USD/CAD weekly special report based on 1 Lot Calculation:

TECHNICAL ANALYSIS:

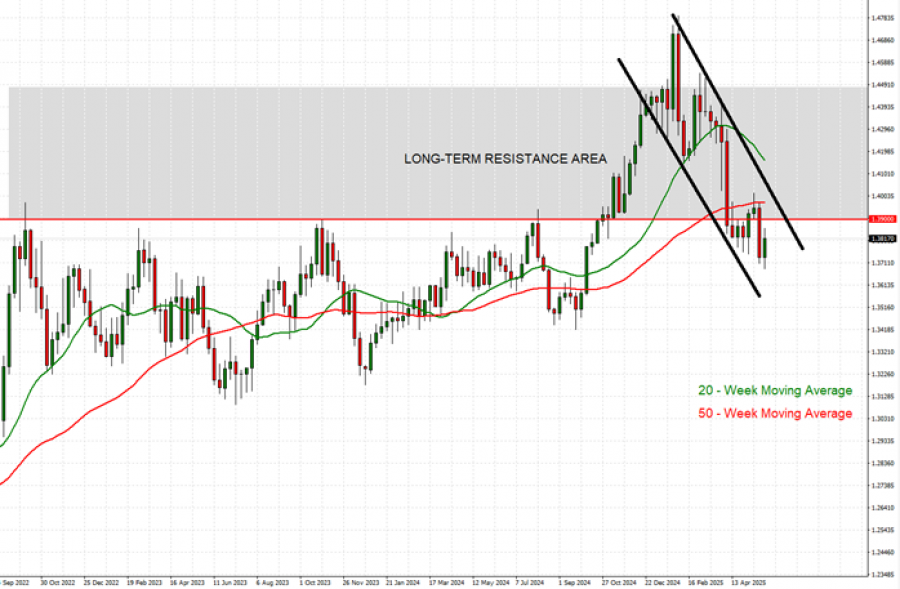

- RESISTANCE AREA ABOVE 1.3900: USD/CAD has maintained long term resistance in the area above the mark of 1.3900, as shown by the weekly chart below.

- WEEKLY MOVING AVERAGES POINT TO DOWTREND: USD/CAD has recently traded below the 20- and 50- Week Moving Averages, pointing to an ongoing downtrend. However, USD/CAD could also change its trend, if prices rise above the 20- and 50- Week Moving Averages.

- LONGER-TERM TREND CHANNEL: The black- lined downtrend channel depicted by the chart below shows that USD/CAD have maintained its downtrend in general since early 2025.

- RESISTANCE AND SUPPORT LEVELS: USD/CAD has remained in a downtrend looking at Support 1 of 1.3730, Support 2 of 1.3680 and Support 3 of 1.3600 to the downside. On the upside, USD/CAD looks at Resistance 1 of 1.3900, then towards Resistance 2 of 1.3950 and Resistance 3 of 1.4000.

GRAPH (Weekly): September 2022 – May 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: TRADE WAR DEESCALATING

- SEVERAL EVENTS HAVE HAPPENED WHICH ARE COOLING TRADE CONFLICTS: A de-escalation of the trade war between the US and Canada could prove negative for the USDCAD pair.

- MARCH 6: US suspended tariffs on goods imported from Canada that comply with the US – Mexico – Canada (CUSMA) Agreement

- APRIL 9: US President Trump suspended reciprocal tariffs on the rest of the world by 90 days

- APRIL 15: Six months tariff delay by the Canadian government towards US goods used in important sectors of the Canadian economy

- APRIL 30: US President Trump relaxed auto tariffs

EVENTS (UNITED STATES):

- MONDAY, JUNE 2, AT 15:00 GMT+1: US ISM MANUFACTURING PURCHASING MANAGERS INDEX (PMI): A lower-than-expected reading should be negative for the USDCAD currency pair, because it will point to future interest rate cuts by the FED, creating negative pressure on the US dollar. The number for the previous month was 48.7 which was lower than for the month before (49.0).

- FRIDAY, JUNE 6, AT 13:30 GMT+1: US NON-FARM PAYROLL (NFP) AND UNEMPLOYMENT RATE (MAY): A lower-than-expected NFP reading should be taken as negative for the USDCAD currency pair, because a weaker US economy could exert negative pressures on the US dollar. This data measures the change in the number of people employed during the previous month, excluding the farming industry. The data for the previous month stood at 177,000 which lower than for the month before (228,000).

EVENTS (CANADA):

- WEDNESDAY, JUNE 4, AT 14:45 GMT+1: BANK OF CANADA INTEREST RATE DECISION: The Bank of Canada could keep its benchmark interest rate unchanged, at 2.75%. A pause in the interest rate cut cycle is expected to create negative pressures for the USDCAD pair, as a paused interest rate will create positive upswing for the Canadian dollar.

USD/CAD May 30, 2025

Current Price: 1.3820

|

USD/CAD |

Weekly |

|

Trend direction |

|

|

1.4000 |

|

|

1.3950 |

|

|

1.3900 |

|

|

1.3730 |

|

|

1.3680 |

|

|

1.3600 |

Example of calculation based on weekly trend direction for 1 Lot1

|

USD/CAD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

-1,303 |

-941 |

-579 |

651 |

1,013 |

1,592 |

|

Profit or loss in €2 |

-1,151 |

-831 |

-511 |

575 |

895 |

1,406 |

|

Profit or loss in £2 |

-968 |

-699 |

-430 |

484 |

753 |

1,183 |

|

Profit or loss in C$2 |

-1,800 |

-1,300 |

-800 |

900 |

1,400 |

2,200 |

- 1.00 lot is equivalent of 100,000 units

- Calculations for exchange rate used as of 10:51 (GMT+1) 30/05/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.