SALES, WORTH 66.7 MILLION CARS IN 2022: The EV sector increased its market share from 4.11% in 2021 to around 9.00% off the global car sales in 2022.

- MARKET POTENTIAL: ELECTRIC VEHICLES (EV) COULD BE EXPECTED TO TAKE UP AROUND 50% OF GLOBAL CAR SALES BY 2030. The 2021 figures of 287.36 billion dollars are an increase of around 76% from 2020’s 160.01 billion dollars. Expecting this number to grow to 823.75 billion dollars, the EV market could be growing annually on average by 18.6%.

TESLA: EVENTS AND ANALYSIS

- EVENT: Q3 EARNINGS REPORT (October 18, Aftermarket). Q3 revenue is expected to come in at $24.12 billion, up 42% from the same period last year ($16.934 billion). Net income is expected to come in at $2.607 billion, up 9.95% from the same period last year ($2.371 billion). The company is expected to release a precise plan on Cybertruck mass delivery start date, which was earlier speculated to be around late October 2023.

- Q3 CAR DELIVERY (October 2). Tesla delivered 435,059 cars in Q3. This was down from its Q2 record when it released 466,140 cars, beating Q1 2023 record of 422,875. Still the company is expected to deliver 1.8-1.9 million cars in 2023, which would be 37% to 44.6% up from 2022.

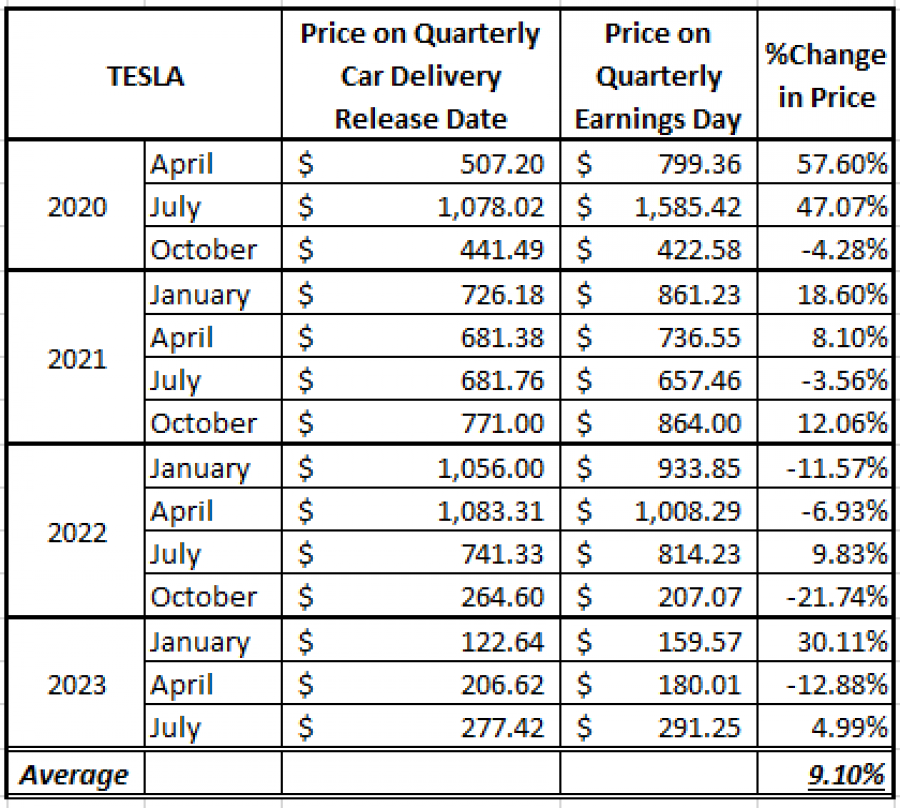

- STATISTICS (2020- 2023) (TABLE I): TESLA STOCK RISES ON AVERAGE 9.10% BETWEEN QUARTERLY DELIVERY DATE AND QUARTERLY EARNINGS DATE.

TABLE I: TESLA STOCK PRICE ACTION BETWEEN DELIVERY AND EARNINGS DATES (2020- 2023) *

DATA SOURCE 1: BLOOMBERG; DATA SOURCE 2: FORTRADE METATRADER 4

Please note that past performance does not guarantee future results.

_______________________________________________________________________________________________

*- Note that prices are not adjusted for stock splits

TESLA: OTHER ANALYSIS

- TESLA AGAIN CONSIDERING TO ENTER THE INDIAN MARKET: Reportedly, the company is in talks with the Indian officials to build a factory there.

- TESLA CONSIDERING TO BUILD A GIGAFACTORY IN SPAIN: Tesla is reportedly considering building a new factory in Valencia, Spain, that could be worth close to 5 billion dollars.

- TESLA IS CONSIDERING A NEW MODEL (MODEL 2): The model is expected to be the cheapest ever offered by Tesla, in a range between 20,000 and 25,000 dollars. The reports say that new Gigafactories to be built will incorporate technologies to produce the new model.

- CYBERTRUCK (PICK-UP) COMING IN THE SECOND HALF OF 2023. Elon Musk said he expects the Tesla Cybertruck to sell between 250,000 and 500,000 units per year once production is fully ramped.

TESLA: PRICE ACTION

- THE STOCK HAS TRADED AROUND 39% BELOW ITS ALL- TIME HIGH OF $414.4 (November 4, 2021). Tesla was last trading around $253, and if a full recovery follows to recent all- time highs, the stock could see an upside of around 64%. However the price could decline further.

- ANALYSTS OPINIONS: Wedbush forecasts $350. New Street Research forecasts $350. RBC Capital forecasts $305. Muziho forecasts $330. Deutsche Bank forecasts $300.

#TSLA, October 17, 2023

Current Price: 253

|

Tesla |

Weekly |

|

Trend direction |

|

|

350 |

|

|

315 |

|

|

277 |

|

|

230 |

|

|

220 |

|

|

210 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Tesla |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

97,000.00 |

62,000.00 |

24,000.00 |

-23,000.00 |

-33,000.00 |

-43,000.00 |

|

Profit or loss in €2 |

92,009.41 |

58,810.14 |

22,765.21 |

-21,816.66 |

-31,302.17 |

-40,787.68 |

|

Profit or loss in £2 |

79,729.09 |

50,960.86 |

19,726.78 |

-18,904.83 |

-27,124.33 |

-35,343.82 |

|

Profit or loss in C$2 |

132,208.09 |

84,504.14 |

32,711.28 |

-31,348.31 |

-44,978.01 |

-58,607.71 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:10 (GMT+1) 17/10/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail