USA100 Weekly Special Report based on 1.00 Lot Calculation:

USA100:

- USA100 represents the Nasdaq 100, which includes 100 of the largest and most innovative non-financial companies listed on the Nasdaq exchange. It features global tech and AI leaders such as Apple, Google, Tesla, Nvidia, Meta, Microsoft, Amazon, and others. In essence, USA100 reflects the strength and evolution of the modern digital economy in the United States.

EVENTS:

- FRIDAY, FEBRUARY 20 AT 13:30 GMT: U.S. CORE PERSONAL CONSUMPTION EXPENDITURE (PCE) PRICE INDEX (JANUARY). The U.S. Core PCE Price Index measures underlying inflation and heavily influences Federal Reserve interest rate decisions. A lower-than-expected reading can boost the USA100 price as investors anticipate looser monetary policy, complementing the lower-than-expected CPI (Consumer Price Index).

- FRIDAY, FEBRUARY 20 AT 13:30 GMT: US GROSS DOMESTIC PRODUCT (Q4). A stronger Q4 GDP reading would confirm solid economic momentum, improving the outlook for corporate earnings and providing a supportive backdrop for further positive sentiment with the USA100 price.

- TUESDAY, FEBRUARY 24: US PRESIDENT DONALD TRUMP: STATE OF THE UNION ADDRESS. President Trump will address a joint session of Congress marking a key yearly political event. Trump is likely to outline US administration successes so far and give a preview on plans for the rest of the year. He may address a variety of subjects including the US economy, trade, foreign policy, energy or taxation, which could all drive higher volatility with the USA100 price.

NVIDIA: THE LARGEST STOCK COMPONENT OF THE USA100

- NVIDIA MAKES UP TO 10% OF THE USA100: NVIDIA is the world’s largest company by market capitalization and the most heavily weighted stock in the USA100. According to some reports it takes up between 9% and 10%. Given NVIDIA’s outsized weighting and its role as a proxy for the AI market, positive Nvidia stock performance could be expected to lift the USA100 price towards fresh all-time highs.

- EVENT (WEDNESDAY, FEBRUARY 25, AFTERMARKET): Q4 EARNINGS REPORT. Its upcoming results are likely to play a decisive role in shaping the overall direction and sentiment of the market. Beyond the headline earnings figures, investors will be especially focused on NVIDIA’s forward guidance, focusing on revenue outlook, data center demand trends and AI infrastructure spending signals.

TECHNICAL ANALYSIS:

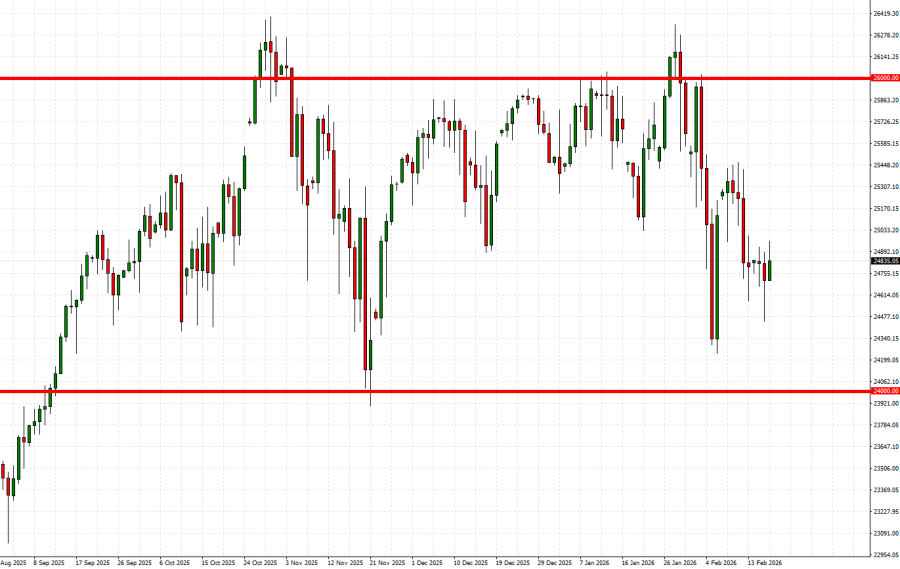

- CHANNEL SIDEWAYS BETWEEN 24,000 AND 26,000: The USA100 price has been moving within a range between 24,000 and 26,000 since August 2025. It has tested the lower boundary near 24,000 three times. Each time the USA100 tested this region, it recovered and moved toward the upper boundary around 26,000.

- SUPPORT: 24,000. It has been tested three times since August 2025.

- RESISTANCE: 26,000. It has been tested five times since August 2025.

GRAPH (Daily): August 2025 – February 2026

Please note that past performance does not guarantee future results

#USA100, February 18, 2026

Current Price: 24,800

|

USA100 |

Weekly |

|

Trend direction |

UP |

|

Resistance 3 |

27,000 |

|

Resistance 2 |

26,500 |

|

Resistance 1 |

26,000 |

|

Support 1 |

24,000 |

|

Support 2 |

23,800 |

|

Support 3 |

23,600 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USA100 |

||||||

|

Pivot Points |

Resistance 3 |

Resistance 2 |

Resistance 1 |

Support 1 |

Support 2 |

Support 3 |

|

Profit or loss in $ |

22,000 |

17,000 |

12,000 |

-8,000 |

-10,000 |

-12,000 |

|

Profit or loss in €² |

18,606 |

14,378 |

10,149 |

-6,766 |

-8,457 |

-10,149 |

|

Profit or loss in £² |

16,233 |

12,544 |

8,855 |

-5,903 |

-7,379 |

-8,855 |

|

Profit or loss in C$² |

30,061 |

23,229 |

16,397 |

-10,931 |

-13,664 |

-16,397 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 11:30 (GMT) 18/02/2026

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit