USD/CAD weekly special report based on 1 Lot Calculation:

- EVENT (WEDNESDAY, JUNE 12 AT 13:30 GMT+1): US INFLATION (CPI) (MAY). The US Inflation stands currently at 3.4%, down from previous 3.5%, which could also encourage the Fed to consider cutting its rates in the coming period. This could be negative for the US dollar.

- EVENT (WEDNESDAY, JUNE 12 AT 19:00 GMT+1): US FEDERAL RESERVE INTEREST RATE DECISION. The US Fed is expected to keep interest rates unchanged at 5.50% on Wednesday, but they are still expected to cut rates at least twice by 0.25% points by the end of 2024. If confirmed by the Fed, the US dollar could come under negative pressure.

- EVENT (TUESDAY, JUNE 25 AT 13:30 GMT+1): CANADA INFLATION (CPI) (MAY). The Canadian Inflation stands currenly at 2.7%, down from previous 2.9%. The Canadian inflation is still above the central bank’s target of 2.00%, which could discourage the Bank of Canada to keep cutting its benchmark interest rate. This could be positive for the Canadian Dollar.

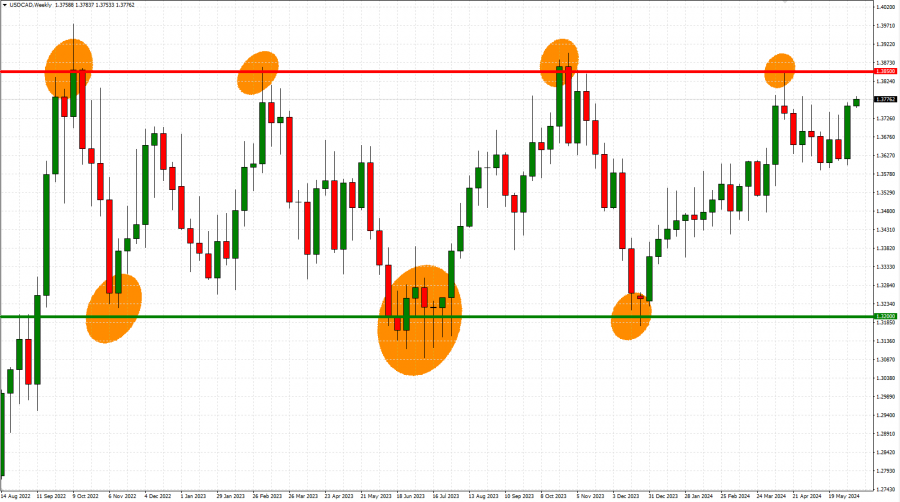

- TECHNICAL ANALYSIS: THE USD/CAD IS TRADING NEAR THE TOP OF ITS SIDEWAYS CHANNEL (BETWEEN 1.3200 AND 1.3850). The chanel has been in place since mid- 2022, whereby the USD/CAD has tested the upper boundary of 1.38500 four times. On the downside, the USD/CAD has tested the lower boundery three times over the same period. The USD/CAD could be expected to soon undergo a downward correction after recently testing its upper boundary of 1.38500.

GRAPH: Weekly (July 2022 – June 2024)

USD/CAD, June 11, 2024

Current Price: 1.3780

|

USD/CAD |

Weekly |

|

Trend direction |

|

|

1.3950 |

|

|

1.3915 |

|

|

1.3880 |

|

|

1.3650 |

|

|

1.3500 |

|

|

1.3400 |

Example of calculation based on weekly trend direction for 1 Lot1

|

USD/CAD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

-1,234 |

-980 |

-726 |

943 |

2,032 |

2,758 |

|

Profit or loss in €2 |

-1,150 |

-913 |

-676 |

879 |

1,894 |

2,570 |

|

Profit or loss in £2 |

-968 |

-769 |

-570 |

741 |

1,595 |

2,165 |

|

Profit or loss in C$2 |

-1,700 |

-1,350 |

-1,000 |

1,300 |

2,800 |

3,800 |

1. 1.00 lot is equivalent of 100,000 units

2. Calculations for exchange rate used as of 12:52 (GMT+1) 11/06/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail