USA500 Weekly Special Report based on 1.00 Lot Calculation:

- WHAT IS A STOCK INDEX: A stock index, as defined by Investopedia.com, gauges the price performance of a collection of stocks utilizing a standardized metric and methodology. The S&P 500 Index, renowned worldwide, serves as a prominent example and a widely utilized benchmark within the stock market.

- COMPONENTS: USA500 includes the largest 500 companies in the US such as Apple, Microsoft, Goldman Sachs, General Motors, ExxonMobil, Chevron and etc.

- Q1’ 24 EARNINGS SEASON IS EXPECTED TO OFFICIALLY START ON APRIL 12. Each season, the banking sector led by Citigroup, JPMorgan, Wells Fargo and Goldman Sachs report their earnings results first. Later on, big companies such as Netflix, Tesla, Amazon, Meta, Microsoft and Apple will release their Q1 earnings reports. The difference between analyst expectations and actual earnings results provides investors with a lot of volatility.

- EARNINGS PERFORMANCE: According to LSEG, on average more than 70% of companies have beat earnings estimates over the past 5 quarterly earnings seasons.

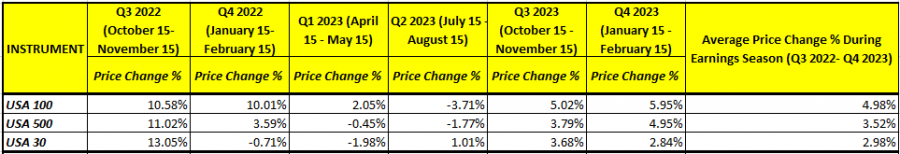

- LAST SIX QUARTERLY EARNINGS SEASONS: THE ARTIFICIAL INTELLIGENCE (A.I.) EUPHORIA. The table below illustrates price reactions of the three major US stock indices. On average, the USA 100 index has risen by 4.98% each quarterly earnings season since Q3 2022. Over the same period, the USA500 index rose 3.52%, while the USA30 index climbed around 3.00%.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results.

USA500, April 5 2024

Current Price: 5,210.00

|

USA500 |

Weekly |

|

Trend direction |

|

|

5,733.00 |

|

|

5,500.00 |

|

|

5,300.00 |

|

|

5,120.00 |

|

|

5,050.00 |

|

|

5,032.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

|

||||||

|

Profit or loss in $ |

5,230.00 |

2,900.00 |

900.00 |

-900.00 |

-1,600.00 |

-1,780.00 |

|

Profit or loss in €² |

4,822.97 |

2,674.30 |

829.96 |

-829.96 |

-1,475.48 |

-1,641.47 |

|

Profit or loss in £² |

4,137.89 |

2,294.43 |

712.06 |

-712.06 |

-1,265.89 |

-1,408.31 |

|

Profit or loss in C$² |

7,093.24 |

3,933.15 |

1,220.63 |

-1,220.63 |

-2,170.02 |

-2,414.14 |

- USA500: 1.00 lot is equivalent to 10 units.

- Calculations for exchange rate used as of 10:00 (GMT+1) 05/04/2024.

- Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail