USD/CAD weekly special report based on 1 Lot Calculation:

CANADA:

- FRIDAY, AUGUST 23 AT 13:30 GMT+1: CANADA RETAIL SALES (JUNE). Canada reported lower than expected decline in Retail Sales for May (-0.8% vs. -0.5% expected). The concensus expects a decline of 0.3% in July. If actual figure comes in stronger than expected, the Canadian dollar then could be expcted to come under upward pressure.

USA:

- THURSDAY, AUGUST 22 AT 13:30 GMT+1: US INITIAL JOBLESS CLAIMS: The US will report its weekly initial jobless claims. Jobless claims have been rising since January 2024, indicating a slowing job market. This could cause a dovish shift in the Federal Reserve’s interest rate stance and may increase gold prices.

- THURSDAY- SATURDAY (AUGUST 22 – AUGUST 24): FEDERAL RESERVE JACKSON HOLE SYMPOSIUM. The event takes place once a year and it is organized by the US Federal Reserve at the end of August each year. The event gathers up the most prominent central bankers in the world, including the President of the European Central Bank, the Bank of England Governor, the Bank of Japan Governor, etc. At this event, the Fed Chair holds a speech that would almost always include announcements about the future Fed interest rate policy, and it therefore could increase the market volatility.

- FED CHAIR JEROME POWEL SPEECH (FRIDAY, AUGUST 23 AT 15:00 GMT+1). Fed Chair Jerome Powell has always held speeches at the Jackson Hole Symposium since he took office in 2018. This year’s topic is “Reassessing the Effectiveness and Transmission of Monetary Policy.”

TECHNICAL REVIEW:

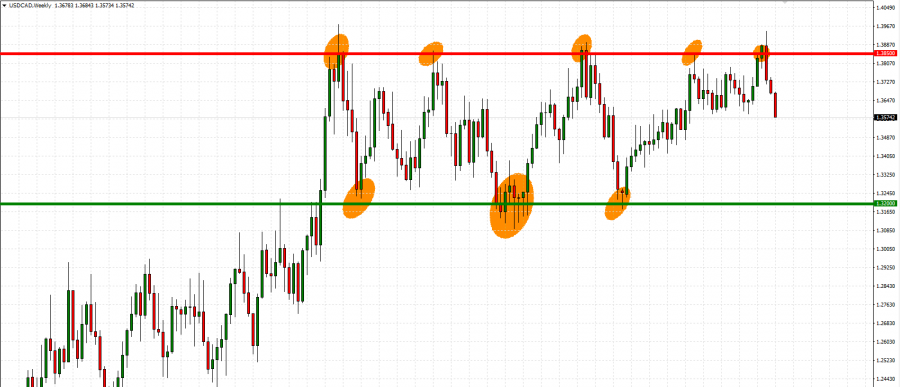

- TECHNICAL ANALYSIS: THE USD/CAD IS TRADING NEAR THE TOP OF ITS SIDEWAYS CHANNEL (BETWEEN 1.3200 AND 1.3850). The channel has been in place since September 2022, whereby the USD/CAD has tested the upper boundary of 1.38500 four times. On the downside, the USD/CAD has tested the lower boundary three times over the same period. The USD/CAD could be expected to soon undergo a downward correction after recently testing its upper boundary of 1.38500 again.

GRAPH: Weekly (April 2021 – August 2024)

Please note that past performance does not guarantee future results.

USD/CAD, August 22, 2024

Current Price: 1.3590

|

USD/CAD |

Weekly |

|

Trend direction |

|

|

1.3800 |

|

|

1.3760 |

|

|

1.3720 |

|

|

1.3450 |

|

|

1.3300 |

|

|

1.3200 |

Example of calculation based on weekly trend direction for 1 Lot1

|

USD/CAD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

-1,547 |

-1,253 |

-958 |

1,032 |

2,137 |

2,874 |

|

Profit or loss in €2 |

-1,388 |

-1,123 |

-859 |

925 |

1,916 |

2,577 |

|

Profit or loss in £2 |

-1,179 |

-954 |

-730 |

786 |

1,628 |

2,189 |

|

Profit or loss in C$2 |

-2,100 |

-1,700 |

-1,300 |

1,400 |

2,900 |

3,900 |

1. 1.00 lot is equivalent of 100,000 units

2. Calculations for exchange rate used as of 09:40 (GMT+1) 22/08/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.